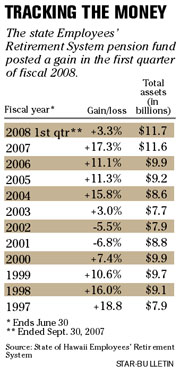

ERS pension fund hits record $11.7B

Fund has posted double-digit returns four years in a row

STORY SUMMARY »

The state Employees' Retirement System pension fund said yesterday it rode the performance of its international and domestic fixed income holdings to a 3.3 percent gain quarter ending Sept. 30.

In boosting its total assets to a record $11.7 billion, the state's largest pension fund beat both its benchmark return and the median for public funds with assets greater than $1 billion.

FULL STORY »

The state's largest pension fund began its new fiscal year on a strong note as it posted a 3.3 percent gain that beat both its benchmark return and the median for public funds with assets greater than $1 billion.

The state's largest pension fund began its new fiscal year on a strong note as it posted a 3.3 percent gain that beat both its benchmark return and the median for public funds with assets greater than $1 billion.

In boosting its total assets to a record $11.7 billion, the state Employees' Retirement System fund rode the performance of its international and domestic fixed-income asset classes in the quarter ended Sept. 30.

The ERS fund is coming off of four consecutive double-digit, fiscal-year gains with the portfolio jumping 17.3 percent in fiscal 2007, its best performance in a decade. For the last 12 months, the ERS fund had a gain of 16.8 percent.

The 3.3 percent return last quarter beat ERS' benchmark return of 2.9 percent and the median fund return of 2.3 percent. The ERS fund is ahead of its benchmark and median fund returns for each of the last one-, three- and five-year periods.

The ERS provides retirement, disability and survivor benefits for 106,000 people, including more than 65,000 active members.

Portland, Ore.-based Pension Consulting Alliance, which took over on Jan. 1 as the ERS adviser, said in a report to the ERS trustees that concerns about the subprime mortgage market continued to contribute to a lagging performance in domestic equities while international equities benefited from a sustained weakness in the U.S. dollar.

"Bond markets rallied as investors sought protection from declines in equity markets," Pension Consulting Alliance said.

The ERS' international fixed-income holdings rose 7.6 percent, the strongest return of any asset class even though it trailed its benchmark return of 8.1 percent. The domestic fixed-income category rose 3.1 percent to beat its benchmark of 2.8 percent.

International equity gained 3.4 percent but trailed its benchmark of 4.0 percent, while domestic equity advanced 1.9 percent, easily beating its benchmark of 1.2 percent.

Real estate, which is reported on a one-quarter lag, rose 6.8 percent to beat its benchmark of 4.3 percent.