Higher spending masks a problem

Isle visitors spent more last month but higher costs threaten to drive them away

Hawaii's visitor industry is struggling to overcome falling demand amid rising vacation costs, an imbalance which has influenced spending and hotel choices for tourists.

The state's visitor industry is touting a 4.2 percent spending increase by visitors to Hawaii February as positive market repositioning in keeping with the state's push to measure visitor industry growth in terms of revenues rather than arrivals.

Even so, some travelers have responded to the decline in availability of budget accommodations by choosing not to visit Hawaii, to stay with friends or family when they get here, or to curb spending habits.

Even so, some travelers have responded to the decline in availability of budget accommodations by choosing not to visit Hawaii, to stay with friends or family when they get here, or to curb spending habits.

Smith Travel has reported that occupancy is down 10 to 12 percent in Hawaii, while room rates are up 8 to 10 percent. The state's hoteliers are scrambling to bring balance back to their industry, said Barry Wallace, executive vice president of hospitality services for Outrigger Enterprises Group.

"Our whole general market slowed down Jan. 1 and it hasn't picked back up yet," Wallace said. "We're definitely seeing some price sensitivity out there."

Hawaii's hotel industry, which has been unable to reduce lodging costs due to prior price commitments with third party travel intermediaries, has begun offering a plethora of special incentives and amenities, he said. Still it's hard to overcome the historic perception that Hawaii is too expensive for what tourists get.

For the past two years running, Hawaii topped the list of most expensive destinations in AAA's Annual Vacation Costs Survey. Hawaii's daily cost of food and lodging for a family of four averaged $559 per day in 2006, more than double the $261 nationwide average.

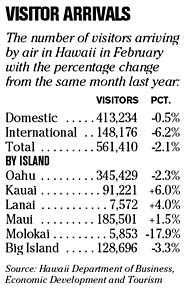

Year to date, visitor spending is only up 1.2 percent, as growth in the U.S. West market has not been able to offset the decrease from other markets, according to figures released yesterday by the state Department of Business, Economic Development and Tourism.

While February fared better than January, it's hard to pinpoint whether tourists who spent more were basking in the glow of retail therapy or feeling the burn of inflation.

Average daily spending rose to $181 per person as compared to $172 per person in February of 2006, boosting February's total visitor expenditures 4.2 percent to $963.1 million, DBEDT said.

"When you reach a certain level of pricing, you'll hit resistance and people won't continue spending," said retail analyst Stephany Sofos.

Year-over-year lodging costs were up substantially in February for both the Japanese and Canadian markets, while both markets were showing a decline in other spending categories and in arrivals.

"Tourist spending is softening, especially in the international markets," Sofos said.

Lodging costs rose 17.7 percent for the Canadian market in February, while arrivals fell 5.3 percent and spending declined in other categories.

Canadians spent 17 percent less on entertainment and recreation, 5.5 percent for food, 8.2 percent for shopping and 6.7 percent on transportation, said Cy Feng, an econo-mist at DBEDT.

Meanwhile, the Japan market, which dropped by 5.3 percent as well, dealt with a 22.7 percent increase in lodging costs. And, while Japan travelers spent 5.1 percent more on entertainment and recreation in Hawaii in February, they spent 1.9 percent less on food, 3.3 percent less on shopping and 6.2 percent less on transportation.

A complete spending breakdown was not available for the U.S. market; however, preliminary numbers indicate that entertainment and recreation spending experienced a single-digit rise and that lodging costs remained relatively flat, said Daniel Nahoopii, chief of the state's tourism research branch.

Lodging costs might have contributed to a 10.2 percent decline in the number of U.S. visitors who planned to stay in a hotel when they visited Hawaii, versus timeshares or friends and family.

While U.S. West visitors appear to have increased their spending outside of lodging in Hawaii in February, the increase could prove negligible after factoring out holiday gift-card spending, Sofos said.

"We have the same stores that they have in the U.S. West," Sofos said. "They probably used their Macy's and Tiffany and William Sonoma gift cards here."

Sofos said it's too soon to forecast where this year's visitor spending will end up, or if gains will be overshadowed by the rising inflation, taxes and operating costs at play in the visitor industry.

"We should know more by July or August," Sofos said.

Despite upward price adjustments, Oahu's hotel rooms are still $15 to $20 below what they would have been at this juncture if the state's visitor industry had not been so hard hit by 9/11, Wallace said.