Stock market pulls down state pension fund 5.1%

The portfolio posted its second straight loss and underperformed its benchmark

The Hawaii Employees' Retirement System said yesterday its pension fund slumped for the second consecutive quarter.

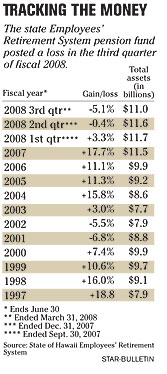

The ERS, which provides retirement, disability and survivor benefits to 106,000 people, saw investments in its portfolio slip 5.1 percent, or $634.5 million in the fiscal third quarter, which ended March 31. The fund underperformed its benchmark, down 4.3 percent, but slightly beat the median large pension fund, down 5.2 percent.

The ERS, which provides retirement, disability and survivor benefits to 106,000 people, saw investments in its portfolio slip 5.1 percent, or $634.5 million in the fiscal third quarter, which ended March 31. The fund underperformed its benchmark, down 4.3 percent, but slightly beat the median large pension fund, down 5.2 percent.

Over the last year, the fund increased by $64.9 million, or 2.5 percent, exceeding its policy benchmark, up 2.3 percent and overperforming the median large pension fund, up 0.5 percent.

In its fiscal second quarter, the portfolio slipped 0.4 percent, the first time the ERS portfolio had a negative return since the fiscal fourth quarter that ended June 2006, when the fund fell 0.1 percent.

In the third quarter, three of ERS' 13 domestic-equity accounts matched or outperformed their benchmarks, slipping from last quarter, when 12 of the 13 managers beat their benchmarks. ERS' domestic-equity investments were down 10.4 percent, underperforming the benchmark by 1 percent. For the year, the category was down 5.3 percent, beating the benchmark, down 6.1 percent.

"The entire market had some difficulty," said Rod June, chief investment officer. "In particular, the domestic equity markets were very challenging for us. Much of this was associated with what was going on with the mortgage crisis. There's going to be continued volatility in the markets. I don't think the credit crisis has fully played out yet, but we do see some optimism in the second half of the year with the stock market and hopefully in the fixed income."

Last quarter, the ERS generated its biggest gains from its fixed-income investments. International fixed income rose 10 percent (trailing the benchmark gain of 10.9 percent) and domestic fixed income rose 1.6 percent (trailing the benchmark gain of 2.2 percent).

The ERS portfolio has averaged a 12.7 percent gain over the last five calendar years to match its benchmark of 12.7 percent growth and exceeded the median return for its peers -- 50 other public pension funds with assets over $1 billion -- of 12.2 percent.

Assets slipped in the quarter to $11 billion, down from the prior quarter's $11.63 billion, and the record level of $11.67 billion at the end of the fiscal first quarter that ended Sept. 30.