Barnwell Industries President and Chief Operating Officer Alexander Kinzler has led the company's stock to a 78.7 percent jump this year.

The oil and real estate

company's stock is the

best-performing in Hawaii

Barnwell Industries Inc.'s oil business isn't the only thing that's been gushing lately.

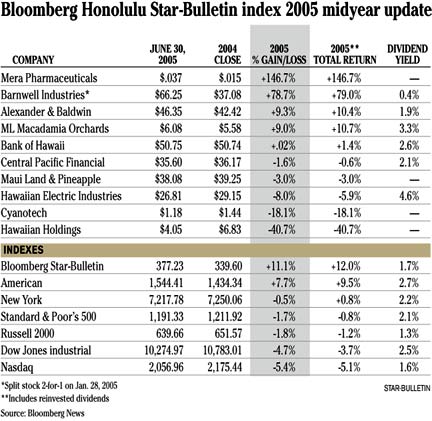

Rising crude prices pushed the company's stock up 78.7 percent during the first half of the year and made Barnwell the best local performer of any company trading at $1 or higher. The surge follows a 134 percent gain last year that established Barnwell as the No. 1 Hawaii stock in 2004.

"In the past, oil and gas investors didn't really understand the real estate business and real estate investors didn't particularly understand the oil and gas industry," said Alexander Kinzler, president and chief operating officer of Barnwell. "Now investors are starting to understand there's a natural hedge being in both businesses at the same time."

The Honolulu-based company, whose fiscal year ends Sept. 30, generated 61 percent of its revenue last fiscal year from its oil and natural gas operations in Alberta, Canada. Another 27 percent of Barnwell's revenue came from its real estate holdings on the Big Island while 10 percent was from its statewide water drilling operations and 2 percent from other interests.

"As it happens, at present there's both high oil and gas prices as well as a very strong real estate market," Kinzler said. "That means both divisions are doing very well and that has had a very positive impact on our stock price."

Barnwell's stock, which hit an all-time high of $71.50 on May 9, ended the midyear point Thursday at $66.25. The price is adjusted for a 2-for-1 stock split in January that was the first in the company's 49-year history. Kinzler said a proxy will be sent soon to investors to enable the company to split its shares again later this summer. In addition, he said the company, which trades on the American Stock Exchange, has considered listing on another exchange but has not taken any action.

Alexander Kinzler, president and chief operating officer of Barnwell Industries, says the company's fortunes will rise along with the cost of oil, but that expenses will also.

While oil was fueling a rise in Barnwell's stock, it was taking the air out of Hawaiian Holdings Inc., the parent company of Hawaiian Airlines. Hawaiian Holdings, runner-up to Barnwell last year with 128 percent gain, nose-dived 40.7 in the first six months of 2005 to $4.05 despite the airline emerging from bankruptcy in early June.

"To me, Hawaiian's performance is not a surprise at all because of two things -- the high fuel costs and the dilution of stock from the refinancing (by the new investors)," said Richard Dole, chief executive of Honolulu-based private equity investment banking firm Dole Capital LLC.

Mera Pharmaceuticals Inc., a Big Island producer of nutritional products from microalgae, actually had the best return in the local index with a 146.7 percent gain. But as a penny stock,the shares only gained 2.2 cents to 3.7 cents.

Alexander & Baldwin Inc., parent of Matson Navigation Co., increased 9.3 percent $46.35 while Big Island-based ML Macadamia Orchards LP, the state's largest grower of macadamia nuts, rose 9 percent to $6.08.

The two pure banking stocks in the index, Bank of Hawaii Corp. and Central Pacific Financial Corp., both were flat during the first six months. Bank of Hawaii edged up a penny to $50.75. Central Pacific, which earlier this year consolidated the branches of newly acquired City Bank, slipped 1.6 percent to $35.60.

Maui Land & Pineapple Co., which continues to be plagued by its pineapple operations, fell 3 percent to $38.08.

Cyanotech Corp., another Big Island producer of nutritional products from microalgae, lost 18.1 percent and fell to $1.18.

While Kinzler can't predict how high oil prices will rise, he said he doesn't expect any drop as long as U.S. troops remain in Iraq. In its last fiscal year, Barnwell's net income soared 74 percent and its revenue jumped 48.5 percent.

"I think prices are going to stay high as long as we're in Iraq and there's strong demand for fuel for military purposes, as well as unrest in other Middle East countries," he said. "It may go higher than it already is. It's the great uncertainty of the future that creates the hoarding of oil, and the need to have a steady supply and other services are driving it up as well."

Dole said despite the added liquidity from Barnwell's stock split, light trading in the company's shares can create severe gyrations.

"Barnwell is a fairly thinly traded stock that can move quite substantially on fairly low volume," Dole said. "If oil prices start going down, it may go down fairly rapidly."

Kinzler said the company's profits will rise as long as oil prices keep going up.

"When your costs are steady and the product you sell can be sold at a higher profit, you basically increase the profit of the division," Kinzler said. "The downside is that when you have a high-price environment, the cost of doing business doesn't remain steady and begins to creep upward as well, such as the cost of securing services for wells, the cost of doing the drilling itself and the cost of acquiring land for drilling sites. If the price of oil doubles, it doesn't all become profit because the costs are going to increase, too."

www.brninc.com

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]