CINDY ELLEN RUSSELL / CRUSSELL@STARBULLETIN.COM

Vishaka Devi Jokiel stands in front of the Kailuan, where she purchased her leasehold apartment in 2004 in the midst of Oahu's last real estate boom. Jokiel and other co-op owners are trying to keep their homes, but their leases end on Dec. 31.

|

|

Leasehold owners face tough decision

Leasehold owners are wrestling with what to do with their properties as expiration dates on their homes draw near

First of two parts

STORY SUMMARY »

At the tail end of the leasehold era, the sleeping dragon has begun to rouse, bringing to light old problems with limited solutions for both lessees and fee owners.

Property records show that some 1,500 or so lessees and lessors on Oahu will face critical decisions in the next decade as the terms of their leases begin expiring in 2010. Leasehold owners at the Kailuan are the first set of owners to be in the throes of an 11th-hour decision about whether to stay or to go. To be fair, the situation also has forced Kaneohe Ranch, the fee owner of this property, to make a grueling decision that has long-term ramifications.

DENNIS ODA / DODA@STARBULLETIN.COM

The Kailuan represents 18 of the 1,500 or so leases on Oahu that will expire in the next decade.

|

|

While the Kailuan represents only 18 of the 1,500 or so leases on Oahu that will expire in the next decade, for now it has taken over the dubious honor of becoming the next poster child for Hawaii's leasehold system.

Experts have said that finding a new business model for a decades-old contract that actually works in modern times is easier said than done.

If lessees decide to go, they know that they'll have trouble finding another home at an affordable price. But, if they stay, they know that their problems could double. On the flip side, fee owners who take back their lease at the term's end have the unhappy task of terminating long-term relationships with lessees and risking public censure. It's not an easy task either, for those that decide to renegotiate the lease or offer the fee.

» Tomorrow: Some say the leasehold crisis of the 1990s is rebrewing.

FULL STORY »

DENNIS ODA / DODA@STARBULLETIN.COM

Mitch D'Olier, president and chief executive of Kaneohe Ranch, stands in front of a big pile of dirt and rocks that was used to fill in the cesspool holes next to some of the apartments in back of him that soon will be torn down. Kaneohe Ranch is the landowner of the Kailuan, whose lease expires on Dec. 31.

|

|

Scott Werkmeister said that he made the decision last year to sell his childhood residence at the Lani Home on Date Street after coming to terms with the inevitability that he needed to act soon or face being left with nothing when the building's lease expired in 2012.

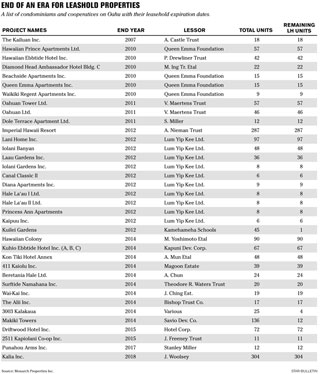

Leasehold residences

Hawaiian Prince Apts.

410 Nahua St.

Leasehold expires: 2010

Diana Apartments

2558 Laau St.

Leasehold expires: 2012v

Iolani Banyan

2565 Laau St.

Leasehold expires: 2012

Laau Gardens

2609 Date St.

Leasehold expires: 2012

Iolani Gardens

2614 Laau St.

Leasehold expires: 2012

Canal Classic II

2621 Laau St.

Leasehold expires: 2012

Beachside

423 Kanekapolei St.

Leasehold expires: 2010

Lani Home

2563 Date St.

Leasehold expires: 2012

Queen Emma

417 Kanekapolei St.

Leasehold expires: 2010

Waikiki Regent

441 Kanekapolei St.

Leasehold expires: 2010

|

Werkmeister moved out of the apartment in 2001 to accommodate a growing family, but he said that he resisted selling the property for many years in the hope that the landowner might eventually offer the fee.

Werkmeister rented the property for a time, and like all leasehold owners of properties with short-term leases, grappled with his dwindling options. Finally, a real estate agent convinced Werkmeister that it was time to sell if he wanted to salvage any value from his investment.

Werkmeister listed the property for $50,000, but said he got nary a nibble until he reduced the asking price to $40,000. In the end, Werkmeister had to let the two-bedroom apartment go for $35,000. It had been in his family since 1966.

"It was a very sad situation," Werkmeister said. "My real estate agent told us to take the offer because the longer we waited to sell the property, the less it would be worth."

At the tail end of the leasehold era, the sleeping dragon has begun to rouse, bringing to light old problems with limited solutions for both lessees and fee owners.

All over Oahu, leasehold owners of properties with short-term leases are facing similar dilemmas as they decide whether to stay or go.

For owners like those at the Kailuan, who are facing surrender of their property by year's end, it's already past the point of now or never.

To be fair, the situation also has forced Kaneohe Ranch, the fee owner of this property, to make a grueling decision that has long-term ramifications. Property records show that another 1,500 or so lessees and lessors will face critical decisions in the next decade as the terms of their leases begin expiring in 2010.

If lessees decide to go, they know that they'll have trouble finding another home at an affordable price. But, if they stay, they know that their problems could double.

Sticking out a short-term lease with the expectation that the fee owner may sell is taking a gamble that could result in even greater loss. And, it's a sure bet that lessees who wait to take action near the surrender of their lease will find that their values have plummeted, and their quest to find alternate housing has become more problematic.

On the flip side, fee owners who take back their lease at the term's end have the unhappy task of terminating long-term relationships with lessees and risking public censure. It's not an easy task either, for those that decide to renegotiate the lease or offer the fee. Experts have said that finding a new business model for a decades- old contract that actually works in modern times is easier said than done.

If Kaneohe Ranch stands firm and does not offer residents of the Kailuan an option to extend their lease or buy the property, residents will become the first of any living at a modern-day condominium or co-op to be evicted.

While the Kailuan represents only 18 of the 1,500 or so leases on Oahu that will expire in the next decade, for now it has taken over the dubious honor of becoming the next poster child for Hawaii's leasehold system.

"The landowner has a right to do what they want with their property, but I feel so sorry for these people," Werkmeister said. "Some of them could end up homeless."

The lease on the Kaneohe Ranch property expires Dec. 31, and experts warn that mass eviction at the Kailuan could trigger panic among potential leasehold buyers and cause further price and sales softening in an already-weakened system.

To be sure, the outcome of the 18-unit Kailuan will impact more than its owners. Kaneohe Ranch's decision could prove precedent setting, but at the very least it will spark further debate in Hawaii about how to preserve the rights of leasehold owners while still protecting the rights of Hawaii landowners.

"If one landlord takes back the property, it will crush all leasehold values," said real estate analyst Stephany Sofos. "You will see that with the Kailuan. If one landlord does it, there will be widespread impacts throughout the state that would be very detrimental to leasehold."

When Vishaka Devi Jokiel bought her leasehold apartment in 2004 in the midst of Oahu's last real estate boom, the Kailuan seemed like a good investment.

The single mother gladly paid $20,000 to own her own little piece of paradise in the Kailuan, a cooperative built on land owned by Kaneohe Ranch.

She was one of many homebuyers and investors during the last cycle that ignored the cautionary tales from the well-publicized lease negotiations of the 1990s and turned to leasehold as a means of breaking into Oahu's heated real estate market.

Jokiel said that she was informed at the time of purchase that the lease on her building was due to expire Dec. 31, 2007; however, she was hopeful that Kaneohe Ranch would eventually offer the fee. Besides, Oahu's frenetic housing market characterized by high valuations and low inventory afforded her few other home- ownership options.

"It was the most outrageous gift as a single parent to be able to own my own apartment," Jokiel said. "It's been the most grounding experience to live there for myself and for my child."

When Jokiel bought her property, the leasehold market was enjoying renewed popularity. Leaseholds, which began to rebound around 2001, had become so popular that prices were up 80 percent by the time Jokiel purchased the property. The conversion of some two- thirds of leasehold inventory into fee properties buoyed consumer confidence in leasehold to the point that 12 out of the 18 owners at the Kailuan bought after 2000 in full knowledge that there weren't many years left on their leases. But the pendulum has swung.

Next month, Jokiel and other owners in the Kailuan face eviction if landowner Kaneohe Ranch does not decide to extend their lease or offer them an opportunity to buy the property. While the Kailuan leasehold co-op has troubles that are unique to its own circumstances, in other ways it is a forerunner of the problems that many leasehold condominiums will face in the years ahead of their expiration dates.

The Kailuan's cooperative owners have dealt with the possibility of eviction in a variety of ways. Some residents have asked Kaneohe Ranch to extend their lease, or if they intend to sell the property, to give them the right of first refusal.

Others have sold their interest in the co-op for next to nothing or taken advantage of an offer from Kaneohe Ranch to compensate them for leaving early.

One family even elected to bank on an eleventh-hour reprieve from the landowner and bought two additional properties in the co-op this summer for a combined $4,000.

And, some are just waiting for someone else to determine their fate.

The Kailuan's impending lease expiration date has brought Kaneohe Ranch its own set of problems.

For starters, Kaneohe Ranch never intended for the property to be anything other than an apartment building, said Mitch D'Olier, president and chief executive of Kaneohe Ranch.

Peter Savio, a kamaaina developer who owned the lease on the apartment building, helped apartment tenants force Kaneohe Ranch into a co-op situation in 1986, D'Olier said.

"This building was so old that we had always viewed it as a teardown," D'Olier said.

Managing the forced co-op situation has been fraught with challenges for Kaneohe Ranch, he said. Because time is running out, there is little incentive for owners to pay their lease rent, maintenance fees or make improvements, and the building sits on a cesspool that is in violation of the Environmental Protection Agency's clean water act, D'Olier said. And, attempts to collect back money or bring the building up to code have been unsuccessful as have attempts to negotiate with leasehold owners, he said.

"This is probably as complicated a situation as I've ever seen," D'Olier said. "There are 18 apartment owners and 18 different situations. This isn't a situation where all the apartment owners want to buy the units."

While some of the leasehold owners in the Kailuan cooperative have expressed interest in purchasing the building from Kaneohe Ranch, D'Olier said that the landowner has never received a formal offer for market value. Some owners have contacted Kaneohe Ranch on their own, others have sent attorneys, a couple have brought in third-party developers and a few haven't done anything at all, he said.

Last Monday, the Kailuan Board hired Michael Pang, principal broker and president of Monarch Properties Inc., a company that specializes in working out lease-to-fee conversions.

Pang's company helped residents at Kahala Garden, which sits on Kamehameha Schools land, avert lease surrender earlier this year.

Residents at the 16-unit co-op located on Oahu would have been the first living in a multi-family coop to be evicted en masse. Though Kamehameha Schools had been adamant that it would not sell the property, ultimately the owners agreed to sell and the fee purchase closed escrow on July 31, the lease expiration date.

"Both sides were happy with the result; the shareholders own a fee-simple property and have housing-certainty in their lives, while Kamehameha Schools can reinvest the proceeds of sale in other potentially more-lucrative invest- ments," Pang said.

While Pang will attempt to reach a viable solution for Kailuan residents and Kaneohe Ranch, it's not going to be an easy task, he said.

"At this rate, we'll just have to look where we are on January 1 and figure it out," D'Olier said. "We'll probably end up selling to a third party."

Regardless, the Kailuan will have to be brought up to code, D'Olier said. There's a cesspool to fix and the property needs to be hooked into the city's sewage system, he said.

Jokiel said that she and the other owners, who have stuck it out to the end at the Kailuan, are willing to do whatever it takes to reach a solution with Kaneohe Ranch. Some have even indicated that they are willing to pay much more than market value so that they won't have to face losing their home.

"If they are going to sell to someone, why not sell to us?" she said. "This is our home and we'd like to stay here. We need to stay here."

In the end, Jokiel's decision to wait could prove to be a metaphor for the whole leasehold system in general. Only time will tell if it was actually a good idea.