|

Credit disrepair

A nationwide scam is leaving

debtors worse off than

when they started

Coral, a Maui resident, was current on her bills but stressed over mounting debt when she decided to contact a debt-settlement company that advertised it could solve her problems by reducing the amount she owed creditors.

HOW TO FIND REPUTABLE DEBT ADVICE

Consumers who want to work with a credit-counseling agency should interview several. Check them out with your Better Business Bureau, state Attorney General, and local consumer protection agency. Any reputable credit-counseling agency should be willing to send free information about itself and the services it provides without requiring a person to provide any details about his/her situation. If not, consumers should consider that a red flag and go elsewhere for help.

Before selecting a credit-counseling agency a consumer should ask for information on the following:

» Are the agency services confidential?

» Will they devise a plan tailored to fit your needs? » Are the counselors certified? » Are budget and credit education opportunities offered? » Will your funds be protected? How? » Is the agency accredited? Source: Council of Better Business Bureaus

|

"They completely took us there. They lied and scammed about what they were going to do for us," Coral said, adding that she and her husband didn't find out how damaging the program had been for their credit until they tried to buy a house and were turned down for a loan.

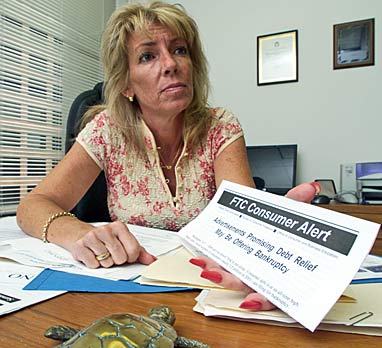

Unfortunately, Coral is just one of many Hawaii and mainland residents who have fallen prey to one of the latest credit-repair scams, said Wendy Burkholder, executive director of the Consumer Credit Counseling Service of Hawaii, a nonprofit dedicated to helping people get out of debt.

The Federal Trade Commission has brought cases against several debt-settlement companies. Most recently in July, the FTC filed charges against Innovative Systems Technology Inc., which also did business as Briggs & Baker and Debt Resolution Specialists. Last November, the commission also brought a case against Massachusetts-based Better Budget Financial Services.

The National Consumer Law Center Inc. also completed an investigation of debt-settlement companies in March of this year. The center concluded that debt settlement does not benefit consumers when its business model requires consumers to stop paying creditors, save money in reserve accounts and pay large fees. The center recommended that debt-settlement assistance should only be allowed when consumers already have saved enough money to settle their debt, or already have attempted to settle their debt and just need assistance with negotiation.

The companies under investigation promised to reduce consumers' debt, negotiate with creditors, and stop harassment from debt collectors in exchange for various fees, but instead pocketed the fees and plunged consumers deeper into debt, the FTC said.

Here's how it works. The companies hook clients by offering them a chance to be debt free in a much shorter period of time. They advertise that they will negotiate with consumers' creditors and settle debt for a fraction of what is owed.

But that rarely happens. Instead, many consumers are shocked to see that after making hundreds of dollars in monthly payments, their debt actually has increased and their credit has been irrevocably damaged, Burkholder said.

"If it sounds too good to be true, it probably is," Burkholder said. "But desperate people do desperate things."

High debt levels have opened new avenues for scam artists to take advantage of consumer vulnerability, Burkholder said.

"When your finances have you overwhelmed and you are fighting with your partner about money and scrapping together change for gas money, almost any promise sounds good," she said.

In an effort to get solvent, many may jump on advertisements that offer quick fixes, she said.

But the ads don't tell consumers that the relief offered may come in the form of bankruptcy or debt charge-offs, which have long-term negative impacts on creditworthiness, Burkholder said.

Two of the three most recent debt-settlement victims who have come to Burkholder for help in sorting out their credit have had to file bankruptcy, she said.

"The debt-settlement company advised them not to pay their bills and to stop communicating with their creditors, which was absolutely devastating to their credit reports," Burkholder said.

The debt-settlement companies, which collected an average of 30 percent of the total debt owed in upfront fees, also neglected to tell Burkholder's eventual clients that in order to settle the debt they would have to have cash on hand to pay off their creditors.

"Most people who are that far in debt don't have the means to settle it," Burkholder said.

Those who are trying to settle a debt also fail to realize that their creditors can report the charge-off to the IRS, which will then count the consumer's savings as earned income, she said.

"They didn't disclose any of those things to us," Coral said. "They told us one thing, but our contract said another. They pulled a bait and switch."

What's especially sad about Coral's situation is that she and her husband didn't really need to settle their debt, Burkholder said. With counseling, the couple likely could have gotten out of debt on their own, she said.

Debt settling is reserved for consumers who are six months or more behind in their credit and it's a process they can easily do themselves, Burkholder said.

When Coral started the program, she and her husband had about $18,000 in debt and they were paying $400 a month in minimum payments on their credit card.

"They were feeling overwhelmed, but they were current on their bills," Burkholder said. "Their credit could still be repaired."

Coral's credit took a major hit when she quit paying her bills and stopped communicating with her creditors on the advice of the debt-settlement company, which promised to reduce or eliminate her consumer debt.

"I should have known better when the company told me that the negative marks on my credit were just temporary," Coral said,

Each month Coral paid the company up to $255 to settle her debt, but her creditors kept calling, she said.

"It was awful," she said. "I hope by speaking out, I can prevent someone else from going down this road."

www.hawaii.bbb.org/

(808) 536-6956

Federal Trade Commission

www.ftc.gov/

(202) 326-2180

Consumer Credit Counseling Service of Hawaii

www.cccshawaii.org/

(808) 532-3225

Here’s how one

debt scam worked

Last November, the Federal Trade Commission opened a case against Massachusetts-based Better Budget Financial Services, which the agency said defrauded consumers out of hundreds of thousands of dollars each, causing many to be sued by their creditors and forcing others into bankruptcy.

The defendants Web sites www.betterbudget.net and www.termidebt.net, claimed that BBFS would negotiate with consumers' creditors to reduce consumers' debt by 50 percent. Consumers who contacted the company were promised that BBFS would negotiate with their creditors for a nonrefundable retainer fee, monthly administrative fees of $29.95 to $39.95, and 25 percent of any savings realized by a debt settlement. According to the FTC, consumers typically paid the defendants hundreds or even thousands of dollars in fees.

Consumers who signed up with BBFS provided the company with a list of all their creditors and the total amount of their debt. BBFS told consumers to set up a special bank account and deposit money into the account, to pay BBFS its monthly fee and to pay creditors.

BBFS allegedly told consumers to stop paying their creditors directly, claiming that consumers' failure to pay their creditors would demonstrate a "hardship" condition that would enable BBFS to negotiate on their behalf. BBFS claimed they would settle each creditor's account once the consumer saves half the amount they owe on each debt.

BBFS told consumers to sign power of attorney forms, claiming that the forms would enable the company to contact creditors on behalf of the consumers and instruct debt collectors to stop calling consumers directly. Consumers were instructed not to talk to any creditors who contacted them directly. Consumers were told any negative information that appeared on their credit reports only would be temporary.,

The FTC charges that rather than negotiating with consumers' creditors as promised, BBFS in numerous instances failed to contact creditors and debt collectors. Instead, consumers continued to be contacted by their creditors, receive repeated phone calls from debt-collection agencies, and incur late fees and penalties on their credit accounts, increasing their debt and worsening their financial situation.

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]