American Classic American Classic Voyages Co., one of the anchors of Hawaii tourism, has been taking on water so fast that industry watchers wonder whether the company can stay afloat.

Voyages heads

into rough waters

The company's stock has fallen

95 percent so far this yearBy Dave Segal

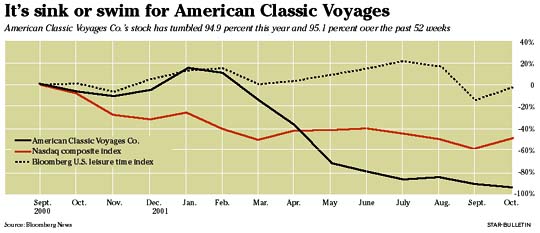

dsegal@starbulletin.comIts stock price has plunged nearly 95 percent since the start of the year, fallout from terrorist attacks reduced ship occupancy levels, travel insurers dropped coverage of the company, earnings continue to hemorrhage, its two ships under construction have been delayed a year each and are over budget, and competitor Norwegian Cruise Lines is bringing a new 2,220-passenger vessel into the market in mid-December.

"I wouldn't want to be in their shoes," said a Hawaii industry insider who asked to remain anonymous. "I know these are very hard times for them and I know they're under a lot of financial duress and the cruise lines are having a lot of pressure to fill their ships. We're all in this industry together and I hope the best for them. But they have old tonnage in a (U.S.) market flooded with brand new tonnage and a product (two new ships) that's been delayed. That's tough in this industry."

American Classic, which operates the Kahului, Maui-based S.S. Independence and the Honolulu-based ms Patriot, has taken steps to stem the fallout from the Sept. 11 attacks. Among the moves are offers of half-price air and cruise packages to Hawaii from the West Coast, Southwest and Chicago.

Company spokeswoman Fran Sevcik said occupancy on the two Hawaii ships was 50 percent the weekend following the attacks and has improved now to about 90 percent on both ships.

"We are getting a good response to various tactical offers, including the half-price packages, although our call volume and retention rates remain affected by the Sept. 11 aftermath," she said. "The trends we are seeing, reduced demand and price discounts, are very consistent with what we are observing in the Hawaii tourism market and in the overall world travel and leisure market."

Still, that doesn't make it any easier for American Classic, which already had been struggling financially.

Its stock, which hit an all-time high of $35.25 on Dec. 29, 1999, has plunged 42.3 percent on the Nasdaq Stock Market since the attacks and is now trading at just 71 cents. The stock is off 94.9 percent since the start of the year.Earlier this month, at least four travel insurance companies -- Travel Guard International, TravelEx, Access America and Unicard -- instructed travel agents to stop offering coverage for cruises involving American Classic.

Travel Guard Vice President of Communications Dan McGinnity said the cancellation will be "until further notice" and that dropping the policies was not an industrywide move nor "on its own" attributable to the attacks.

Travel insurance policies typically offer protection against a number of traveling perils, such as trip cancellation, emergency medical, evacuation, lost baggage and trip delays.

American Classic, in a statement released after the dropped coverage, said "recent actions by several travel insurance providers to discontinue coverage for our customers were made unilaterally and without consultation with American Classic Voyages Co.

"We are contacting the companies involved in an effort to favorably resolve this issue."

American Classic, which is in the process of relocating its headquarters to Sunrise, Fla., from Chicago, is scheduled to report its third-quarter earnings Oct. 26. In the second quarter, American Classic reported a loss of $7.7 million compared with a profit of $1.3 million a year earlier. In 2000, the company lost $10.1 million compared with a deficit of $1.8 million in 1999.

Raymond James analyst Joe Hovorka, who has a "market perform" rating on the stock, expects the sea of red to continue.

"We obviously expect them to lose money again," said Hovorka, whose company is based in Boca Raton, Fla. "Our estimate for them was to lose about $4.5 million in the third quarter. And this was before Sept. 11. Things have obviously gotten worse since then. But it's hard to quantify, so that's why we haven't changed our estimates. They'll clearly lose money, though, in this quarter and the rest of the year and all of next year."

A financial analysis Hovorka published in a company report painted a picture of financial trouble."Cash commitments for AMCV over the next 18 months are expected to exceed the company's current cash balance," the Aug. 20 report said. "We believe the company will need to seek external financing."

The report, published before the attacks, obviously takes on greater significance now. In the report, Hovorka projected that American Classic, which had $76.7 million in unrestricted cash as of June 30, would end this year with just $8 million in cash and would have a deficit of $22.1 million at the end of 2002.

He also noted that American Classic had disclosed -- prior to the attacks -- that it expected its Hawaii cruise lines in 2001 to lose $17 million in earnings before interest, taxes, depreciation and amortization. The report projected that the company's Hawaii cruise lines' total revenue (fare plus on-board spending) would need to increase nearly 10 percent to break even on a cash-flow basis.

The report concludes that the key factors to watch over the next 18 months are American Classic's pricing, particularly in Hawaii, the company's ability to meet its cash obligations and the company's success in raising additional capital.

"While we will not speculate on any funding prospects for American Classic Voyages," spokeswoman Sevcik said, "it is fair to say that for many companies access to capital has been dramatically curtailed due to the slowing economy and the events of Sept. 11."

American Classic Chief Executive Officer Philip Calian and President and Chief Operating Officer Roderick McLeod did not return several phone calls.

In August, American Classic amended its $30 million revolving credit agreement with Chase Manhattan Bank in order to extend the maturity date from Sept. 13 to March 31, 2002. In doing so, however, American Classic was required to first pay $29.5 million outstanding and had to accept tighter credit restrictions that seemingly would question its finances. The new agreement is for $10 million with new interest rates approximately 1 percentage point higher than the original agreement.

American Classic, though, has the opportunity to generate funding from its recent agreement with Northrop Grumman Corp.'s Ingalls Shipbuilding unit, which is building it two new ships in Pascagoula, Miss., under a U.S. Maritime Administration-backed initiative. American Classic and Northrop Grumman have each committed more than $40 million to buy preferred stock over the next four years in the new American Classic subsidiary called Project America.

Nevertheless, American Classic still faces choppy seas ahead.

"Hawaii has not panned out as expected," Hovorka said last week. "When they introduced the Patriot and increased capacity by more than 100 percent, pricing deteriorated quite dramatically. In the Hawaii market, most everybody expected the pricing to come down, but no one expected it to fall as fast and as far as it did."

In terms of occupancy, though, Hawaii's prospects have improved recently.

"We're consistently 90 percent booked all the way to Thanksgiving," said Dan Bayne, American Classic's director of government and community relations for Hawaii. "The interesting thing for us is that, for the most part, most of these cruises had been sold out. So it's been a matter of cancellations every week. But we're seeing the number of cancellations drop."

American Classic, which operates four cruise lines, entered the Hawaii market in 1993 by buying bankrupt American Global Line. The 50-year-old, 860-passenger Independence, operates under the company's American Hawaii Cruises line. The 1,212-passenger Patriot, formerly known as the ms Nieuw Amsterdam and previously owned by Holland America Line, was acquired Oct. 18, 2000, for $114.5 million and refurbished for another $20.4 million. It was renamed and then relaunched Dec. 9 in Honolulu Harbor. It operates under the United States Lines flag. The company's two new ships being built in Mississippi are due for Hawaii delivery in 2004 and 2005.

Those two ships, though, have been the subject of controversy due to building delays, cost overruns and objections over the federal program that paves the way for the first U.S. cruise ship construction in 40 years.

American Classic, which in 1999 agreed to pay $880 million for the two 1,900-passenger ships, received commitments from the U.S. Maritime Administration for financing guarantees of up to 87.5 percent of the cost of the ships. Delivery of those ships, originally scheduled for 2003 and 2004, has been delayed a year for each, while the costs to complete the construction have increased by an extra $19 million apiece.

The Title XI Maritime Guaranteed Loan Program, which paved the way for building the ships, has come under attack by U.S. Sen. John McCain. He wrote a letter to President Bush in July, amid the project's ongoing disputes and delays, in which he said "the taxpayer is going to be left holding the bag for over $1 billion" if the project does not turn around soon. The government holds a guarantee of $1.08 billion for the building of the two ships.

Peter McMullin, an analyst for Boca Raton, Fla.-based Ryan, Beck & Co., who in March cut his rating on the company's stock to "hold" from "strong buy" when the shares were at $14.88, says now he should have been more aggressive with his downgrade.

"It should have been a sell," McMullin said last week. "Their near-term predictability is quite low.

"I was getting a little optimistic when the building issues with the shipyard were straightened out, but I'm still assessing the loss of the insurance. It's not a fatal thing, but it's something you didn't want to have happen at this time."

In the past two years, two cruise lines have gone out of business. Fort Lauderdale, Fla.-based Renaissance Cruises, which operated eight cruises that mostly traveled to the South Pacific, filed for Chapter 11 bankruptcy Sept. 26 and disembarked its passengers in midcruise.

Nearly a year earlier, Miami-based Premier Cruise Lines was forced to suspend operations after investment bank Donaldson, Lufkin & Jenrette Inc., which held Premier's mortgage debt, seized its five ships as collateral.

While American Classic owns the Independence outright, a mortgage note for the Patriot is held by Holland America. As a condition of its deal with Holland America, American Classic was scheduled to begin paying back an $84.5 million promissory note to the Seattle-based cruise line this year, with payments of $5.1 million each due on March 31 and Sept. 30. The remaining $30 million of the purchase price was financed with convertible preferred securities of a subsidiary trust.

American Classic, which is 36 percent owned by an investment group led by Chicago billionaire and real estate tycoon Sam Zell, will have a total of 10 vessels once the new ships are delivered.

Besides the two cruise lines it operates in Hawaii, American Classic has two others on the mainland. One of them, the Delta Queen Steamboat Co., is comprised of the Delta Queen, American Queen and Mississippi Queen, which take passengers on cruises along the Mississippi and Ohio rivers, and the Columbia Queen, which sails along the Columbia and Willamette rivers from Portland, Ore.

The other cruise line, Delta Queen Coastal Voyages, was launched in 2001 and operates the 224-passenger Cape May Light. It will be joined by its twin, the Cape Cod Light, in April 2002. Both vessels will visit ports along the East Coast, in the Canadian Maritime Provinces and in the Great Lakes.

American Classic, besides the half-price offers, has taken other measures to try to fill up its ships and reduce expenses. It cut the upcoming cruise schedule for Delta Queen Coastal Voyages and Delta Queen Steamboat Company by a combined 27 cruises, including 24 in the early part of 2002, due to the slower winter off-season and reduced demand. The company said those lines would offer more short cruises, fewer long cruises and a greater variety of itineraries.

Earlier, American Classic took aim at Hawaii residents by cutting its kamaaina rates on cruises to $349 on the Independence and to $499 on the Patriot for cruises starting on Nov. 17, Nov. 24 and Dec. 15.