Home prices jump

on neighbor islands

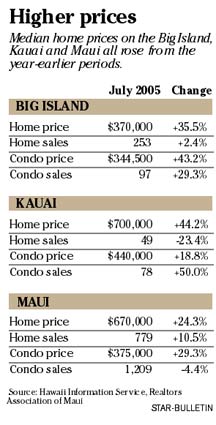

Home sales on the neighbor islands remained hot in July, with prices and total volume continuing to increase nearly across the board.

![]()

"What's happening in Hilo right now is that the homes that we have are the least expensive in the state," said David Martins, of Martins & Martins Realty, who has been active in Hawaii real estate since 1978.

"We have people buying from all the different islands, Las Vegas and California," Martins said. "They are buying everything in sight and there are price wars too."

On Kauai, a lack of medium-priced housing continues to be a problem, said Robert J. German of Aloha Island Properties. "Our county is extremely antidevelopment, with the exception of affordable housing," German said. "The county doesn't seem to understand the law of supply and demand."

While affordable housing projects are in the pipeline, they aren't enough of them to appease the demand for Kauai homes, German said.

The median prices for both single-family homes and condominiums on Kauai increased in July, with home prices rising 44.2 percent to a median of $700,000 and condo prices moving upward by 18.8 percent to $440,000.

The high median single-family home price might have dissuaded some buyers, as reflected by a 23.4 percent drop in the number of sales to 49 from the year-earlier 64. Lower-priced condos recorded 78 sales in July, a 50 percent gain from July 2004.

While Maui posted strong sales statistics in July, the market is softening and properties are staying on the market longer, said Carol Ball, owner and principal broker at Carol Ball & Associates.

"We've reached the length of time that the seller's market can play out and we are starting to see more buyer's resistance," Ball said.

While about the same number of Maui single-family homes sold as last year, prices jumped 19.8 percent to a median of $679,000. Condominium prices increased to a median of $380,000, up 36.3 percent from July 2004's median of $278,850.

In July 2005, Maui's single-family homes stayed on the market 116 days as compared to 105 in the year earlier. Maui condominiums also took longer to sell, with the median number of days on the market increasing to 108 from 95 in July 2004.

"As a result of properties staying on the market longer, we are going to see more negotiating," Ball said. But because of limited homes available for sale, highly desirable properties likely still will command a premium, she said.

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]