BIOTECH MERGER APPROVED

STAR-BULLETIN / JULY 2005

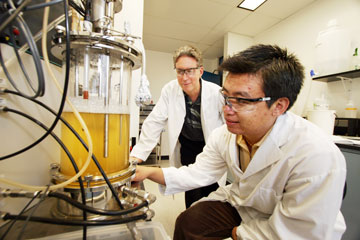

Hawaii Biotech Inc. is taking its next big step toward a public stock offering next year. David Watumull, left, watches Bo Liu, who is pictured working with a bioreactor that produces components for a dengue fever vaccine. Watumull will remain chief executive of a Hawaii Biotech spinoff.

|

|

Hawaii Biotech will keep headquarters in islands

The company's board has approved a merger between its vaccine division and an Australian firm

Hawaii Biotech Inc., the Aiea-based company that has become a symbol of biotechnology's potential in the state, has taken a major step toward a public offering as its board has approved a merger between its vaccine division and an Australian company.

But in a reversal since the merger plans were first announced, the company also has decided to retain the Hawaii Biotech name and keep its headquarters in Hawaii.

The merger marries Hawaii Biotech's vaccine business with that ofAvantogen Ltd., which is developing a product that improves the effectiveness of certain kinds of vaccines.

The deal gives Hawaii Biotech a jolt of about $3.5 million in cash and accelerates its quest to develop a vaccine-making technique that could make obsolete the process that pharmaceutical companies now often employ to make vaccines. The deal gives Avantogen access to promising vaccines, which could be used with Avantogen's vaccine-boosting products.

As part of the transaction, Hawaii Biotech has spun off its anti-inflammatory research business into a new company,Cardax Pharmaceuticals. That company will continue to develop anti-inflammatory compounds targeting major disease where inflammation plays a newly defined role, such as cardiovascular disease.

Management originally had indicated it would give an entirely new name to the merged Hawaii Biotech-Avantogen firm. But on Monday the board voted to put Hawaii Biotech's name on the merged entity. In addition, the company will keep its headquarters in Hawaii rather than moving it to San Diego, as management had said it would do.

Best known for its research and development into vaccines for West Nile virus and dengue fever, Hawaii Biotech is sending a clear message to capital markets that it wants to be a pure-play vaccine company with sights set on a vaccine for avian flu, a potential blockbuster.

Flu vaccine is now a $2 billion market, said Len Firestone, Hawaii Biotech's new chief executive. In the event of a flu pandemic, the market could balloon to $40 billion, he said.

The new Hawaii Biotech also has established an aggressive timetable. The company plans to raise a round of private financing this year and go public next year, Firestone said.

The company is now engaged in preclinical development of its dengue fever and West Nile virus vaccines, focusing on meeting Food and Drug Administration standards for manufacturing practices. Before going to market with those products, the company still must complete preclinical testing and manufacturing and conduct human clinical trials, which could take several years.

Firestone said it would be 2010 at the earliest before Hawaii Biotech could have a flu vaccine ready for the market.

What makes Hawaii Biotech promising is not simply its products, Firestone said, but its method of making them. Most vaccines are made from live but weakened viruses that are grown in eggs, said Firestone, a Yale-educated medical doctor who has been a professor at Harvard Medical School and the University of Pittsburgh.

Hawaii Biotech has devised a method of creating vaccines by using bioreactors to grow cells that have been genetically altered to produce virusCK proteins. Avantogen, meanwhile, is developing a product called an adjuvant, which improves the effectiveness of the kind of vaccines that Hawaii Biotech is developing.

If proven safe and effective, Hawaii Biotech's process would become the state of the art for making flu vaccines, Firestone said.

"Overnight everybody else's product becomes obsolete," said Firestone, who also has been chief executive of biomedical start-upsManhattan Pharmaceuticals Inc. andIntrac Inc., which trade as over-the-counter stocks.

When originally announced, the merger appeared to have some negative consequences for Hawaii. Although research operations were to stay in Hawaii, the loss of the startup's headquarters would have been a blow to a state eager to establish itself as a biotech center. Losing the name Hawaii Biotech would have represented a similar but less tangible blow.

But management ultimately decided to keep the name Hawaii Biotech because it is well-respected among grant-giving bodies such as the National Institutes of Health and the Centers for Disease Control and Prevention, Firestone said. Since December 2001, Hawaii Biotech has raised more than $30 million in federal and state research grants and more than $25 million in private equity financing.

Likewise, Firestone said he wants to keep a residence and office on Oahu so he can be close to researchers and to help maintain the morale of Hawaii Biotech's team of researchers. Trying to transplant such a team, he said, would be difficult if not impossible.

"Right now, there's a great sense of mission, and we like that sense of mission," Firestone said. "Why should we lose that?"