FL MORRIS / FMORRIS@STARBULLETIN.COM

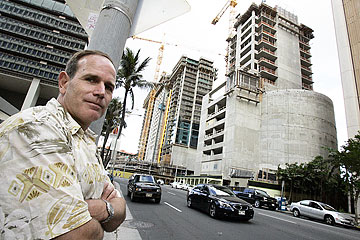

Steven Baldridge stands outside his office at Baldridge & Associates Structural Engineering Inc. on Bishop Street in downtown Honolulu. In the background are Capitol Place, left, and the Pinnacle Honolulu, two of the large construction projects that his company is testing for concrete strength. CLICK FOR LARGE

|

|

Fear of building

Contractors and engineering firms are capping the amount of residential work they can do because of the growing threat of lawsuits

EACH TIME Audrey Hidano books a residential job for her construction company, a potential lawsuit crosses her mind.

The office manager of Hidano Construction Inc. must be careful that the firm not work on two houses in a subdivision or on a condominium project under the jurisdiction of an association of apartment owners for fear of potential litigation.

The threat of class-action lawsuits, which has become prevalent in the building industry, is driving up the cost of homes in Hawaii as local firms increasingly are restricted by their insurers from doing residential projects or are forced to substantially raise the price on a high-risk residential job.

"I try to settle things before it even smells like a lawsuit," Hidano said. "We would take a loss in fixing a problem even though sometimes we're not really wrong."

General contractors, subcontractors and related design and engineer firms say that insurance carriers either won't insure residential projects, or are capping the amount of residential work they can do because of the growing threat of lawsuits in recent years.

Typically, developers and construction-related firms must have liability insurance in order to secure financing for a project.

FL MORRIS / FMORRIS@STARBULLETIN.COM

Steven Baldridge shows a concrete test cylinder and the "cylinder buster" concrete strength test machine in the company lab at Baldridge & Associates Structural Engineering in downtown Honolulu. The Baldridge firm's residential work is capped at 25 percent of gross revenue. CLICK FOR LARGE

|

|

While the industry doesn't track the number of lawsuits or complaints against construction-related firms, local companies say the problem has worsened, especially with the statewide boom in condominium developments that have multiple owners.

The issue has for years affected builders nationwide and is similar to the problem doctors have encountered with malpractice lawsuits and skyrocketing insurance premiums, said Steven Baldridge of Baldridge & Associates Structural Engineering Inc.

It's not unusual for an attorney to talk to an association of apartment owners and hire a consultant to look for problems several years after a project is completed, he said.

"They try to sue the contractor, architect and all the engineers who worked on a project or try to get insurance money from someone," he said. "As things get busy, there are people in our industry who just won't do residential."

Residential work for the Baldridge firm is capped at 25 percent of gross revenue, otherwise the company would lose its insurance policy altogether, he said.

The company pays about $100,000 a year for professional liability insurance -- or 5 percent of its billings -- to cover any potential claims against the business. The premium is based on annual gross revenue.

"The cost of residential construction in Hawaii is inflated by a significant amount because of this," Baldridge said. "Our insurance is higher because we do some condos -- and we're penalized. That gets put back into those projects because we've got to cover that cost."

A contractor that might price a job at $100,000 for a school, would likely price a similar residential project at $125,000 just because of the added risk, Baldridge said.

"Doing condominium work is almost like putting your drunken uncle on your car insurance -- it's just not going to happen," he said.

Other companies such as architectural firm Wimberly Allison Tong & Goo have chosen not to do condominium work altogether because of the litigious nature of homeowners in the United States, said Howard Wolff, senior vice president.

"We've been busy doing other work and have been able to be selective," he said.

For Armstrong Builders LLC, condominium projects comprise 90 percent of the business, which provides a general liability insurance policy that covers all contractors working on a project.

The consolidated insurance policy covers a two-year period and is based on $250 million worth of work.

"That's the way we've been getting around general liability insurance," said Robert Armstrong, company chief executive officer

"A smaller condo project is probably not going to get insurance at all."

Insurers underwrite these so-called "wrap" policies for larger builders that pay substantially higher premiums, but they require more stringent third-party inspections to minimize the possibility of construction defects.

FL MORRIS / FMORRIS@STARBULLETIN.COM

"They try to sue the contractor, architect and all the engineers who worked on a project or try to get insurance money from someone."

Steven Baldridge

Baldridge & Associates

Structural Engineering Inc.

|

|

MEANWHILE, state officials have been trying to find a solution to the rash of construction-related lawsuits in recent years, said J.P. Schmidt, state insurance commissioner.

The state enacted legislation in 2005 that requires anyone that claims to have a construction defect to notify the contractor and give the firm the opportunity to fix the problem rather than immediately filing a lawsuit.

However, it is too early to tell whether the law has had an effect on reducing lawsuits and liability insurance premiums, he said.

While the class-action suits primarily have targeted condominium builders, suits recently have turned to developers of hotels converted into condos. The litigation also is affecting developers of townhouses, subdivisions and time-share projects, said Karen Hong, an agent with Finance Insurance.

For most builders, settling a complaint is much simpler than a long, drawn-out battle with multiple owners in a class-action suit, which is why most claims don't become public, she said.

"The claims aren't because there's so many mistakes out there, the claims are because the legal system allows people to file a lawsuit for anything," Hong said.

Overall, the problem has led to the shrinkage of smaller builders, while larger national firms that can insure themselves have scooped up much of Hawaii's residential projects, said Karen Nakamura, executive vice president of the Building Industry Association of Hawaii.

The problem has impacted the supply of new homes and ultimately has driven up the cost of housing, she said.

"Every single time we allow people to shut down the supply of new homes, it increases the cost of new homes and it increases the value of existing homes," Nakamura said. "So prices just escalate and keep escalating."