Gas prices around the nation continue to rise. A Mahalo gas station is pictured in Manoa.

Drivers undeterred

by rising gas prices

Fuel prices would have to hit

$3 a gallon to match the all-time highs

Soaring gasoline prices are getting a rise out of many U.S. motorists, but by and large they're not getting in the way of summer vacations, commuting habits or SUV sales.

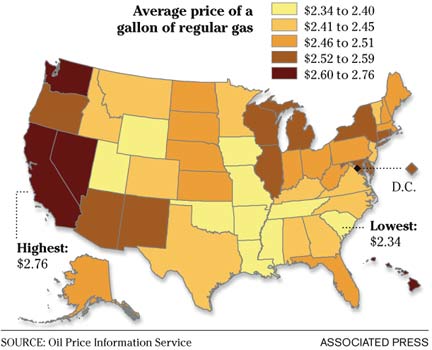

Hawaii gas prices

|

Diana Amaro, of Denver, said that if gas reached $3 a gallon, she'd consider taking the bus. Ray Sykora, of Yuba City, Calif., said pump prices would have to exceed $4 a gallon before he hopped on public transportation.

No matter how much motorists shake their heads in disgust at record pump prices, fuel consumption isn't expected to plummet anytime soon. Spending on other goods and services is likely to suffer first, economists said, partly explaining why U.S. financial growth has been slower in 2005 than the previous year.

The latest Energy Department data show regular unleaded gasoline averaging $2.55 a gallon nationwide, or 67.5 cents above year ago levels. At the same time, daily gasoline demand is up 1 percent compared with last year.

Almost two-thirds of those surveyed for an AP-AOL poll said they expect fuel costs to cause them financial hardship. That was up from April, when only about half felt that way. Still, there is little evidence that this has led to meaningful changes in driving habits.

Experts point to a wide range of reasons why U.S. consumers and businesses have, in aggregate, absorbed higher energy prices and maintained a healthy appetite for fuel.

In the April-June quarter, when oil prices regularly hovered above $50 per barrel, the U.S. economy grew at a 3.4 percent annual rate.

This solid economic growth is important to understanding America's resiliency in the face of rising energy prices, said Citigroup Smith Barney senior economist Steve Wieting.

While U.S. consumers spent $50 billion more on home and vehicle energy in 2004, total disposable income grew by almost 10 times that amount, Wieting said.

"This has been a siphon for us, but we've still kept a lot of water in the boot," Wieting said.

Another mitigating factor is that the steep rise in oil prices has occurred gradually, giving families and businesses time to adjust their budgets and mindsets.

A 50-cent-per gallon increase in the price of gasoline amounts to just $5 for every 10 gallons, the average weekly per-vehicle consumption in the U.S., according to John S. Herold, a Norwalk, Conn.-based energy consultant.

Still, Wieting said he has been mystified by motorists' continued love affair with SUVs and trucks. Ford, Chrysler and GM all said strong July sales were led by trucks, fueled by sales incentives.

Despite the small-but-growing market for hybrid-electric vehicles, "consumers clearly want large inefficient vehicles," Wieting said.

None of this detracts from the fact that many Americans, particularly those with fixed or low incomes, are feeling the pinch. But there are often few significant, affordable changes that can be made overnight, economists said.

"If somebody lives 20 miles from where they work and they have an SUV, they can't do very much about that in the short run," said Stephen P. Brown, an economist at the Federal Reserve Bank in Dallas. The savings from switching to a hybrid-electric vehicle would be negligible when the cost of the new car is factored in, he said.

Brown believes an average price of $3 a gallon will spur more fuel conservation, perhaps in the form of carpooling, but he and other economists said consumers were more likely to cut back their spending on food and trips to the mall first.

"You and I are locked into our daily commutes and it's pretty difficult for most of us to switch and dramatically alter the way we get to work and get to the grocery store," said William Veno, a fuel expert at Cambridge Energy Research Associates in Cambridge, Mass. Veno said 40 percent of all gasoline consumption in the U.S. is tied to commuting.

Migration out of urban areas increases gas usage, while the rise in employment is putting more Americans back on the road, he said.

Jay Ricker, president of Ricker Oil Co., in Anderson, Ind., said sales are down anywhere from 6 percent to 10 percent compared with last year at the 30 retail outlets he operates. But, he acknowledged, that might also reflect the rising popularity of so-called hypermarts, such as Wal-Mart and Costco, which sell gasoline cheaper to attract customers to their stores.

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]