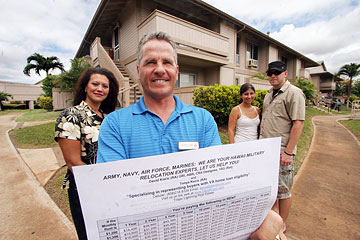

DENNIS ODA / DODA@STARBULLETIN.COMDavid Kucic, who together with his wife Tonya, front, formed Tropic Lighting Real Estate in Hawaii, displayed a list he shows prospective buyers comparing rental payments with mortgage payments. The Kucics helped Brett Salter, a U.S. Coast Guard second class gunner's mate stationed at Sand Island, and his wife Jackie Merino, buy a home recently in Ewa Beach. CLICK FOR LARGE |

|

Deployed troops get jump on Hawaii housing market

Service members are getting a jump-start in the Oahu housing market by buying while deployed

STORY SUMMARY »

Oahu's overall housing market has softened in terms of sales, but among some military buyers there's a sense of urgency to get into the market before home prices and interest rates rise.

While Oahu's overall home- buying market might have slowed in terms of sales, transactions from military buyers are booming.

New government laws, an improved economy and continued low interest rates have armed military buyers with more buying power than they've had in the past two decades. And, their base housing allowances are generous enough to give them some choices in Hawaii's residential real estate market.

COURTESY OF THE LAUGHLIN FAMILY Jacob Laughlin, a staff sergeant stationed in Iraq, looked over Hawaii houses recently from abroad. With the help of a Realtor, technology, and his wife Stephanie, who was in California, the couple was able to close on a house in Mililani. CLICK FOR LARGE |

|

The wars in Iraq and Afghanistan have created more interest in veterans' benefits and have made more of Hawaii's active-duty military eligible to buy into the market.

Since 2005, military loans have more than doubled in Hawaii, said the Veterans Administration, which administers housing benefits for Hawaii's military.

Realtors and home builders who cater to this market also have reported significant increases, especially in the last six months or so, as thousands of military soldiers who have been serving in Iraq and Afghanistan prepare to return home.

STAR-BULLETIN

FULL STORY »

Shelley Patrick, a 33-year-old staff sergeant with the 3BCT/25th infantry division, is deployed to Iraq. But that isn't stopping her from hunting for Hawaii real estate.

Patrick, who will be home from deployment in about a month, began looking at Hawaii real estate listings online as a way to pass the time in Iraq. She began looking in earnest when friends referred her to Hawaii-based Realtor David Kucic, who has conducted many dual-location real estate transactions for Hawaii's deployed service members.

"Up until now I have lived in (government) housing, which is OK, but I think for the money I am losing to stay there, sometimes in old, drabby housing... I could be paying on something I own," Patrick said via e-mail from Iraq.

DENNIS ODA / DODA@STARBULLETIN.COMDavid Kucic and his wife Tonya, above, who together formed Tropic Lighting Real Estate in Hawaii, searched for properties from the computer at their Ewa Beach home while their 8-year-old daughter Caitlin looked on. CLICK FOR LARGE |

|

Although Patrick could have waited until her return to look for housing in Hawaii, she's hoping to get a jump-start on the 4,000 or so deployed Hawaii soldiers who will be returning home by October. While many will choose to rent or live in government quarters, an increasing number are electing to get into Hawaii's home market from afar.

More generous base allowances, higher loan caps and continued low interest rates have armed military buyers with more buying power than they've had in the past two decades.

The wars in Iraq and Afghanistan have created more interest in veterans' benefits and have made more of Hawaii's active-duty military eligible to buy into the market, said Ivonne Perez, a loan guarantee officer for the Loan Guarantee Division for the Department of Veteran Affairs, which serves clients in the Hawaii and the Pacific.

"We have more activity because of the war," Perez said. "The number of soldiers has heightened and there is more activity."

In addition, since 2005 Hawaii's military has had access to higher maximum VA loan amounts, she said. The maximum loan amount rose from $240,000 to $539,475 in 2005 and increased to $625,500 in 2006, she said.

DENNIS ODA / DODA@STARBULLETIN.COMThe Kucics, who mostly assist service members, helped Brett Salter, a U.S. Coast Guard second class gunner's mate stationed at Sand Island, and his wife Jackie Merino, buy a home recently in Ewa Beach. Here, Merino and Salter stand in the backyard of their new home. CLICK FOR LARGE |

|

"That put us in the game," she said, adding that the number of VA loans in the Pacific virtually doubled from 2005 to 2006, when 758 VA loans closed. This year, based on activity to date, Perez is expecting the number of loans that her office handles to reach 1,000, she said.

The increase in military basic housing allowances also has made it possible for even the military's entry-level enlisted, who would typically get in the neighborhood of $1,698 a month in housing allowance, to qualify for a mortgage to purchase starter homes and condos, especially in the Leeward and Central Oahu areas, said John Riggins of John Riggins Real Estate.

The increase in loan caps also has made it possible for senior officers, who would typically net about $3,000 a month in housing allowances, to buy into more expensive markets in East and Windward Oahu, Riggins said.

"In Leeward Oahu, the military are really driving this market," said Riggins, who said most of the deals that he's seen in his region have a military connection.

Likewise, D.R. Horton's Schuler Division in Hawaii has seen an increase in military buyers during the last six months to a year and has consciously targeted them in marketing its Sea Country project in Maili, said Mike Jones, Hawaii Division president.

"Typically, we've had a fair amount of military buyers, but over the last six months to a year we've seen an increase in military buyers -- especially at Sea Country," Jones said.

Because Sea Country is located close to Schofield Army Base with base access via Kolekole Pass, it has been embraced by military buyers, he said. It's also Oahu's lowest-priced, new, single-family home community, Jones said. Sea Country homes sell for between $378,000 and $450,000, he said.

In May, the company catered to the military by offering a $4,000 closing bonus to active duty and right now is offering $2,000 bonuses, Jones said.

"They deserve it," he said.

Oahu's overall housing market has softened in terms of sales, but among some military buyers there's a sense of urgency to get into the market before home prices and interest rates rise, said Kucic, who is currently supplying real estate information to 68 soldiers based in Iraq.

"The market hasn't slowed down for us," said Kucic of the real estate business Tropic Lighting Real Estate that he formed with his wife Tonya after coming back in 2005 from his third deployment in Iraq and retiring as a first sergeant.

While Kucic doesn't work exclusively with the military, the troops supply the bulk of his client load. The current deployment schedule has created an unusual marketing opportunity abroad. However, Kucic said that he also has found Hawaii's military buying market to be strong at home, too.

There's a growing recognition among some military members like Brett Salter, a U.S. Coast Guard second class gunner's mate stationed at Sand Island, and his wife Jackie Merino, that it just makes more sense to use their housing allowances to buy property on Oahu rather than use it to pay rent.

"I really hadn't looked into buying a house, but after my neighbors bought their house, I realized that I could buy a house for about the same as it would cost to rent," said Salter, who just used a VA loan to close on a two-bedroom, 1 1/2- bath property in Ewa.

Other real estate agents who cater to the military, like Kelly Barnes of GotHomesHawaii.com, said they've also seen buying frenzy from military members who are due to go overseas.

CRAIG T. KOJIMA / CKOJIMA@STARBULLETIN.COMRaj and Mona Butani, sitting with their son Rohan, chose Kelly Barnes, right, of GotHomesHawaii.com to sell their Harbor Court condominium after Raj returned home to Hawaii from a yearlong deployment in Iraq and separated from the U.S. Army. Barnes' prior military service enhanced the couple's comfort level, Raj said. CLICK FOR LARGE |

|

"My last buyer knew he was going to get deployed so he wanted to get a unit before he got deployed," Barnes said. "Many of the military buyers that I deal with are worried that when they come back Hawaii's real estate market will be too expensive or interest rates might be too high."

But regardless of deployment schedules, many Oahu Realtors have found that military home buyers are a constant source of real estate activity.

Barnes and his wife Naoko have only been in Hawaii's residential real estate market for a year, but said that they are off to a good start thanks to the strength of the military market which tends to prefer using Realtors that have an understanding or connection to the military.

Barnes, who has more than 24 years of military experience, retired as a program reserve officer working for the U.S. Pacific Command in Honolulu. He formerly served as a naval aviator aboard aircraft carriers such as the USS Enterprise and USS Constellation.

"We're pretty new agents. We've only done residential for just over a year, but it's getting really active," Barnes said. "We're one of the premier agents for military moving stations on the islands."

Raj and Mona Butani chose Barnes to sell their Harbor Court condominium after Raj returned home to Hawaii from a yearlong deployment in Iraq and separated from the U.S. Army. Barnes' prior military service enhanced the couple's comfort level, Raj Butani said.

"In our case, our buyer was a former military couple, we are a former military couple and our agent was former military," Butani said. "Having military experience in common does provide people with some level of comfort, but it's not absolute. We know non-military agents that cater to military families because there is a constant pool of buyers and sellers because there are always people moving on and off the island."

Military moves and deployments aside, the desire to get settled after dealing with so much displacement from the war-driven deployments of the past several years also has fueled the military home-buying market on Oahu.

For Jacob Laughlin, a staff sergeant stationed in Iraq and his wife Stephanie, who had been living in California with family during her husband's absence, getting set up with a home in Hawaii prior to his return from deployment was due more to the desire to get on with their lives than to beat the rush.

Like a growing number of military buyers in Oahu's marketplace, the couple took advantage of technology to find and later close on a two-bedroom, one-bath Mililani townhouse, sight unseen

"We had just had a baby, so it didn't seem feasible for me to physically look for homes in Hawaii," Stephanie said. "And I really wanted to have everything set up for Jacob when he came home. I didn't want him to have to go through all that stress after coming back from Iraq."

Team Kucic sent pictures and video of Hawaii homes to Iraq and California. Once the couple found a house that they liked, they had a friend who was based in Hawaii visit the property for a second opinion. Stephanie used power of attorney to close on the property from California and picked up the keys a month later.

"It was the most amazing feeling," Stephanie said. "It's almost surreal."

And best of all, come October when many of Hawaii's returning military begin searching for housing in earnest, the Laughlin family will be hunkered down enjoying their little piece of paradise. This time, Jacob's return will literally be a "home" coming.