OFFICE SPACE HONOLULU STAR-BULLETIN

Oahu office vacancies were impacted by troubles in the subprime lending industry, but the increase is likely a blip, according to a report by Colliers Monroe Friedlander Inc.

|

|

Office vacancy in Honolulu rises to 6.9%

Subprime troubles are behind the first increase in four years, a Colliers report says

STORY SUMMARY »

The collapse of the subprime lending industry has had an effect on Honolulu's office market, which posted an increase in vacancy for the first time in four years, according to a new report.

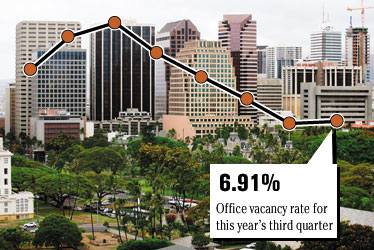

The slight rise in vacancy at the end of this year's third quarter to 6.9 percent, compared to 6.5 percent in the second quarter, is the result of the recent volatility in the credit markets, a slowdown in home sales and slower growth in the Hawaii economy, said the report released this week by Colliers Monroe Friedlander Inc.

However, Colliers said the rise in vacancy is likely a blip and not an indication of a turning point in the still-tight market, which has yet to see rents decrease.

FULL STORY »

Honolulu's office market has seen an increase in vacancy for the first time in four years in the wake the collapse of the subprime lending industry, according to a new report.

The slight rise in vacancy at the end of this year's third quarter to 6.9 percent, compared to 6.5 percent in the second quarter, was due to the recent volatility in the credit markets, a slowdown in home sales and slower growth in the Hawaii economy, said the report released this week by Colliers Monroe Friedlander Inc.

"We think it's a blip -- one period of time doesn't indicate a trend yet," said Mike Hamasu, Colliers' director of consulting and research. "The Hawaii office market was impacted by subprime woes and the impact of the mortgage lending community. Whether it continues depends on the default rates for residential homes and whether or not the difficulties faced by the residential market continue for any period of time."

About 70,000 square feet office space was freed up on Oahu during the third quarter, the report said.

The market change follows the closure of several mortgage companies' local operations, which either subleased their space or put it back on the market.

Lenders that downsized their offices earlier in the year gave back more than 15,000 square feet at Davies Pacific Center and 1132 Bishop St., according to a separate report by Hawaii Commercial Real Estate LLC.

The report also noted that Topa Financial Center has nearly 10,000 square feet pending vacancy from Countrywide Home Loans Inc., BNC Mortgage LLC and a small brokerage firm.

Meanwhile, Pacific Guardian Center lost a 2,500 square foot American Home Mortgage operation, while City Financial Center lost the more than 5,000 square foot office of First Magnus Financial Corp. However, both of those have been subleased to IndyMac Bank.

"We've had strong job growth that is likely to continue as long as the economy remains healthy," Hamasu said. "If that continues, it should counterbalance the negative impact currently faced by the residential marketplace."

The highest class high-rise buildings -- which typically offer parking and other amenities -- saw more tenants move out in the third quarter, as overall vacancy in the central business district also increased.

But office rents continued to rise across the board even as vacancy rose, reflecting the tight market conditions.

Several submarkets in the East, Leeward and Windward Oahu continued to be extremely tight, with vacancy rates between 3 percent and 4 percent and some of the highest rents in the market.

As a result of higher office expenses, inflation, the slowing economy and shortage of employment resources contributing to increased wages, employers will likely slow hiring practices and future expansion, Hamasu said.

"The compounded affect is to the bottom line of business," he said.