|

Hoku’s honcho

breaks his silence

An affable speech

to venture capitalists

ultimately reveals little

The chairman, president and chief executive of Hoku Scientific Inc. broke months of silence yesterday with his first public speech since the company entered the long quiet period before its initial public offering last month.

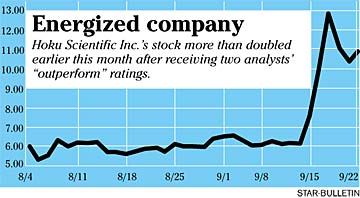

But Dustin Shindo's luncheon talk before the Hawaii Venture Capital Association failed to address perhaps the most scintillating news surrounding the company in recent days: the meteoric rise of Hoku's share price, which has been followed by a slight decline.

Hoku, which makes alternative energy fuel cells, began trading early last month at around $5.35 a share and spent August and the first two weeks of September in the $5-to-$6 range. Then last week, shares began to spike, culminating to close Monday at $12.80 before settling to close yesterday at $10.90.

Nonetheless, the event did offer some insight into Hoku's stock gyrations.

Rob Robinson, director of he University of Hawaii's center for entrepreneurship, attributed the rise to the fact that the research arms of two of the company's IPO underwriters, Piper Jaffray & Co. and Thomas Weisel Partners, both initiated coverage of the company last week with "outperform" recommendations. That, Robinson said, was followed by a plug of the stock by the colorful market guru James Cramer.

With rising oil prices after Hurricane Katrina and another storm heading to the Gulf of Mexico's Oil Patch, the bullish thinking goes, alternative energy companies like Hoku are ripe for growth.

So why this week's dip?

Robinson noted that on Tuesday, The Motley Fool published a highly skeptical report about Hoku on its website. Titled "Joke's on You With Hoku," the column, among other things, questioned whether it was really a coincidence that the laudatory analysts reports came from the firms that underwrote Hoku's IPO and pointed out that Hoku has ackowledged in corporate filings that "our (two) customers have not commercially deployed products incorporating (Hoku's technologies), and we have not sold any products commercially."

After his presentation, Shindo continued to decline to say anything that could violate disclosure regulations. Although clearly affable, and charming in front of an audience, Shindo said the realities of running a public company limit communications.

"All the responses have to be measured," he said. "And you have to be more conservative.

www.hokuscientific.com/

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]