Isle lawyer accused

of stealing $12 millionJerrold Chun allegedly

diverted money from an

insurance company

A Honolulu attorney has been charged with fraudulently diverting at least $12 million from the estate of an insurance company declared insolvent after Hurricane Iniki.

Jerrold Chun, 55, of Chun & Nagatani, made his initial appearance yesterday in District Court on theft charges. He was released after posting $150,000 bail -- reduced from $300,000 -- pending a preliminary hearing Nov. 10. He had been held at the District Court cellblock since turning himself in Sunday afternoon, when he was booked on three counts of first-degree theft.

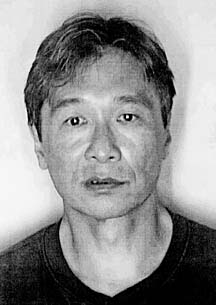

COURTESY PHOTO

Attorney Jerrold Chun, accused of diverting $12 million from an insolvent insurance company, is free on $150,000 bail.

Chun is accused of diverting more than $20,000 on each of three occasions from June through July from HUI/UNICO, acronyms for two insurance companies set up by Hawaiian Electric Industries and taken over by the state insurance commissioner in 1992, said Richard T. Bissen Jr., first deputy attorney general.

Chun could not be reached for comment. His attorney, William Harrison, said he was just retained and didn't have enough information to respond to the charges.

The insurance commissioner in 1993 declared Hawaiian Underwriters Insurance Co. Ltd. and United National Insurance Co. Ltd. insolvent and ordered them liquidated because the amount of their insurance claims exceeded their available funds, due to losses from Hurricane Iniki, Bissen said. Iniki hit Kauai in September 1992.

HUI/UNICO provided property insurance, workers' compensation and other lines of insurance. Chun was hired by HUI/UNICO as counsel to the liquidator to help administer the estate.

But while Chun was successful in negotiating settlements of creditors' claims and administering the claims of policyholders, the state Insurance Division uncovered irregularities in financial reports, said state Insurance Commissioner J.P. Schmidt.

Schmidt conducted an internal investigation that resulted in the criminal charges.

The inquiry found that "significant sums had not been properly accounted for and appeared to have gone to Mr. Chun and other individuals," Schmidt said.

"At this time, we believe there has been at least $12,401,343 misappropriated," he said.

Schmidt said Chun does not dispute he received the money and provided various explanations, including an agreement he claimed he struck with the previous insurance commissioner, Wayne Metcalf, regarding a "success fee."

According to Chun, Metcalf agreed that if Chun negotiated a smaller payment to creditors than anticipated, he could keep the difference, Schmidt said.

Chun allegedly received the "success fees" in addition to his hourly fee.

Schmidt said there is no evidence of any verbal or written approval or authorization of such an arrangement and called it "highly unusual and inappropriate." Chun had said he discussed it only with Metcalf.

Metcalf could not be reached for comment.

Schmidt, in his capacity as liquidator of HUI/UNICO, filed a civil complaint Friday against Chun, asking the court to issue a temporary restraining order to protect the estate's funds.

Before filing the complaint, Schmidt had learned that substantial amounts of money had been transferred from HUI/UNICO to client trust accounts and business and personal accounts in the names of Chun and Chun & Nagatani. From the trust account, $2,699,740, which Schmidt says is part of the $12 million diverted from HUI/UNICO, was deposited into an account in the name of Michael Chong of Adjusting Services of Hawaii. Chong is named in the civil complaint.

"He was apparently a part of this 'success fee' arrangement and received some of the funds," Schmidt said.

Chong could not be reached for comment. He was not named in the criminal complaint. The Attorney General's Office is continuing its investigation, Bissen said.

Chong's position was that the arrangement had been approved and that they were acting properly, Schmidt said.

The civil suit, which alleges fraud, conversion, unjust enrichment and negligence, was filed because both have refused to return the money, Schmidt said.

The complaint also alleges Chun breached his fiduciary duty, Schmidt said.

The Insurance Division is continuing its investigation and conducting an audit of all HUI/UNICO operations to ensure no other money has been improperly disbursed and all money has been appropriately accounted for, he said. Chun was removed shortly after the fraud was discovered.

Despite the alleged diversion, people who held policies with HUI/UNICO will be paid "100 percent," Schmidt said.

The money that was allegedly misappropriated is a surplus "over and above the amount paid to people who had policies and claims based on those policies," he said.