State construction faces soft landing

STORY SUMMARY »

Hawaii's construction industry appears to be heading for a soft landing, despite concerns in the wake of the recent turmoil in the global credit markets.

Local economists are forecasting a shallow downturn in construction over the next few years, according to the annual Hawaii construction forecast released today by the University of Hawaii Economic Research Organization.

However, UHERO warns that any further worsening in the availability or cost of credit will adversely affect the local building industry forecast in the upcoming years.

Already, the authors say, some construction projects are at risk and may fall through because investors in alternative financing structures are no longer buying debt because of the uncertainty in the market.

FULL STORY »

Local economists are forecasting a shallow downturn in construction over the next few years, though recent turmoil in the global financial markets may yet have an impact on the industry in Hawaii.

Despite credit concerns, the construction industry appears to be poised for a "soft landing," according to the annual Hawaii construction forecast released today by the University of Hawaii Economic Research Organization.

"But the caveat is ... any material worsening in the cost or availability of credit will probably result in an outcome that's worse than our forecast," said Paul Brewbaker, Bank of Hawaii economist and co-author of the report.

"But the caveat is ... any material worsening in the cost or availability of credit will probably result in an outcome that's worse than our forecast," said Paul Brewbaker, Bank of Hawaii economist and co-author of the report.

While a soft landing is good news, economists say there are projects at risk here, particularly those that have opted for lower-cost alternative financing through investment banks and institutions that sell part of a pool of loans to individual investors -- who are no longer buying debt because of uncertainty in the market.

"Those kinds of financing schemes are the ones at risk," said UH economist Carl Bonham, co-author of the report. "Any time you have a flattening out of the market there's going to be projects that might be in the planning stages that don't continue."

For instance, liquidity has all but dried up in the market for short-term, 30-day commercial paper as a result of the recent meltdown in the residential lending market.

"That business is dead as a doornail," Brewbaker said. "That means there's a bar you have to jump over to make commercial real estate viable."

Another problem for developers is that credit risk has now been priced upwards, so it is more costly to borrow money, he added.

Growth in real contracting receipts already is expected to slow this year, turning negative in 2008 and 2009. Economists expect hotel renovations and industrial and commercial construction to stabilize the market as the residential sector continues to weaken.

The value of residential building permits is projected to decline 4.2 percent this year, with a double-digit decline in 2008 and a drop to $1.4 billion by 2009.

Meanwhile, nonresidential construction is expected to fall from $1.96 billion in 2006 to $1.70 billion this year and remain at roughly $1.63 billion over the next several years.

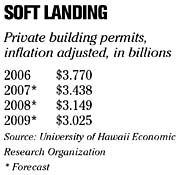

Total private building permits, which reached $3.77 billion in 2006, are expected to drop to $3.44 billion, or by 8.9 percent, this year, receding to just over $3 billion by 2009.

The construction job count is expected to peak next year and drop slightly in 2009.

Construction payrolls are projected to increase 5 percent this year from 35,880 construction jobs in 2006, and rise by 1 percent to 38,120 in 2008. However, building jobs are expected to fall by slightly more than 1 percent to 37,680 in 2009.

Still, economists say there are no signs of a significant and prolonged downturn in the state's construction industry, despite the closure of alternative channels of financing.

"Simply because one channel of credit formation has been closed it doesn't mean there isn't liquidity available," Brewbaker said. "It's not like liquidity just evaporated -- it just went to a different place."