HMSA pursues

rate hikeBut the health insurer is still

hoping to offer a lower-cost option

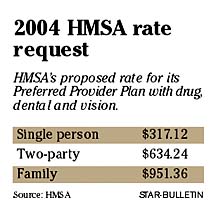

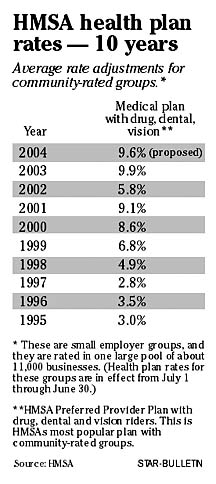

Hawaii's largest health insurer, Hawaii Medical Service Association, still hopes to gain state approval for a new, less-benefit rich, but less-costly health plan. But in the meantime, it has filed a request with the state Insurance Division to approve a 9.6 percent rate increase for its Preferred Provider Plan.

The latest rate hike, which takes effect July 1 if approved, will affect about 11,000 of HMSA's small-business customers. The increase includes drug, dental and vision coverage, as well as the basic medical plan. A year ago, HMSA's small-business groups got a 9.9 percent increase after the company originally requested an increase of 11.5 percent.

HMSA's larger groups, with 100 or more employees, renew their contracts separately and are not impacted by the rate increase.

HMSA's largest competitor, Kaiser Permanente, is waiting to hear whether its request for a 14.5 percent increase will be granted. That request would be retroactive to Jan. 1. The Insurance Division has 90 days to approve or reject requests, but that can be extended if questions come up, said Kaiser spokesman Chris Pablo.

"We're still awaiting decision on our rate filing, but we've asked for what we need, not a penny more," he said.

With pressure from business customers about rising premium costs, both Kaiser and HMSA have sought approval from the state Department of Labor's Prepaid Health Care Advisory Council to offer less-costly plans featuring fewer benefits and higher costs for employees. HMSA had hoped to offer its new plan to its small business customers by July 1.

"We're still in discussion with the Department of Labor and looking at alternatives available to us," said HMSA Vice President Cliff Cisco.

The council, which advises the director of the Department of Labor & Industrial Relations, compares benefits of any new plans wanting to enter the market against the two dominant plans already doing business here. Those plans belong to Kaiser and HMSA.

The council has been reluctant to grant a so-called "A" status to either company's proposed plans.

The plans would need an "A" rating from the council in order for an employer to maintain the same percentage of premium contribution as it makes for the plans already offered. A "B" rating instead of an "A" rating would mean they would have to pay more toward the monthly premium, and cost savings is a central issue for employers.

Still, the latest 9.6 percent rate increase for HMSA's Preferred Provider Plan is an improvement on the double-digit increases seen in past years, said HMSA Chief Financial Officer Steve Van Ribbink.

"We are finally seeing some slowing in double-digit health care cost trends and claims utilization data. We hope this slowing will continue. If it does, then adjustments to our health plan rates will be more favorable," he said.