|

|

Maxed-out mortgages

risky but common

A financial emergency, such

as a health problem or job loss,

could ruin some homeowners

Homes that are too small. Commutes that are too long. Mortgages that are too high.

|

|

For now, many make ends meet with credit cards, refinancing -- and creativity, financial counselors say. But month-to-month will not keep them afloat forever: An emergency, like job loss or a health problem, could force some homeowners to sell or push them into bankruptcy or foreclosure.

"You have people living on the edge, but that's the only way they can make it work. You have people who are just maxing themselves out," said Kendall Hirai, director of the Hawaii HomeOwnership Center. "Obviously, they're having to do without."

Some are giving up on big things -- private school for their children, a second car or family vacations -- he said. Others, who could not afford big purchases to begin with, are shopping at thrift stores and getting rid of small expenses -- like plate lunches and evenings out -- to make ends meet.

"Our clients tend to make a lot of sacrifices to get into homes," said Lehua Rosa Malott, a counselor at the center, which is a nonprofit dedicated to educating prospective home buyers, mostly with low and moderate incomes, on their finances. "People have to think in 30-year terms (and ask themselves), 'What do I see myself doing with this property, especially in this market?'"

FOR BRYSON and Nicole Carr, owning a place meant giving up space -- lots of it.

A year ago the couple bought a condominium in Ewa Beach for $174,000, just barely within their budget. The 800-square-foot two-bedroom, two-bath was a snug fit for Bryson Carr, a Navy petty officer, his wife and their 2-year-old daughter. The family had been renting a roomy 1,000-square-foot two-story townhouse, with its own garage, for $1,000 a month in Mililani.

"We settled for something smaller than we wanted," said Carr. And before the family could move into their new home, they got rid of much of their furniture because it would not have fit.

But now, with the Carrs expecting a second child in September, they have chosen to move into a 1,200-square-foot house on base and rent out their apartment for $1,400 a month.

They looked into trading up, Carr said, but could not afford a mortgage hike.

Not only are many Hawaii residents, like the Carrs, settling for smaller homes farther from town, they are overextending themselves to become homeowners, analysts say.

Michael and Ellen Burton and their daughter, Natasha, in their 16th-floor Salt Lake apartment. They are paying for the spectacular view with almost 45 percent of their monthly income going to the mortgage.

If those guidelines were followed, though, many Hawaii families would not be able to buy a home.

"Lenders are loosening their guidelines to allow more homeownership," said Tarumoto, who is also vice president of mortgage banking at Central Pacific Bank. "More of your income levels are going to your mortgage ... and I think people are dealing with it. Their lives may have to adjust."

Some homeowners, though, are barely making it.

"They're just sort of skidding from one month to the next," said Wendy Burkholder, executive director of Consumer Credit Counseling Service of Hawaii, a nonprofit aimed at helping people decrease their debt and avoid bankruptcy. "Then, very often it's a crisis that just tips everything."

In 2004 about 1,500 sought help from the agency, many for debts they incurred while juggling a high mortgage, credit card debt and the everyday expenses.

Nearly 200 low- to moderate-income families, meanwhile, went to Legal Aid of Hawaii because they were in mortgage default or facing foreclosure. Other nonprofits, like the Self-Help Housing Corp. of Hawaii, have also been bombarded with homeowners' request for aid.

Broader statistics that would show how new homeowners are making it are hard to find.

Experts say Hawaii's mortgage delinquency rates, which are some of the lowest in the nation, do not tell the full story: Homeowners could be tapping from their savings or credit cards or depending on loans from family members.

Foreclosures in Hawaii also are low, according to the Mortgage Bankers Association.

But Claudia Shay, executive director of the Self-Help Housing Corp., said many foreclosed homeowners are selling their homes before they reach the auction block.

Foreclosure attorney Gary Dubin agreed. "It's not true that people are not in financial trouble," he said when asked about the statistics. "The system is very rigid, and it doesn't take into account that the borrowers are human beings."

Plus, said Paul Brewbaker, chief economist for the Bank of Hawaii, "measures of financial stress are really not the first thing that show up under pressure." Give the market a year or two -- if interest rates rise, foreclosures and the delinquency rate will likely be up, he said.

Michael Burton and his wife, Ellen, bought where they vowed they never would: Salt Lake.

It was too far from Chinatown, where they like to shop, inconvenient and a little run-down. But, after about a year of planning and looking, they purchased a $260,000 three-bedroom Salt Lake condominium. May will make their ninth month in their new home.

Nearly 45 percent of the Burtons' monthly income -- they make $48,000 annually between them -- goes to their $1,700 monthly mortgage, and the rest is accounted for with little wiggle room: a portion for utilities, some for groceries and an allotment for their 3-year-old daughter's day care.

On top of all that, the apartment needed major renovations when they moved in.

Finance classes at the HomeOwnership Center taught the Burtons not to overdo it on frivolous expenses, especially in the first few months. So the couple made changes to the home little by little -- first adding new flooring in the living room, then concentrating on the bathrooms and now looking at buying new cabinets for the kitchen.

Michael would compare prices for each buy, take a calculator along on shopping trips and always get three quotes on big purchases. They got furniture -- sofas, a rug and a television cabinet -- from friends who were moving, and kept splurges to a minimum.

"As a homeowner you have greater responsibilities," said Michael as he sat in his living room on a recent afternoon. "But," Ellen added with a smile, "it just feels good that you can say it's yours."

Even with the couple's frugal lifestyle, there have been some hard times. One month, they could only pay a portion of the mortgage and had to catch up later. Another month, car trouble sucked up some of the money earmarked for bills, and they were left short.

Today, though, there are signs of a family settling in. Michael has joined his condominium's board and helped increase security at the building. The couple is already shopping around for good public schools in the area for their daughter.

And at their door there's a mat -- a gift and a reminder from the Hawaii HomeOwnership Center -- that reads, "Proud member and homeowner." Burton said he wipes his feet on it every day.

How to avoid financial pitfalls

There are several things, financial counselors say, that new homeowners can do to better their chances of staying in the black: » Be prepared for homeownership. Once you buy your home, make sure not to overextend your finances, and keep a "rainy day" fund for unexpected home maintenance problems, car trouble and other small emergencies. Lehua Rosa Malott, a counselor at the Hawaii HomeOwnership Center, said homeowners should have at least three months' worth of living expenses in the bank to cover unforeseen problems. Also, don't overdo the renovation of your home -- take things slowly and try not to rely on credit. » Plan for the unexpected. The top three reasons people go into foreclosure are divorce, health problems or job loss. Though these occurrences are not anticipated, they can be dealt with more easily if you plan ahead. Malott suggested saving at least 1 percent of the value of your home a year for large-scale maintenance problems. » If you miss three or more mortgage payments, you are in serious danger of losing your home to foreclosure. So if you know you're not going to be able to make a payment, work out a monthly expenses plan, look for places to cut costs and talk to your lender. "At least the lender will know where they're coming from," Malott said. "The lender is also a human being, and they understand things happen." » Homeowners facing foreclosure should also try to work with their lender on a plan to get up to date with their mortgage. If you have suffered a temporary loss of income but can demonstrate that it has returned to previous levels, you may draw up a repayment plan that will having you making your regular payments plus a sum that would cure your delinquency in one to two years. » In some circumstances, homeowners are unable to make payments for an extended period of time. If you have a good record with your lender, you can ask for a "forbearance plan" that will allow you to suspend payments or make reduced payments for a specified period of time. In most cases such plans last less than 18 months.

Sources: Hawaii Homeownership Center and the Mortgage Bankers Association of America.

|

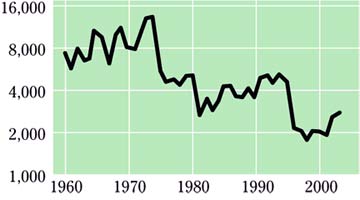

If you build it ...

A tightening of land-use laws in the 1970s has resulted in fewer building permits being issued, contributing to Hawaii's periodic home shortages: |

Tonight on KITV 4 News at 10 ...

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]