HMSA rates for large groups to rise 9.2%

Higher reimbursements to physicians and hospitals prompt the increase, the insurer says

STORY SUMMARY »

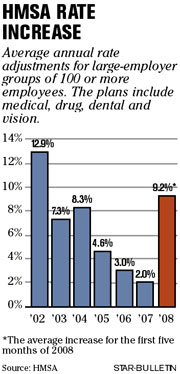

Health insurance rates will rise by an average 9.2 percent, the highest since 2002, for 158 businesses and about 132,500 members of Hawaii Medical Service Association.

Those large-employer groups of 100 or more workers are renewing their policies within the first five months of the year.

Though hospital admissions remain flat, the state's largest health insurer said it substantially increased medical payments to hospitals and physicians last year and must pass along that cost to members. HMSA would not disclose the percentage of increase in reimbursements to providers, though it expects the trend to continue this year.

HMSA's medical costs to providers has escalated by about 9 percent, said Steve Van Ribbink, company chief financial officer.

"We don't have more people going into hospitals; what we have is for the same number of people going in a much higher reimbursement rate to hospitals that is being caused by the fact that government payers are not paying their fair share," he said. "So hospitals are looking to HMSA to make up the inadequate reimbursements from government payers."

HMSA raised rates by 12.9 percent in 2002.

FULL STORY »

Hawaii Medical Service Association is boosting rates by an average 9.2 percent for most of its large business groups renewing in the first five months of the year.

The premium hike -- the highest since 2002 -- will affect roughly 158 businesses with 132,500 members, or about 83 percent of HMSA's total merit-rated groups with 100 or more employees that have medical, drug, dental and vision coverage. HMSA raised rates by 12.9 percent in 2002.

The premium hike -- the highest since 2002 -- will affect roughly 158 businesses with 132,500 members, or about 83 percent of HMSA's total merit-rated groups with 100 or more employees that have medical, drug, dental and vision coverage. HMSA raised rates by 12.9 percent in 2002.

Though hospital admissions remain flat, the state's largest health insurer said it substantially increased medical payments to hospitals and physicians last year and must pass along that cost to members. HMSA would not disclose the percentage of increase in reimbursements to providers, though it expects the trend to continue this year.

HMSA's medical costs to providers has escalated by about 9 percent, said Steve Van Ribbink, company chief financial officer.

"We don't have more people going into hospitals; what we have is for the same number of people going in a much higher reimbursement rate to hospitals that is being caused by the fact that government payers are not paying their fair share," he said. "So hospitals are looking to HMSA to make up the inadequate reimbursements from government payers."

About 94.5 percent of the premium dues HMSA collects goes toward paying providers, Van Ribbink said, adding that HMSA has tried to subsidize the increases with investment income.

In total, HMSA has about 220 large-business groups with 160,000 members, whose rates are determined by the group's claims experience.

The company raised rates by an average 9.4 percent in January for about 120 large businesses -- the bulk of its merit-rated groups -- with 106,486 members.

HMSA also filed an 8.7 percent premium increase on Jan. 4 with the state Insurance Division under the controversial rate-regulation law that was reinstated on Jan. 1.

That was the first rate filing since the law was reinstated that the state must approve before HMSA can move forward with a proposed increase for 38 large groups and 26,000 members renewing health plans from March through May. Rate regulation expired in June 2006 after lawmakers failed to reinstate the previous law.

HMSA plans to file rate adjustments in March for small businesses renewing in July.

The state is concerned about inadequate reimbursements to providers and has been discussing the issue with HMSA and other insurers, according to Insurance Commissioner J.P. Schmidt.

"There are statistics showing that they (HMSA) have one of the lowest reimbursement levels in the country for hospitals, and there are some facts that indicate they have lower reimbursements for doctors than most other insurers in other states," Schmidt said. "I'm happy that they say they're moving to correct the imbalance in reimbursement rates, but of course we are going to examine the file closely to make sure the rate is justified."

Hawaii's overall hospital payments last year from government programs and private insurers was 92 percent of the cost to provide care -- the lowest in the nation, said Rich Meiers, president and chief executive of the Healthcare Association of Hawaii.

"If HMSA is going to increase its rates in order to increase payments to providers to pay for the cost of health care, then that would be a good thing," he said. "It would perhaps stop the hemorrhaging to the health-care system in Hawaii."

In addition, Schmidt said the federal government has given Hawaii an unfairly low Medicare reimbursement rate, which insurers across the board look to as a base to determine its reimbursements, which are typically a percentage above Medicare.

"They (HMSA) are increasing reimbursements, but in a lot of cases our costs are rising probably faster than the reimbursements because of the changing dynamics in heath care," said Wesley Lo, chief executive of Maui Memorial Medical Center.

Some doctors say they are at odds with HMSA because the health plan has essentially shifted money to increase payments for certain procedures while lowering reimbursements for others.

"They pay more than Medicare, there's no question, but they don't pay similar to other insurers nationally," said Dr. Alistair Bairos, a general surgeon at Kona Community Hospital on the Big Island. "Medicare is not the standard in anybody's mind for what payments should be."

Bairos received nearly $1,300 from HMSA to remove a gallbladder in 1992, compared with a little more than $700 for the same procedure today, he said.

"An increase still doesn't make up for the fact that they're underreimbursing us terribly from what they even used to reimburse us 15 years ago," Bairos said. "An increase is kind of insulting, frankly."