Advertisement - Click to support our sponsors.

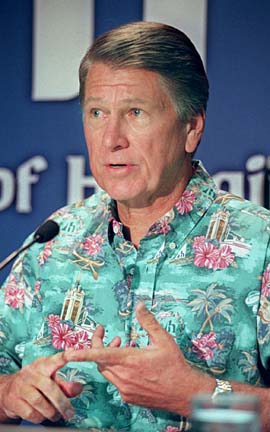

Sagging stock, "I've never quit from anything in my life," Lawrence M. Johnson said today.

troubled loans force

Bankoh chief to resignPacific Century top executive

At a glance

Lawrence Johnson to retire after

42 years with the bankBy Tim Ruel

Star-Bulletin

But yesterday, in the wake of his company's poor profit and stock performance, the 59-year-old chairman and chief executive officer of Pacific Century Financial Corp. announced he will retire after 42 years with the parent of Bank of Hawaii, the state's largest bank.

Wall Street shrugged off yesterday afternoon's announcement.

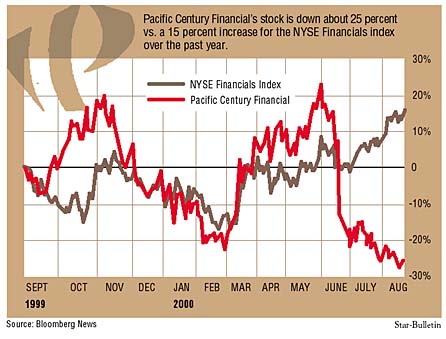

In today's New York Stock Exchange trading, the company's long-suffering stock rose 19 cents, or less than 2 percent, to close at $13.94, not far above the shares' 52-week closing low of $13.50 on Friday. Today's trading was nearly 50 percent more than normal levels, with 432,500 shares trading hands vs. the 291,173 daily average for the past six months.

Johnson said he is not considering other jobs right now, and will remain until the $14.3 billion bank-holding company's board names his replacement. Johnson said the bank needs someone who can adapt, who knows the industry and who is sensitive to Hawaii's community.

Pacific Century will hire an executive search firm to look for a successor, he said. One in-house candidate is Richard Dahl, the bank's president and chief operating officer, the company said.

Dahl is among a small group of top bankers who have survived recent departures at the company, said Richard Dole, chief executive of Dole Capital LLC, a Honolulu private-equity investment banking firm.

If the board approves Dahl, it would signal no change from the bank's management team headed by Johnson, Dole said today.

"It wouldn't represent a major banking shakeup," Dole said. Hiring an outsider, however, could lead to a whole new management team. Dole said he did not know which approach would be best, or whom the bank would prefer.

Johnson said his decision to retire from Pacific Century is a result of his failure in the past year to improve the value of the company to its stockholders."I'm a realist," Johnson said. "I've always understood the responsibility of a CEO of a large public corporation. Basically, you're only as good as your last quarter."

In the last quarter, the bank's troubled loans erased most of its profits, prompting an international credit-rating agency to downgrade its ranking, and leading to Bankoh's lowest stock price in about five years.

Brock Vandervliet, stock analyst for the New York-based Lehman Brothers, said today the key problem with Pacific Century, and the reason for Johnson's departure, is the quality of the company's loan portfolio.

"Investors have really stayed away from the stock and that's why you see it trading right around book value," he said. Book value is the benchmark that divides total shareholders' equity by the number of shares, and most banks trade higher than that number.

Vandervliet noted that more than 2 percent of the bank's total loans are nonperforming, meaning the bank must either try harder to collect or write them off. Similar-sized banks on the mainland classify less than half of 1 percent of their total loans as nonperforming, he said.

Also, Pacific Century's portfolio of syndicated loan -- those underwritten by groups of banks -- is more than five times that of Bankoh's local competitor, BancWest Corp., parent of First Hawaiian Bank. Much of the syndicated loans are on the mainland, and out of Pacific Century's immediate control.

"It significantly deteriorates the bank's earnings power," Vandervliet said. "It's all come back to the credit."

Johnson agreed.

"In the end, I'm accountable for the good and for the bad things. There have been a number of good things that have happened. But the one big disappointment is the inability to increase shareholder value."

He noted that 67 percent of Pacific Century's shares are held by institutional investors -- companies that constantly worry about earnings.

"They don't care about Larry Johnson. They don't care about the environment we're operating in. They want to see a return on their investment, and they deserve a return," Johnson said.

"Quite possibly, a new leader might be able to fix it faster than we had been able to do," he said.

Last September, Pacific Century announced a major restructuring to address its performance problems. The redesign included cutting the work force by about 20 percent, or 1,015 positions.

Vandervliet said the company needs someone familiar with corporate reorganizations and dealing with tough credit issues. The bad news is not over, he said.

In its second-quarter earnings report, the banking company noted a $65 million investment-grade loan in its syndicated portfolio could be criticized by national credit examiners in the third quarter.

Fixing the credit quality could take at least 18 months, Vandervliet said. "It's like trying to turn a supertanker. It takes a while."

Still, Vandervliet said he was surprised by Johnson's retirement. "My take on the company was that he was going to stick it out until the credit issues . . . are put behind them."

Johnson, who had told the bank's board last year that he would improve stock performance or retire, said he has to accept responsibility for the problems.

Johnson received no bonus last year, and his salary remained unchanged at 1998's $735,000. The board noted it would postpone last year's cash awards to Johnson and Dahl until the directors assessed their success in starting the reorganization, dubbed the "New Era Redesign."

When Johnson retires, his retirement package will depend on his average annual salary, according to the company's most recent proxy statement filed with the Securities & Exchange Commission. Johnson has at least 32 years credited toward his retirement.

Johnson blames much of the bank's performance on the economy of the Asia-Pacific region, where Bankoh began expanding in 1997. After changing its parent's name to Pacific Century from Bancorp Hawaii, it bought banks in Tahiti, New Caledonia, Papua New Guinea and put $20 million into the Bank of Queensland in Australia.

Shortly after, Vandervliet noted, the currency of Thailand unexpectedly plummeted, taking with it the financial sectors of Japan, South Korea and every other neighboring Asian country.

Hawaii's economy, meanwhile, hit a bust period for much of the 1990s. Johnson said that is why Pacific Century is not faring as well as competitor BancWest, which has about 75 percent of its earnings coming from California and other booming mainland states, which have been booming for several years.

"I wish we had 75 percent of our assets in California right now."

At a glance

Lawrence M. Johnson

Age: 59

Positions: Chairman and CEO since Aug. 1, 1994

Succeeded: Howard Stephenson

Joined company: 1958, as summer trainee

Career: Branch manager, assistant vice president, vice president, district administrator, senior vice president, and executive vice president

Pacific Century Financial Corp.

Founded: 1897

Headquarters: Honolulu

Name change: From Bancorp Hawaii Inc. in 1997

Employees: 4,400

Operations: A regional financial services company covering Hawaii, the Western United States, the South Pacific and Asia

Principal subsidiary: Bank of Hawaii, with 76 branches in the state

Stock: Traded under the symbol BOH on the New York Stock Exchange. Down about 25 percent from a year ago

Recent history: Last September, the company announced a major restructuring, which included cutting the work force by 20 percent.