Fed increases

rates 1/4 point

Isle experts say raise

By Russ Lynch

won't affect economy

Star-BulletinThe Federal Reserve's move to raise interest rates should have virtually no affect on Hawaii's economy which is being directed by too many other forces, most of them positive, some isle experts said today.

"It's insignificant. I don't think it's going to change anything here," said Henry Wong, chief economist at City Bank. "At this point a quarter of a point won't make much difference."

Economist Michael Sklarz, chief of research at real estate firm Prudential Locations Inc., said the Fed's action on short-term rates won't immediately affect long-term mortgage rates. And if the Fed's move is seen by bond buyers and others in the long-term markets as a good move to control inflation in the long run, it could bring down mortgage rates, he said.

In any case, Hawaii's housing market is getting busy as the economy starts to pull out of its 1990s' slump, he said.

And Hawaii's home buyers are sophisticated in how they handle their loans, Sklarz said, switching in and out of fixed- and adjustable-rate mortgages to get the best interest.

Peter Freeman, president and chief executive of the Honolulu Board of Realtors, said home sales have been brisk. "The pricing of homes is so favorable that a small change in the interest rate is not going to have very much of an impact," he said.

Another positive sign, observers said, is Asia's economic recovery which will have a positive effect on Hawaii that a small interest rates hike won't hinder.

Dow jumps 171

Star-Bulletin news services

after 3rd hike

of the yearWASHINGTON -- The Federal Reserve raised interest rates by a quarter point today, boosting a key rate for the third time this year in an effort to slow the sizzling U.S. economy and keep inflation from becoming a problem.

But policy-makers concluded that inflation risks have declined and signaled a shift away from a bias toward raising rates in the near future. Wall Street responded positively, sending the Dow up 171.58 points, or 1.6 percent, and the Nasdaq composite index up 73.51 points, or 2.3 percent.

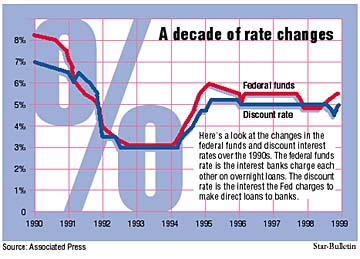

The announcement came after a closed-door meeting of the Federal Reserve Open Market Committee, the policy-makers who set interest rate policies. The Fed said it was increasing its target for the federal funds rate -- the interest banks charge each other on overnight loans -- to 5.50 percent from 5.25 percent. The move will increase borrowing costs for businesses and consumers throughout the country. The central bank also raised its mostly symbolic discount rate, the interest that the Fed charges to make direct loans to banks, by a quarter point to 5 percent.

In a statement explaining its decision, the Fed said, "Although cost pressures appear generally contained, risks to sustainable growth persist."

Fed policy-makers said that while there had been some slowing of economic activity, they were worried that the pace of growth "continues in excess of the economy's growth potential.""The Fed is taking out an insurance policy against more inflation," said Sung Won Sohn, chief economist for Wells Fargo. He believes the increase in the federal funds rate will be the last for the year and expects the Fed to leave rates unchanged at their Dec. 21 meeting. "The Fed doesn't like to raise rates in the middle of the holiday season and also doesn't want to raise them because of possible problems because of Y2K."

The Fed's quarter-point increase in the funds rate was expected to be followed quickly by announcements from commercial banks that they were boosting their prime lending rate by a similar quarter point, from the current 8.25 percent to 8.50 percent. The prime rate is a key benchmark for millions of loans, from home equity and credit card balances to short-term loans for small businesses.

The Fed's aim in boosting borrowing costs for businesses and consumers is to keep the economy from overheating. Unemployment fell to a 29-year low of 4.1 percent last month as the pool of available workers continued to shrink. The economy expanded in the third quarter at the fastest pace in a year and is likely to come close in 1999 to matching the 4-plus percent growth rates of the past two years.

That has led to repeated warnings by Fed policy-makers that companies will be forced to pay higher wages and benefits to attract and retain workers. With labor accounting for two-thirds of business costs, that eventually requires prices to rise or profits to fall, unless companies can boost the efficiency of their workers, Fed Chairman Alan Greenspan and his colleagues have said.

"Inflation will inevitably grow out of an economy that is overheated," Fed Governor Edward Kelley said in a Houston speech Oct. 21. "Labor is the most important and most basic input of all, and we have at this time a very tight labor market and the concern is that might put us into a boom-and-bust cycle."

Internet stocks also have powered the Nasdaq composite index to a 50 percent increase this year, adding to the wealth effect that's kept consumers spending and the economy growing.

William Gross, manager of the world's largest bond fund, last week said the surge in stocks made a rate increase more likely. "We have the makings of a bubble, if a bubble doesn't already exist" in U.S. stocks, said Gross, who oversees about $180 billion of bonds at Pacific Investment Management Co. in Newport Beach, Calif.

Still, the Fed has been patient and allowed the economy to grow faster than it once might have, and central bankers have cited recent gains in worker productivity as one reason inflation has showed few signs of actually picking up this year.

The Fed's decision today marked the third time this year the central bank has raised the funds rate.

On June 30, the Fed nudged up the federal funds rate by a quarter of a point, the first time in two years. It raised the funds rate again, by the same amount, on Aug. 24.

The Fed's action today moves short-term rates the Fed controls back to where they were before the central bank cut rates in three quarter-point moves in the fall of 1998 to keep financial turmoil in Asia and Russia from derailing the U.S. economy.

"Today's increase in the federal funds rate, together with the policy actions in June and August and the firming of conditions more generally in U.S. financial markets over the course of the year, should markedly diminish the risk of inflation going forward," the Fed said in a brief, one-page announcement of its action.

Based on the belief that inflation risks have been lowered, the Fed said it was moving its policy directive, intended to signal future actions, from one leaning toward raising rates back to a neutral position.

The Fed said the vote on changing the discount rate was 5-0. Changes in the discount rate are made by the Federal Reserve Board, which has only five members. The central bank will not announce the vote on the federal funds rate, an action taken by the entire Federal Open Market Committee, until it releases the minutes of this meeting in December.

Critics complained that the bump-up in the federal funds rate wasn't needed.

"Raising interest rates during a period of negligible inflation makes as much sense as trying to slow down a stopped car," said Gordon Richards, economist with the National Association of Manufacturers. "Inflation is in hibernation and this hike in rates is simply ill-timed."

Analysts had been split over whether the Fed would change rates, saying there were valid arguments for a rate increase and for leaving rates unchanged, as was done in October.

Many private economists had said they couldn't remember a time when the Fed faced such a close call.

The Associated Press and Bloomberg News

contributed to this report.