Oahu home sales slow

The median price for a single-family home reaches a three-year low

STORY SUMMARY »

The median price paid for an Oahu home slumped to a three-year low in February, and sales slid to their lowest level since 1999, according to data released yesterday by the Honolulu Board of Realtors.

On the other hand, while condominium sales followed the softening trend, the median price paid by buyers spiked to $335,000, tying a record high.

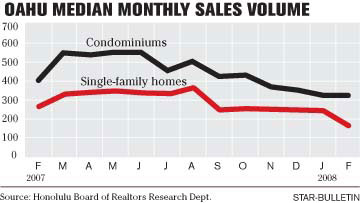

Dramatic downturns in February sales -- 40.1 percent for single-family homes and 20.1 percent for condos -- created some angst in the industry, which has seen spotty results across the regions. It did not help alleviate fears, either, when the median price paid for an Oahu single-family home fell to $599,000, a three-year low.

On the other hand, there were a few positive fundamentals in last month's market as the median price buyers paid for condos reached a record.

In addition, the high-end market continued to hold strong. Single-family home and condominium sales over $1 million continued to increase.

While market conditions benefited buyers, sellers who were looking to upgrade found that the price spreads worked in their favor, too.

FULL STORY »

Oahu's residential market posted declines in both sales and prices in many regions last month, but real estate experts do not think it has hit the tipping point yet.

Even as the median price paid for an Oahu home slumped to a three-year low in February, and sales slid to their lowest level since 1999, condominiums spiked to a record-tying median price of $335,000 despite softer sales, according to data released yesterday by the Honolulu Board of Realtors.

There is no doubt that the Hawaii market has softened. However, when Oahu prices are compared with the downturn in the housing markets on the mainland, the market still appears stable, said Harvey Shapiro, research economist for the Honolulu Board of Realtors.

And while Oahu's residential market finally posted declines in both sales and prices last month, real estate experts have said the market still has not passed the tipping point as demonstrated by its relatively low inventory levels.

"It's clear that prices are still holding up," Shapiro said. "The single-family home price dropped below 2005 levels, but it was only a thousand below. We are much more stable than many markets on the mainland. Hawaii is still a good place to invest."

Last month the median price paid to purchase a single-family home fell 2.5 percent, to $599,000 from $614,500 a year earlier. However, the condominium median reflected a 4.7 percent gain over February 2007, when it was $320,000. Still, the dramatic year-over-year downturns in sales -- 40.1 percent for single-family homes and 20.1 percent for condominiums -- created some angst in the industry, which has seen spotty results across the regions.

"People don't understand what's happened to the market, and I think that they fear the unknown," said Jerry Bangerter, owner of RE/MAX Kai Lani in Kailua. "Buyers are looking to get a home for less than the asking price, and sellers are saying that they won't sell until they get their asking price. We're ending up with a standoff, philosophically."

On the flip side, high-end buyers do not seem to share the same market concerns, said Chason Ishii, president of Coldwell Banker Pacific Properties.

"The high end continues to be strong. We saw 35 sales over $1 million last month as compared to 34 sales over $1 million in February 2007," Ishii said. "Those that have wealth don't seem to be as concerned with fluctuations in the market."

It is also a good market for buyers or sellers who are looking to move up, Ishii said.

"If you are looking to upgrade, the time to do it is when the market is heading down," he said.

As a result of last month's softening, the total dollar sales volume generated in the housing market through the first two months of this year was down 17 percent to $598.5 million -- a decline of $122.4 million -- from $720.9 million through the first two months of 2007.

"While everything has slowed -- from the number of new listings being put on the market to the quantity of sales transactions and even the number of properties going into escrow -- the inventory hasn't ballooned like in past post-boom periods, and this should be taken as a positive sign," said Dana Chandler, president of the Honolulu Board of Realtors.

Single-family home inventory in February climbed 12.1 percent to 1,924 and condominium inventory increased to 2,294, a 7.9 percent gain from the year prior.

"When the market slowed down in the late 1980s and early 1990s, the inventory soared to 4,500 condominiums and 2,500 single-family homes," Shapiro said. "We're nowhere near that point."

As long as inventory remains below 2,500 single-family homes and 3,000 condominiums, Oahu's market should remain stable, he said.

"I don't see an indication that the inventory will build up rapidly," Shapiro said.