Aloha Air prepares to depart bankruptcy

» CEO Banmiller has long-term contract with Aloha Airlines.

ALOHA AIRLINES had a gun to its head from the start.

When it filed for bankruptcy just more than 13 months ago, it could not afford employee payroll. Its unions were balking at what would become the first of two rounds of concessions. And liquidation was an all-too-real possibility for an airline that had mounting debt and just $2 million left in cash.

THE NEW TEAM

Here is a look at Aloha's new investors:

» Yucaipa Corporate Initiatives Fund ILP, headed by billionaire grocery magnate Ronald Burkle, $43.25 million.

» Aloha Aviation Investment Group, led by former football star Willie Gault, $16.8 million.

» Aloha Hawaii Investors LLC, $2.2 million. The group consists of the Ing family partnership of Richard Ing and his sister, attorney Louise Ing Sitch, both of whom are among the current owners of the airline; Hawaii developer Stanford Carr; Duane Kurisu, who has Hawaii commercial real estate and communications holdings; Colbert Matsumoto, president of the parent company of Island Insurance; and Steve Yamane, managing partner of Diamond Head Capital Partners LLC.

» GMAC, the finance arm of General Motors, $750,000.

|

Then things got worse: soaring fuel costs, a demand from lenders to shut down mainland flights, a 15.5 percent loan interest rate and last-minute appeals to its reorganization plan.

But the state's second-oldest airline somehow survived. And in a turbocharged pace for an airline bankruptcy, Aloha plans to emerge from reorganization around noon today with new owners, a $63 million cash infusion that it will use to pay off existing liabilities, a $15 million term loan and a $20 million revolving line of credit it can tap if necessary.

"(Liquidation was mentioned) so many times that people said we were crying wolf, but I wasn't," David Banmiller, president and chief executive of Aloha Airlines, said this week. "We had to find a way to pull it off because failure was not an option."

Banmiller would not detail Aloha's plans, but he did say the airline will begin another daily flight to Orange County, Calif., in April and plans to add more routes next year. The airline is sticking with its long-haul 737-700s for now but is "re-evaluating the fleet mix," he said.

The near death of Aloha's mainland routes came in June. The company's lenders, Goldman Sachs and Ableco Finance LLC, asked Aloha to shut down its mainland operations and return all its long-haul 737-700s because Aloha was in default of its loan agreement.

"We would have had to furlough 500 people, and I felt it would diminish the value of the enterprise for the sale," Banmiller said. "There were some serious issues because we were in default and they could have stopped funding the airline. I was pretty stubborn in saying (shutting down the mainland flights) is a mistake, and some people thought I was wrong."

Banmiller said he does not know what will happen to local carriers if Mesa Air Group follows through with its plan to start an independent interisland carrier in April.

"It's a tough market to support a third and a fourth," he said in reference to existing carriers Hawaiian Airlines and Island Air. "Island Air (a former sister carrier of Aloha Airlines) just kind of focuses on certain markets, and a fourth is tough. But (Mesa CEO Jonathan Ornstein) is going to do what he thinks he needs to do."

Aloha, which filed for bankruptcy on Dec. 30, 2004, will spend the remainder of this year refocusing on the airline, particularly its 3,500 employees, and planning for the future, Banmiller said.

To that extent, Aloha is planning a TV, radio and print advertising campaign, produced by Milici Valenti Ng Pack Advertising, that will debut Sunday and will focus on thanking employees and customers for their loyalty. The company held a coming-out-of-bankruptcy party for its employees last night at Dole Cannery in which the airline unveiled the new advertising campaign.

Karen Nakaoka, vice president of the Aloha unit for the Association of Flight Attendants union, said she hopes a lot of good will come out of the employees' sacrifices.

"We have no choice but to remain hopeful that Aloha will turn around and be a profitable airline where employees are happy to work again," Nakaoka said. "The employees reluctantly agreed to so many concessions because we were told that it was needed to keep Aloha operating. I'd hate to think that the employees are making all these sacrifices in vain. Understandably, the concessions have taken a toll on employee morale; however, everyone has made a conscious effort not to let that impact the way we service our passengers."

Banmiller said the airline's earnings rose in 2005 from the previous year, but revenue went down because Aloha dropped routes and returned five planes.

"When you're in bankruptcy and out of cash, you've got to do stuff," he said.

"We went toward preserving cash and hunkering down and not giving up on the mainland."

CINDY ELLEN RUSSELL / CRUSSELL@STARBULLETIN.COM

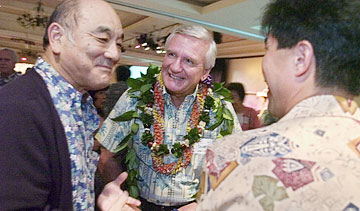

Aloha Airlines CEO David Banmiller, center, and Frank Tokioka of Island Holding Inc., left, talked at yesterday's employee bash celebrating Aloha's emergence from bankruptcy.

Highlights of Aloha Airlines' reorganization

Nov. 14, 2004: Airline veteran David Banmiller takes over as president and chief executive of Aloha Airlines following the October resignation of Glenn Zander due to his wife's health.

Dec. 30, 2004: Aloha files for Chapter 11 reorganization.

Jan. 3, 2005: The Ching and Ing families, owners of Aloha, put in $3 million to help the airline meet operating expenses. The families later contribute an additional $1.6 million.

Feb. 24: MatlinPatterson reaches an agreement in principle to provide the company up to $90 million in financing. MatlinPatterson provides Aloha with an immediate $4 million loan but walks away in mid-March and relinquishes the option it has to purchase the airline.

April 1: Aloha finalizes a $65 million loan from Ableco Finance LLC and Goldman Sachs and uses $24.1 million of it to pay off the remainder of its $45 million federal loan guarantee.

Sept. 22: The Yucaipa Cos. LLC, headed by grocery magnate Ronald Burkle, and the Aloha Aviation Investment Group, managed by former National Football League star Willie Gault, sign a letter of intent to invest in Aloha and put forth a reorganization plan.

Oct. 15: Aloha files a motion in U.S. Bankruptcy Court seeking to terminate the pilots union contract, which includes their defined-benefit plan.

Nov. 29: Bankruptcy Judge Robert Faris approves the Aloha-Yucaipa plan.

Dec. 9: The Pension Benefit Guaranty Corp., the federal agency that insures pension plans, files a notice of intent to appeal the confirmation of Aloha's reorganization plan. The appeal thwarts Aloha's plans to get out of bankruptcy by a Dec. 15 deadline.

Dec. 13: Aloha's pilots become the last union to ratify a new labor contract as part of a second round of concessions. Earlier in the year, all the unions took 10 percent pay cuts on top of previous 10 percent pay cuts.

Feb. 2, 2006: Faris approves Aloha's modified reorganization plan after the airline signs a settlement with the PBGC.

Today: Aloha expects to emerge from bankruptcy after 13 1/2 months.

|

|