Market stabilizing

Isle Homes: Sales still low but some prices pick up

STORY SUMMARY »

It's still anyone's guess whether Honolulu's real estate market, which peaked in 2005, has bottomed out or is gearing up to land.

Caution from real estate buyers continued to translate into few sales and lower prices on Oahu last month. However, the rate of decline has softened, and prices in a few luxury neighborhoods picked up.

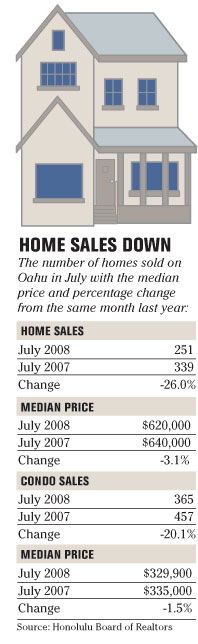

Single-family home sales dropped 26 percent in July, and condominium sales declined 20.1 percent, according to statistics released yesterday by the Honolulu Board of Realtors. More than half of single-family homebuyers paid more than $620,000 for a house in July, a 3.1 percent decline from the year-prior $640,000. Meanwhile, the median price paid for a condominium in July decreased a scant 1.5 percent to $329,900 from $335,000 a year ago. It also took sellers longer -- 52 days for a home and 42 days for a condominium -- to turn their listings into solds.

The median prices in neighborhoods like Wahiawa, the Ewa plain and Makakilo experienced substantial declines as problems with the subprime market made their way over to Hawaii.

However, sales were up in luxury Kapahulu/Diamond Head and Waialae/Kahala -- an indicator that demand for Hawaii still exists among those that can afford it.

FULL STORY »

Caution from real estate buyers continued to translate into few sales and lower prices on Oahu last month, but the rate of decline has softened and prices in a few luxury neighborhoods picked up.

It's still anyone's guess whether Honolulu's real estate market, which peaked in 2005, has bottomed out or is gearing up to land. However, it's safe to say that lackluster consumer confidence, which has been sharply hit by the mainland mortgage crisis, the frenetic stock market and the rising cost of fuel and other necessities, is slowing down the market.

It's still anyone's guess whether Honolulu's real estate market, which peaked in 2005, has bottomed out or is gearing up to land. However, it's safe to say that lackluster consumer confidence, which has been sharply hit by the mainland mortgage crisis, the frenetic stock market and the rising cost of fuel and other necessities, is slowing down the market.

"We are seeing the market plateau, but we aren't seeing wild swings any way," said Scott Higashi, executive vice president of sales for Prudential Locations LLC. "The net effect has been relatively mild overall. I hope it maintains itself but you never can tell."

Single-family home sales dropped 26 percent in July, and condominium sales dropped 20.1 percent, according to statistics released yesterday by the Honolulu Board of Realtors. While the market drop was still in the worrisome double-digit category, the percentage drop was not as dramatic as in June when both categories posted year-over-year 30-percent-plus declines.

"The rate of decline has softened a bit, and this could signal that we're nearing the bottom of this slower market, but we need to see a few more months of data to confirm this," said Harvey Shapiro, HBR research economist.

More than half of single-family homebuyers paid more than $620,000 for a house in July, a 3.1 percent decline from the year-prior $640,000. Meanwhile the median price paid for a condominium in July decreased a scant 1.5 percent to $329,900 from $335,000 a year ago. Again, the decline was not as widespread as in June, when the median price of a single-home fell by 8.8 percent from the year-earlier period and the median price for a condominium fell by 1.9 percent.

"The number of resales in the Oahu housing market may be starting to stabilize at these reduced levels," Shapiro said. "Our prices are still staying near current levels, although these softer market conditions may require more seller concessions to make a deal."

It also took homeowners longer to sell their properties last month, said Dana Chandler, HBR president. Single-family homes needed 52 days to sell, and condominiums took 42 days, both increases from last year's 44 and 38 days, respectively, Chandler said.

"Buyers may be more cautious with the current state of the economy, but so far our markets still seem to be operating normally, and Honolulu continues to provide a stable environment for both buyers and sellers," Chandler said.

Oahu's slower market should not be mistaken for a bad market, Higashi said.

"Prices by and large have maintained themselves, and owning a home is still a good idea," he said. "People who need to buy and want to buy are finding great opportunities."

Neighborhood by neighborhood, the performance is different on Oahu, said Chason Ishii, president of Coldwell Banker Pacific Properties.

Oahu neighborhoods in which a greater percentage of buyers used subprime loans or other creative financing to purchase homes are starting to see market declines due to rising foreclosures and short sales, which is when the lender agrees to take less than what is owed on the mortgage from a distressed owner, Ishii said.

"Prices in neighborhoods like Wahiawa, the Ewa plain and Makakilo are substantially down," he said. "We had more subprime activity in these markets, so we are starting to see more short sales and foreclosures affecting these neighborhoods."

Wahiawa experienced the largest month-to-month, single-family-home drop of any region, with the median price falling 23 percent.

Still, strong gains in luxury markets like Kapahulu/Diamond Head and Waialae/Kahala, where financing has historically not been as big an issue, demonstrate that demand for Hawaii remains strong, he said.

"Most luxury buyers are cash buyers, and they are not affected by the stricter underwriting standards," Ishii said.

Single-family home sales increased 50 percent last month in the Kapahulu/Diamond Head region. Sales also went up 25 percent in Aina Haina/Kuliouou and 7.7 percent in Waialae/Kahala.

"Typically, the luxury homeowner has more staying power and can hold on to their properties even with lifestyle changes," Ishii said. "First-time homeowners or owners in areas where more subprime loans have occurred generally don't have as much staying power."