|

High prices

a good thing

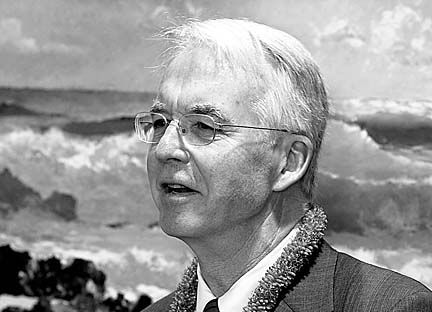

A Federal Reserve official says

Hawaii's home prices are the

result of the state's desirability

While economic conditions may have fueled a housing boom that has led to higher prices in Hawaii and pockets of the United States, the impact on the U.S. consumer and the economy in general has been good, Federal Reserve Gov. Edward Gramlich said yesterday.

"People debate it, but a lot of this basically reflects good news," Gramlich told the Hawaii Business Roundtable during a breakfast meeting at the Pacific Club.

In Hawaii, higher housing prices are linked to the state's desirability, he said.

Gramlich, a strong proponent of affordable housing, was in town to speak on lower-cost housing and home ownership. The median sale price of an existing home in the United States rose in June to $219,000, an almost 15 percent year-over-year increase, according to data released this week by the National Association of Realtors.

While the Federal Reserve has continued to raise short-term interest rates, mortgage rates have remained relatively low and credit conditions have remained easy. New types of mortgage instruments, such as interest-only and adjustable-rate loans, have allowed consumers to buy more expensive homes than they normally could afford, raising the prospect that consumers could get into trouble when rates begin to rise.

Oahu's median home price rose 23.3 percent in June to $593,000 from a year earlier, according to the Honolulu Board of Realtors.

|

Recent price gains have raised concerns that the housing market in some regions might be fueled by what Fed Chairman Alan Greenspan has called a "speculative fervor." But Gramlich's speech and discussions with community leaders should help dispel the notion that Hawaii is headed for a housing bubble, said Paul Brewbaker, chief economist for Bank of Hawaii.

"The thing that really resonated from an outside perspective is that it's clear that there is a combination of natural factors that would lead one to believe that it's reasonable for home prices here to be higher," Brewbaker said. Hawaii's pattern of above-average economic performance justifies a higher valuation of real estate than other markets.

Still, the rise in prices in high-demand regions including Hawaii has made it difficult for some low-income people to buy houses, especially near where they work, Gramlich said.

As housing prices rise, the quest for affordable housing often pushes consumers outside of major metro areas, he said.

"Real thought ought to be given to transportation networks, especially in a place like here," Gramlich said.

Gramlich, who submitted his resignation to the Fed earlier this year, formerly was chairman of the Neighborhood Reinvestment Corp., a partnership that has helped more than 500,000 families of modest means purchase or improve their homes or secure housing.

Broader lending standards have helped some homeowners get a leg up, but foreclosure rates have grown, Gramlich said.

"The home ownership rate has risen and that's a good thing, but we need to recognize that it's not right for everyone," he said. Lenders and consumers need to be careful in calculating a consumer's ability to buy a home.

Gramlich and Lt. Gov. Duke Aiona also presented keys yesterday to the Hawaii HomeOwnership Center's 100th home-buying family. Ronald and Amelia Jose said they were grateful for the assistance in buying their first home, a $210,000 single-family house in Makaha.

"It's been a really wonderful experience," Amelia Jose said.

Nearly 1,200 people, along with the Jose family, have completed the Hawaii HomeOwnership Center's orientation program since it opened in October 2003.

The center provides education, information and support to create successful first-time homeowners on Oahu and Kauai, and has plans to expand throughout the state.

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]