Advertisement - Click to support our sponsors.

State looks to

end up in the

black -- maybe

Revised forecasts point to

Health issues ‘could break the bank’

increasing surpluses in the state

general fund, but officials are wary

Legislative Q&ABy Gordon Y.K. Pang

Star-BulletinA revised economic forecast may signal a rosy new trend for the state's $3.2 billion general fund.

But as the curtain rises on the 2000 state Legislature, Budget Director Neil Miyahira is wary about potential problems that could put a kink in state revenues and Gov. Ben Cayetano's budget plan.

The Council on Revenues, a group of economists who forecast state tax revenues, estimated last month that the state will take in an additional 1 percent in each of the next five years.

For this year, that means a 3 percent increase in revenues instead of the 2 percent previously forecast.

So does that mean the state will have a hefty surplus at the end of 2001 and beyond? "What this means is that we will have bigger (end of year) balances," said Miyahira, whose office has stricken the word "surplus" from its vocabulary."One percent is like $30 million in the first year, $60 million in the second year, $90 million in the third year," he said.

The additional revenues could mean the state will be $190 million in the black at the end of the fiscal year instead of the earlier forecast of $168 million.

By June 30, 2005, according to the latest forecast, the state could have as much as $495 million left over.

The revised forecast was enough for Cayetano to scrap plans to impose a 4 percent excise tax on used car sales, increase the tour vehicle surcharge from $3 to $4 and repeal a 1 percent insurance company tax credit.

But hold on, Miyahira said. Items not factored into the 2001 budget -- namely the effects of upcoming collective bargaining talks and anticipated emergency appropriations for things like cost overruns, settlement fees and shortfalls -- could pose trouble, he said.

Factoring in a 2 percent pay raise and the emergency appropriations means only $28.5 million left over at the end of the 2001 fiscal year and deficits of $142 million, $344 million, $456 million and $507 million in each of the ensuing four years, Miyahira calculated.

The state will go to binding arbitration in the coming year with each of the units of the Hawaii Government Employees Association.

"If you crank in a 2 percent-a-year pay raise, you're going to start running into red ink very fast," Miyahira said.

"We just have to be diligent in terms of what the state spends its money on," he said. "We don't have the money to fund, to try to do, what everybody wants," he said.

Miyahira said that in general, the instructions from Cayetano are to provide as much protection as possible to the existing lower- and higher-education budgets.

Other priorities include maintaining a safety net of health and human service programs to help the disadvantaged, Miyahira said, while a third goal is fostering economic development.

"We're basically cutting back on basically everything else," he said.

Sen. Andy Levin (D, Kau-South Kona), co-chairman of the Ways and Means Committee, said he's "cautiously optimistic" about the budget outlook. He noted that the personal income tax cuts that began last year will mean a loss of $2 billion in revenues through 2005.

A business tax cut that will gradually reduce the "pyramiding" of the general excise tax will mean an estimated $120 million to $150 million annual reduction in revenues after 2006, according to the tax department.

Legislature Directory

Legislature Bills & Hawaii Revised Statutes

Question: What are biennial and supplemental budgets? Legislative Q&A

Answer: The state plans its budget for two years at a time, and that is known as a biennial budget. That budget was passed last year. This year, a supplemental budget is submitted to the Legislature to reflect changes to the biennial budget.

Q: How much does the state bring in and spend annually?

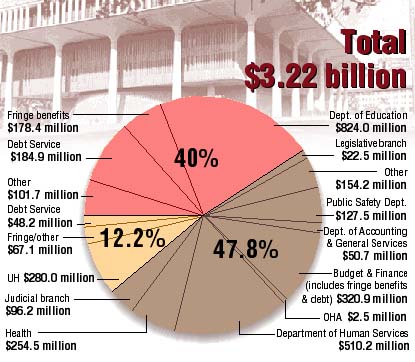

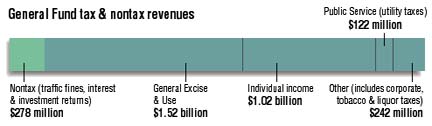

A: The state will be bringing in some $6 billion in fiscal year 2001, which runs from July 1, 2000, to June 30, 2001. Of that amount, between $3.1 billion and $3.2 billion belongs to the general fund. The rest of the money consists of special funds, federal funds, trust funds, revolving funds and other accounts.

Q: So what is the general fund, and why does everyone focus on it?

A: The general fund -- roughly $3.2 billion in the 2001 fiscal year -- is where most tax dollars go, including income and excise taxes. It gets the most attention because of its flexible nature. Nongeneral funds have special purposes. For instance, the state Department of Transportation is paid for from special-purpose and federal funds that must be used exclusively for transportation programs.

Q: What does the supplemental budget for fiscal 2001 include?

A: While the administration proposes redirecting parts of the general fund though cuts and increases, there is only $7.8 million in new revenues and expenditures.

Q: What is a fund balance, and will there be a surplus on June 1, 2001, the end of the fiscal year?

A: The Budget and Finance Department's latest numbers project $3.234 billion in revenues going into the state general fund and $3.225 billion in expenditures, leaving $9 million in leftover money which will be added to the existing fund balance of $147 million to give a positive fund balance of $156 million. Some people call a positive fund balance a surplus.

Q: What is the difference between discretionary and nondiscretionary funds in the general fund?

A: It is a gray line between what the state deems a discretionary and nondiscretionary item. Items that the state is locked into -- such as debt service, collective-bargaining salaries and benefits, and court-mandated consent decrees -- are nondiscretionary. But so too are nearly all instructional programs in the lower- and higher-education budgets. Among the items now deemed discretionary are the governor's office and the entire departments of Agriculture, Budget and Finance, Land and Natural Resources, Labor and Industrial Relations, Accounting and General Services, the attorney general, and Business, Economic Development and Tourism.

Q: What is a capital improvement program budget, and what is debt service?

A: A capital improvement program includes construction projects and other long-term improvements undertaken by a government entity. It sometimes includes major equipment purchases, but rarely, if ever, salaries and wages. These projects are often paid for with the government borrowing special types of funds through general obligation bonds. Debt service is like a mortgage in that it involves the principal and interest due on bonds.

Q: What is the Council on Revenues, and why is it important?

A: The council calculates projections of revenues derived from the state's taxes. Much of their calculating is based on economic indicators. The Budget and Finance Department, the Legislature and everyone else bases the state budget on those forecasts. The council -- whose makeup is determined by the governor, the House speaker and the Senate president -- meets four times a year.

Legislature Directory

Legislature Bills & Hawaii Revised Statutes

Legislative session’s

‘big ticket’ health issues

‘could break the bank’Much attention will be given to

By Helen Altonn

health care after years of near 'neglect'

Star-BulletinSome of the most controversial and costly issues confronting lawmakers this year deal with the health of Hawaii's people.

"We should label this the 'health session,' " said Rep. Alex Santiago (D, Waialua-Kahuku), House Health Committee chairman. "All these health issues are huge."

The Rev. Frank Chong, Waikiki Health Center executive director and close political observer, points to these "big ticket" health items: court-ordered adolescent mental health and Hawaii State Hospital improvements, and fiscal problems of rural state hospitals operated by the Hawaii Health Systems Corp.

"Those three could break the bank," he said.

The state Department of Health expects to ask for at least $24 million in emergency funding to cover unanticipated costs this year involving the State Hospital and child mental health services.

Funding also will be sought to reduce a rising number of residents without health insurance and provide services to 800 to 900 developmentally disabled people on a waiting list.

Emotional proposals will be aired to ban or regulate fireworks and fluoridate the state's water systems. How Hawaii's share of tobacco settlement money is used also may be a sore political issue.

Santiago said he's happy with Gov. Ben Cayetano's attention to the health care area "after years of very difficult decisions, almost to the point of neglect in the health care area." The administration's financial package includes about $20 million to $30 million in health funding, he said.

State workers' benefits

But some of the governor's funding proposals "are based upon very controversial issues that he's banking on us passing," Santiago said. One involves taking away some health benefits from retired state workers, the legislator said, raising legal and philosophical questions about such action.Cliff Cisco, Hawaii Medical Service Association senior vice president, said he anticipates considerable discussion regarding the state employees health fund because of forecasts of huge unfunded liability -- the amount the state will be obligated to pay in medical benefits for state workers and retirees in the future. "Among options would be to take benefits away or restructure," he said.

Santiago and Suzanne Chun Oakland (D, Palama-Alewa Heights-Kalihi), who heads the Senate Health and Human Services Committee, agreed in the last session that the tobacco settlement money should be used for new prevention programs.

But Cayetano wants to use some of the tobacco money to replace state general funds for such programs as Healthy Start, the legislators said. "He's trying to balance the budget using tobacco funds coming in," Santiago said.

Oakland said, "It was never the intent of the Legislature to take away state money from any existing program like Healthy Start and use tobacco settlement money. If anything, it would be used to expand programs like Healthy Start."

State Health Director Bruce Anderson said the state so far has received roughly $27 million from the tobacco settlement in two payments, and the second one was 13 percent less than expected.

Court-ordered deadlines

The legislators also question administrative proposals to eliminate the peer education program in the schools and part of the state dental program, including 12 dental hygienists who go into the schools. "We can fluoride the water system all we want, but there has to be another component to make sure children do take care of their teeth," Oakland said.Anderson said his department is looking to the Legislature for help to meet looming U.S. District Court deadlines for improvements ordered under consent decrees covering the Hawaii State Hospital and mental health services for school-age children.

Money for State Hospital

The DOH used about $6.2 million of its fourth-quarter budget to relocate State Hospital patients in community facilities, Anderson said. At least that much will be requested in emergency funding to continue the hospital operations and community services, he said. An additional $8 million is sought in the next fiscal year to expand community facilities and shift more patients from the State Hospital.An emergency appropriation of about $17.7 million is being requested for adolescent mental health services under the Felix consent decree. Anderson said the program started the year with a budget shortfall and incurred unanticipated expenses in developing school-based mental health services.

He said the executive budget includes "a few million" in supplemental funds to develop and expand children's mental health services in the next year, and the department is trying to increase federal Medicaid reimbursements for the program.

Oakland said substance abuse treatment is her top priority because 95 percent to 99 percent of families in child protection are involved with drugs. She said she would like to see an increase in "sin taxes" to bolster support for substance abuse programs.

Companies also have been asked to look at giving substance abuse and mental health parity to employees under health insurance plans, she said. Advocates at least want coverage for "major depression," she said.

However, the Healthcare Association of Hawaii, HMSA and others have formed a coalition to seek a two-year moratorium on any new benefits.

Rich Meiers, Healthcare Association president and chief executive officer, said it is asking the Legislature to provide money to try to reduce the medically uninsured rate, which has climbed as high as 9 percent.

Hospitals warn of crisis

Meiers said all hospitals are losing money because of inadequate Medicare and Medicaid reimbursements and the cost of charity or uncompensated care. Hawaii's Medicare reimbursement rate is one of the lowest in the nation, he said."At this point we don't know how long everybody is going to be able to last. We will reach the point -- and it's going to be sooner than later -- that there will be very dire consequences on some of our facilities," Meiers added.

Chong said community health centers are struggling to care for the uninsured. Underinsurance, with no drug coverage, is a significant problem, he said. Especially older people with asthma, heart disease, diabetes and other serious chronic conditions can't afford to pay for essential prescriptions, he said.

Coming up

Tomorrow: The politics of the session.

Wednesday: Opening day of the Legislature.

Legislature Directory

Legislature Bills & Hawaii Revised Statutes