An eye for stock splits

puts Melton into the lead

of Star-Bulletin contest

Dwight Melton has had a hot hand this year when it comes to selecting companies that split their stocks.

Three of the seven he's picked have split their shares 2-for-1, but Melton said that's no accident.

![]()

![]()

Dwight Melton: Several of his companies split their stock during the first half

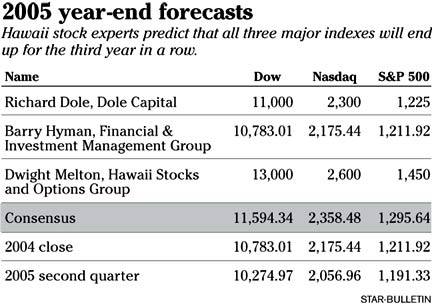

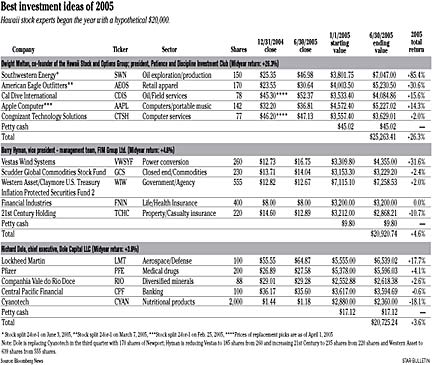

Melton, co-founder of the Hawaii Stock and Options Group investment club, was the runaway leader in the first half of the year in the Star-Bulletin's annual survey of best stock picks for 2005. His hypothetical $20,000 portfolio, which he revamped with two replacement stocks after the first quarter, rose 26.3 percent during the first six months to $25,263.41.

Not too shabby considering the three major indexes were underwater at midyear. Melton expects the economy's slow, uneven growth to continue in the second half of this year.

"This economy, which is in a neither too hot nor too cold type of business expansion, is now widely known and will meet with investor approval," he said. "That is because under such a scenario, the economy should grow at a sufficient pace to keep earnings on the rise, but not move ahead strongly enough to cause inflation to veer out of control."

The other two stock pickers in the contest also beat the indexes. Financial adviser Barry Hyman, a vice president in charge of the Maui branch for Michigan-based FIM Group Ltd., had his five picks rise 4.6 percent to $20,920.74 And Richard Dole, chief executive officer of investment banker Dole Capital LLC, saw his stocks gain 3.6 percent to $20,725.24

Melton padded his first-quarter lead as two of his three holdover stocks and both of his new picks gained ground. Southwestern Energy Co., which split its stock 2-for-1 in the second quarter, was up 85.4 percent at midyear and was the best performer of any of the experts' picks.

Another holdover Melton pick, American Eagle Outfitters Inc., was ahead 30.6 percent at midyear while Apple Computer Inc., which had a 29.4 percent advance after the first quarter, gave back some of that gain and was up 14.3 percent through six months. Both those stocks split in the first quarter.

The two stocks Melton added after the first quarter, Cal Dive International Inc. and Cognizant Technology Solutions Corp. rose 15.6 percent and 2 percent, respectively.

Hyman, the only local expert to stick with his original picks, maintained his cautious outlook for the rest of 2005.

"U.S. stocks, as measured by the major indexes, are priced for perfection in a less-than-perfect economic environment," he said. "It will continue to be a risk-laden environment that favors prudence, caution and security selection over unwarranted optimism and speculation."

Hyman followed that philosophy when he made his picks and put nearly a third of his $20,000 hypothetical portfolio in the conservative Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2. The company's fund, which invests at least 80 percent of its assets in U.S. Treasury Inflation Protected Securities and trades like a stock, was up 2 percent at midyear.

"We erred on the side of caution (with the five stock picks) because we felt the environment warranted a cautious portfolio," Hyman said. "That has not changed."

Despite his conservative stance, Hyman had the second-best performing stock of any of the experts in Vestas Wind Systems A/S, a Danish company that is the world's largest windmill maker. Vestas was up 31.6 percent at midyear.

Dole, who has touted defense stocks for the past several years, saw it pay off with Lockheed Martin Corp. leading his portfolio with a 17.7 percent gain.

However, he threw in the towel on Cyanotech Corp. after the Kona-based nutritional supplement company posted its first loss after five straight profitable quarters. Cyanotech was the worst performer among any of the experts' picks with a decline of 18.1 percent.

In its place, Dole is buying 170 shares of Newport Corp., a scientific and technical instrument company that serves the semiconductor and fiber-optics industries. Newport was down 1.7 percent during the first half of the year.

"It has digested its 2004 acquisition of Spectra-Physics, and is expected to have increased quarterly earnings over the course of the year," Dole said.

Even with the removal of Cyanotech from his portfolio, Dole still has one other local company in Central Pacific Financial Corp. The parent of Central Pacific Bank was off 0.6 percent at midyear.

"Central Pacific is small enough in Hawaii to grow both internally and through possible acquisitions without raising much anti-trust concern," Dole said. "Its larger competitors are not in this position. The company is now large enough to attract more analyst covering, which might be beneficial to the stock's liquidity."

Having said that, though, Dole noted that Central Pacific's performance has been flat and cites market trends and a declining market interest in Hawaii banks.

"The Hawaii banks are not cheap in relation to some other (mainland) banks," he said.

Both Melton and Hyman expect energy stocks to continue their strong performance as investors rotate from sector to sector.

"Probably one of the most successful investment strategies for increasing returns is sector rotation -- moving investments from various sectors as the economy changes," Melton said. "This is one of my most profitable strategies. Your objective in sector rotation is to be invested in the sectors that are hot and to avoid ones that are not. Currently, the two strongest sectors are energy and utilities."

Hyman also acknowledged energy's strength but warned that investors shouldn't bet the mortgage on oil prices remaining high.

"In the short term, the price of oil has been driven up by short-term speculation," Hyman said. "The long-term direction of oil as well as many other commodity prices must be up in a world of increasing demand.

"However, oil prices have overshot their equilibrium levels as momentum investors have bet heavily on other investors doing the same in the short term. I would not be surprised to see oil pull back down to the $40 per barrel level when the hedge funds and other speculators begin to cover their extreme bets."

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]