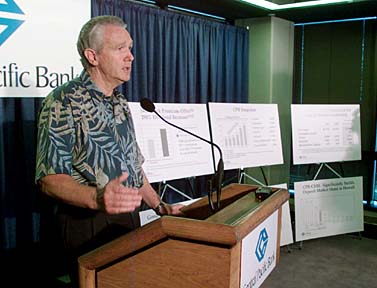

DEAN SENSUI / DSENSUI@STARBULLETIN.COM

Central Pacific Bank chief executive Clint Arnoldus announced yesterday the bank is attempting to buy local rival CB Bancshares, parent of City Bank, for $285 million.

Takeover would Central Pacific Bank's proposed takeover of City Bank would afford it more resources to compete with Hawaii's top three banks, but would also remove an aggressive competitor from the marketplace.

cut a competitor

Regulators would have to weigh in

April 25 deadline set

on the proposed purchase of City

Bank by Central Pacific Bank

Bank mergers common here

CPB earnings up 14%By Tim Ruel

truel@starbulletin.comCentral Pacific, Hawaii's fourth-largest bank, has offered to purchase City Bank, the state's fifth-largest bank, but City Bank has so far rebuffed the advances.

A merger would endure the scrutiny of federal and state regulators, who would have to assess the effect on competition.

Leroy Laney, a local economics professor and consultant to First Hawaiian Bank, said the Hawaii banking market is already concentrated, and a merger would make the market even smaller.

The federal government is suspect of mergers that occur within a specific geographic location, Laney said. "They don't like market concentration," he said. "They like smaller banks ... that do offer more choice. They offer competition."

State regulators would consider the potential for effects on competition, which would be weighed against the public interest, said Mark E. Recktenwald, director of the state Department of Commerce and Consumer Affairs. The state would also have to consider the financial soundness of the resulting merged company, he said.

The assets of Central Pacific's parent company increased 10.3 percent to $2.03 billion in December 2002 from $1.84 billion in December 2001. The assets of City Bank's parent grew 5 percent to $1.67 billion from $1.59 billion.

Christine Camp, principal and managing director of Avalon Development & Consulting, said both Central Pacific and City Bank have been aggressive in offering service to local small businesses. "It's enhanced the opportunities for businesses to grow," Camp said.

Consumers in Hawaii have the additional choice of 99 credit unions statewide, which have combined assets of $5.4 billion. Credit unions recently received approval to handle business loans guaranteed by the U.S. Small Business Administration, but not all credit unions plan to offer that service, said Dennis Tanimoto, president of the Hawaii Credit Union League.

If the two banks merge, "I guess it's one less competitor in the market, so it gives less choice to customers," Tanimoto said.

Gregory Pai, a former chief economist at First Hawaiian Bank, said the merger would leave Central Pacific Bank a stronger competitor against the big three banks, Bank of Hawaii, First Hawaiian Bank and American Savings Bank.

"I think they would target small businesses more," said Pai.

Consumer protection committee leaders in the state Legislature said they will review the situation. "There's plusses and minuses, upsides and downsides," said state Sen. Ron Menor (D, Mililani).

Central Pacific Bank

City Bank