ASSOCIATED PRESS

Hawaii's foreclosure rate jumped 132 percent in August from a year earlier and 47 percent over July, new figures show. Here, in an increasingly common sight in Hawaii and across the nation, a foreclosed home is seen for sale in Sacramento, Calif.

|

|

State foreclosures jump 132 percent in 12 months

Kauai resort foreclosure paces downslide

STORY SUMMARY »

Hawaii's foreclosure rate climbed to 34th in the nation and more than doubled for the second month in a row as island households struggle with job losses, rising costs and the effects of a weak economy.

A total of 336 Hawaii foreclosures were filed during the month, or one in every 1,488 households, the report said. The state's 132 percent year-over-year foreclosure increase included 177 notices of defaults, 137 notices of trustee's sales and 22 properties that were repossessed by banks.

Among the counties, Kauai posted the highest rate last month with one in every 205 households being foreclosed, followed by Maui with one in every 994 households, up 121 percent from a year earlier.

FULL STORY »

Hawaii's foreclosure rate more than doubled for the second consecutive month as the effect of job losses and rising costs took its toll on island households.

No Place to Call Home

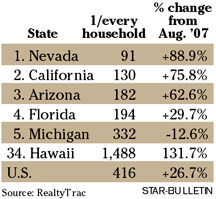

The states with the most foreclosures activity per household last month.

|

The state's foreclosure rate jumped 132 percent in August from a year earlier and 47 percent from the preceding month, pushing Hawaii to 34th in a national foreclosure ranking, according to RealtyTrac, an online marketplace for foreclosure properties. The state ranked 40th in July and No. 41 a year earlier.

A nearly $30 million foreclosure on the Kauai Beach Resort, owned by Big Island developer Brian Anderson, inflated the August results as filings on upward of 100 units pushed Kauai's rate by more than 1,000 percent from August 2007.

"Hawaii has got a special issue; we see this in resort-type places like Florida where you see foreclosures in mass happening on (condominium) developments," said Daren Blomquist, a RealtyTrac spokesman. "That's the kind of special thing you don't see happening in a lot of areas in the country. That's a result, unfortunately, of developers, just like homeowners, who are getting in over their heads on a project."

A total of 336 Hawaii foreclosures were filed during the month, or one in every 1,488 households, according to the report. The state recorded 177 notices of defaults, 137 notices of trustee's sales and 22 properties that were repossessed by banks.

Among the counties, Kauai was the highest last month with one in every 205 households being foreclosed, followed by Maui with one in every 994 households - up 121 percent from a year earlier - and the Big Island, with one in every 2,685 households, down 13 percent from a year ago. Honolulu reported that one in every 3,139 households received a foreclosure notice last month, an increase of 47 percent from a year earlier.

As job losses and pay cuts continue to mount, so does foreclosure activity and a slowdown in residential sales, said local developer Stanford Carr.

"We're in a liquidity crisis that's unlike what we've seen before," he said. "It's unprecedented, uncharted waters."

Unlike past economic downturns, converging factors including high fuel prices, a mortgage industry crisis and a credit crunch are adding to the pressure on U.S. households.

On a national level, about half of the total foreclosures earlier this year were attributed to subprime loans, according to Blomquist.

"Although Hawaii is fairly inflated in some ways in its housing market, there's still this trend overall of an increase in foreclosure activity because of all the financial stress that folks are under because of what's going on in the overall economy," he said.

Foreclosure filings - default notices, auction sale notices and bank repossessions - were reported on 303,879 U.S. properties last month, a nearly 27 percent jump from August 2007 and 12 percent increase from the preceding month - the highest since January 2005. One in every 416 U.S. households saw foreclosures during the month.

Nevada, California and Arizona posted the nation's highest rates, with one in every 91 Nevada households being foreclosed last month, an 89 percent spike from a year earlier and 16 percent increase from the previous month. Nevada reported 11,706 filings, though California posted 101,724 foreclosed properties - one-third of the national total and the highest among the states. The state's foreclosure activity rose 76 percent from August 2007 and 41 percent from the preceding month.

West Virginia, Vermont and South Dakota recorded the fewest number of foreclosures, with 43 total filings in West Virginia, or one in every 20,414 households, a decrease of 59 percent from the year earlier, though up 13 percent from the previous month.