New Ilikai buyer would ‘get in ... and get out’

A lawsuit has slowed sales after a planned redevelopment failed

STORY SUMMARY »

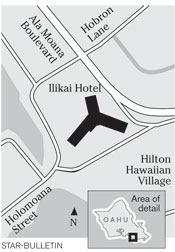

Another high-profile developer is seeking to acquire more than 200 units at the controversial Ilikai hotel, marked by constant turmoil over its redevelopment since 2006.

Peter Savio, an expert in condominium conversions, put in a bid two weeks ago to buy the units in bulk -- a move that potentially could bail out Ilikai developer Brian Anderson from some financial troubles.

Anderson, who took over the property in July 2006, was slapped with a federal lawsuit last month seeking to prevent the "fire sale" of unsold rooms for an average $200,000 per unit and accusing him of mishandling investors' money in an attempt to redevelop the landmark property.

FULL STORY »

Local developer Peter Savio is seeking to purchase more than 200 units at the embattled Ilikai hotel, which has been plagued for two years by controversy over its redevelopment.

Savio, an expert in condominium conversions, put in a bid two weeks ago to acquire the units, a move that potentially could bail out Ilikai developer Brian Anderson from some of his financial troubles.

Savio, an expert in condominium conversions, put in a bid two weeks ago to acquire the units, a move that potentially could bail out Ilikai developer Brian Anderson from some of his financial troubles.

Anderson, who took over the property in July 2006, was slapped with a federal lawsuit last month seeking to prevent the "fire sale" of unsold rooms for an average $200,000 per unit, and accusing him of mishandling investors' money in an attempt to redevelop the landmark property -- a 1960s Waikiki icon made famous on the television show "Hawaii Five-O."

"To me it's an excellent opportunity," Savio said. "The Ilikai's a good project. If it's priced right, it will sell."

Anderson's ambitious plans to reposition the middle-age hotel into an upscale condominium with a $60 million makeover failed to come to fruition, in part due to opposition from condominium owners disheartened by the rapid deterioration of the property and hotel services since the developer took over.

Anderson and his company, Anekona LLC, gained control of the board of directors of the association of apartment owners earlier this year, prompting fears that the developer would force owners to pay for improvements through special assessments.

Anderson, who told the Star-Bulletin earlier that he has been mischaracterized, did not return calls for comment.

If his bid is successful, Savio plans to turn around and immediately sell off the units as they are.

"I wouldn't change what's there," he said. "I'd get in and sell everything and get out. I'm not interested in controlling the board. I'm not going to stay behind as an owner, and I'm not going to retain anything. I have a different approach."

Three or four groups seeking to buy the units in bulk have approached Savio about handling sales if they win the bid, he said.

Savio began talking with Anderson about buying the units five to six months ago before realizing the Ilikai owner was in trouble, and recently resumed talks, he said.

"We've talked on the phone and he's interested. He wants to sell them," Savio said. "The lawsuit has kind of stopped him in his tracks, and timing-wise, the market is slowing."

Last month a federal judge extended to Aug. 5 a temporary restraining order that prohibits Anderson from selling the rooms below market prices.

"It doesn't prevent sales efforts or even sales themselves if it's at a price everybody agrees is market price," said James Bickerton, Anekona's attorney, adding that if there is a disagreement on the market price, then a sale would need to be approved by a federal magistrate. "It's absolutely not true that the average list price is $200,000. It's competitively priced in the market-value range."

There is no set time frame for the sales of units, according to Bickerton, who said there is substantial interest in the property.

The federal lawsuit was filed June 13 by Network Development Properties LLC and California investor Gordon Carlson, who together invested $5 million in the Ilikai to help Anderson acquire 343 condominiums, and is among other complaints filed in recent years by former Ilikai tenants and investors in Anderson's other hotel ventures.

At least 97 owners/investors have acquired units at an average $532,000 each, according to court documents.

The units vary -- some with and some without kitchens, one- and two-bedrooms, and some with ocean views with an average closer to $375,000 to $400,000, Savio said.

Still, Anderson, who acquired the property for $218 million and simultaneously sold the attached 360-room Yacht Harbor Tower, along with the ballroom and central swimming pool, has failed to gain support for the hotel condominium conversion project.

"I actually think he had an exciting plan, but if you can't sell it to the people, it's not going to work," Savio said. "In retrospect, could he have done a better job or been a little softer or tried something different? Maybe, but it's always hard to buy a building, be the new kid on the block and take control. Maybe he was not as sensitive as he should have been, but it's not a crime. It's more of a tactical error."