Investors are betting $50 million that Mobi PCS can use a customer-friendly business model to grab a big share of Hawaii's wireless-phone market

In a market where seven out of 10 people already have wireless phones, where heavyweights like Cingular, Verizon, Nextel, T-Mobile and Sprint brawl for market share and newcomer Hawaiian Telcom is fighting for a foothold, it might seem foolhardy for another player to join the fray.

JOINING THE CROWD

Mobi PCS, a local wireless phone startup, plans to bring its new network online on Jan. 3.

Parent company: Coral Wireless Holding LLC.

Investors: M/C Venture Partners, Columbia Capital, Pacific Communications LLC, Barry Lewis.

Investment: $50 million.

Plan features: Mobi will allow customers to make unlimited local or local and long-distance calls for a fixed amount.

|

But

Mobi PCS is doing just that.

On Jan. 3, Mobi plans to step into the market, backed by a consortium of mainland investors who are betting $50 million that the startup can hold its own in Honolulu's brutal market.

To hear the company's chief executive explain it, Mobi's move is anything but foolhardy. The key, says President and Chief Executive Bill Jarvis, is to adopt a wholly new business model that will appeal to a range of customers.

"The 'How do you do it?' is a really good question for this market," said Jarvis, who once led 1,200 employees in four states as president for the Western United States for Nextel Communications. "I, too, would not want to enter this market and play the same game that everybody else is playing."

Central to Mobi's strategy is a menu of payment plans that the company says could not be more simple. Customers will pay a flat fee each month, from $40 to $50, and receive unlimited local service, or unlimited local and long-distance service. There's no small print in the company's contracts; in fact, there are no contracts at all. Customers aren't billed, but instead receive messages on their phones when their monthly payment is due. Mobi performs no credit checks. And customers can cancel at any time.

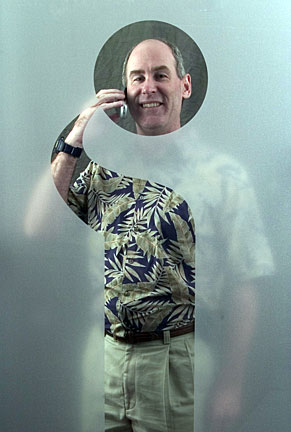

CINDY ELLEN RUSSELL / CRUSSELL@STARBULLETIN.COM

Bill Jarvis, chief executive of Mobi PCS, is framed by the company's logo. Mobi offers a customer-friendly cellular phone service that allows users to pay a flat fee of $40 to $50 a month with no contracts. "Our five-year plan calls for Mobi to be one of the top 150 companies in Hawaii" by 2010, he said.

|

|

This simplicity also is intended to keep Mobi's operating costs low, much the way simplicity allowed

Southwest Airlines to fashion itself as a low-cost airline. The prepaid format, for instance, eliminates billing and bill-collection expenses. And Mobi's offices are anything but palatial; instead of a corner office, Jarvis occupies, well, a corner.

To be sure, there are some qualifiers. At launch, customers will not be able to use Mobi phones while roaming outside of Oahu, although Mobi is in talks with mainland service providers to change that eventually. There are also the standard fees, taxes and surcharges associated with many plans, which can tack more than $5 onto a $40 bill. And there are some additional costs, such as an activation fee, and costs for some add-on services. Plus, customers must buy their own phone to use with the service.

But compared to the bafflingly complex plans offered by many wireless companies, Mobi's model is utterly simple.

"They're basically adopting the old land-line model," said Sean McLaughlin, principal of Hawaii Consumers, a telecommunications consulting firm on Maui. "It's very interesting model; it could be very successful."

On its face, the model seems more customer-friendly than many prepaid wireless plans, said Morgan Jindrich, who oversees Consumers Union's telecommunications-industry Web site, HearUsNow.org. Most prepaid plans charge according to minutes bought; Mobi charges according to calendar periods.

"Ideally more prepaid plans would come out where you didn't have to lock in and you could be more flexible," Jindrich said.

Mobi is counting on this simplicity and flexibility to reach several types of customers. Some would include a portion of the 30 percent of people here who don't have wireless phones, including immigrants who have not yet established credit in the United States. But Mobi also intends to target parents who want their children to carry a wireless phone but not to run up huge bills, as well as small business owners who want to provide phones for employees without worrying about fluctuating costs.

Jarvis expects this approach will enable Mobi to seize a big share of Hawaii's market in a short time.

"Our five-year plan calls for Mobi to be one of the top 150 companies in Hawaii" by 2010, he said.

Wall Street watching

The prepaid unlimited wireless phone business is nothing new for one of Mobi's main investors, M/C Venture Partners, which invests in startup telecommunications and media companies.

The Boston-based venture capital firm also is a substantial investor in Metro PCS, which was founded in 1994 to buy cellular licenses, build networks and operate services in big cities. Using the same payment model that Mobi plans to employ, Metro PCS now operates in Miami;, Tampa, Fla; Atlanta and San Francisco and is expanding into other major markets.

M/C Ventures and its co-investors Columbia Capital and Pacific Communications LLC have invested $50 million into Mobi's parent company, Coral Wireless Holding LLC. The $50 million includes the cost of a new network and startup working capital.

"It's a substantial commitment to the market and a substantial commitment to the business," Jarvis said.

At the same time, Jarvis said, M/C Ventures has seen the power of the prepaid-unlimited minutes model.

"They have the luxury of knowing how the movie ends," he said. "And it's usually with a lot of happy customers."

CINDY ELLEN RUSSELL / CRUSSELL@STARBULLETIN.COM

Mobi PCS Chief Executive Bill Jarvis sits with his back to Executive Assistant Nina Daniels in the cubicle that they share. Mobi plans to keep its costs low, such as sharing cubicle space, as well as eliminating billing and bill-collection expenses by messaging customers on their phones when monthly payments are due.

|

|

Brian Clark, an M/C Ventures vice president who sits on Metro PCS's board of directors, said Metro and others that have adopted the unlimited, prepaid model "have effectively competed with the national carriers, in some cases positioning themselves as the second- or third-largest carrier in a market in a dramatically shorter time frame."

Some on Wall Street are anticipating Mobi's arrival, wondering what it will mean for Hawaii telecommunications companies, including Hawaiian Telcom. It's not just wireless carriers that are expected to feel heat from Mobi; at least one analyst reckons that Hawaiian Telcom's wireline phone business also might suffer. In a Dec. 5 report, Lehman Brothers high-yield debt analyst David Sharret predicts that Mobi's new service "could add pressure on (Hawaiian Telcom's) access line results."

Dan Smith, communications director for Hawaiian Telcom, said the company is taking Mobi seriously as a "another entrant into a very competitive wireless marketplace and very competitive telecommunications marketplace in Hawaii."

Smith said the new company is good for consumers, in that it gives them more choices, and he added that Hawaiian Telcom will use the additional competition "as just a further incentive to make our own product offerings stronger in the future."

Mobi is counting on the continuation of the trend that has hurt wireline firms like Hawaiian Telcom -- the trend of consumers, particularly younger customers, abandoning wireline phones altogether.

Younger people, Jarvis said, "just don't identify with the notion of a home phone anymore."

Creating raving fans

The flexibility of Mobi's plan also presents a challenge that executives seem to understand: If the network does not work well, and customers are unhappy, then people simply will cancel their service.

With that in mind, Mobi is fine-tuning its network so that it will work without glitches upon its launch.

Set to cover at least 75 percent of Oahu initially, the network will cover more than 90 percent of the island by the middle of next year, Jarvis said. Built using state-of-the-art "3G" technology, the network eventually will enable Mobi to offer high-speed wireless data service to complement its phone business, Jarvis said.

The 3G network also has been easier to install than first-generation systems, said Ed Kurzenski, Mobi's chief technology officer, who has built 10 networks in a 20-year career.

And it's easier to maintain. Eight to 10 years ago, Kurzenski said, a company would typically need one technician to monitor 10 base stations in its network. With Mobi's new system, one technician can handle 40 to 50 base stations, Kurzenski said.

Kurzenski would not say how many cell sites, or base stations, Mobi has set up, but he did say that the system would provide service equivalent to that offered by Mobi's Hawaii competitors.

"We have enough to give customers a really good experience on the network," Kurzenski said.

Mobi's marketing executives are counting on that good experience to drive sales, and keep customers.

"We have to earn our customers' business every day," said Renee Awana, Mobi's director of marketing. "We don't lock them into a contract."

Although Awana said that Mobi will advertise through traditional media, she said it will also use nontraditional methods to reach youth market segments, such as boarders and the nightclub crowd.

Mobi is counting on its customers to become "raving fans" who will sing the company's praises from the rooftops, Jarvis said.

"It's an amazing word-of-mouth product," he said.

Jarvis admits that requiring customers to buy their own phones would likely make them think twice about cutting their Mobi service too quickly.

But Jarvis said it's a reality he doesn't let himself linger over.

"I don't ever acknowledge that to myself; I can't afford to," he said. "The minute you start thinking like your competition, you've lost the game."