|

Isle bankruptcies

rise after 3 years

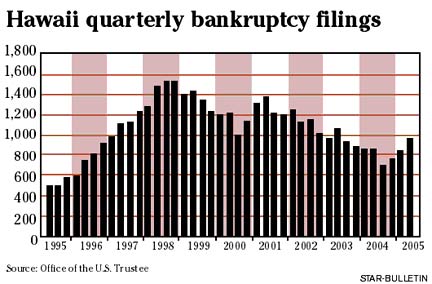

After 13 quarters of year-over-year

declines, filings increase by 15 percent

as filers try to beat a new October law

Bankruptcies rose statewide last quarter for the first time in more than three years as Hawaii residents rushed to file ahead of a new federal law that will make it harder and more expensive to claim financial relief.

![]()

"It's all the people trying to beat the clock," bankruptcy attorney Dawn Smith said. "If you thought you might have to file after October, it's less expensive, less intrusive and less difficult to do it now. It still can be done after October, but it will cost more."

Smith, who handles consumer bankruptcies, said she possibly could be forced to triple her rates after the federal law takes effect on Oct. 17 because of the additional burden the law places on attorneys to take responsibility for their clients' information.

Her regular rates now for a Chapter 7 liquidation -- the most common bankruptcy -- run between $300 and $600 for a simple bankruptcy in addition to the $209 court filing fee. Smith's fees for a Chapter 13 filing, which allow a wage earner to pay creditors over three years, can be anywhere from $1,800 to $3,000 -- in addition to a $194 filing fee -- depending on the complexity of the case. When the new law takes effect, consumers will have five years to repay creditors.

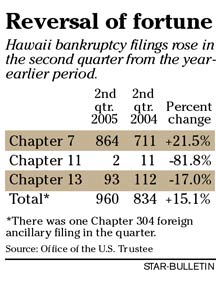

Second-quarter numbers released yesterday by U.S. Bankruptcy Court showed that Chapter 7 filings in Hawaii soared 21.5 percent to 864 from 711 in the second quarter of 2004. Chapter 13 filings fell 17 percent to 93 from 112 while Chapter 11 filings, which usually involve business reorganizations, fell to two from 11.

The new law requires individuals to take an approved financial counseling course within six months before filing bankruptcy and complete a course on personal finance management before exiting either Chapter 7 or Chapter 13 bankruptcy.

It also places a burden on attorneys because it requires them to investigate individuals' claims and could make the attorney pay for court costs and the attorneys' fees of creditors if the individuals' statements about their property and finances turn out to be false or incomplete.

In addition, a person filing for Chapter 7 has to provide a federal tax return for the most recent tax year, and someone filing for Chapter 13 has to have paid their taxes for the previous four years.

Smith said the bankruptcy reform is quickly earning the moniker of bankruptcy deform among attorneys.

Bankruptcy attorney Bradley Tamm, who only handles complex individual cases, said he expects his fees are going to double because of the attorney certification and investigation requirements.

"It's a nightmare for lawyers right now who want to practice bankruptcy law, because under the new bankruptcy law the attorney has to certify certain things when the bankruptcy schedules are filed," Tamm said. "Before that you were entitled to rely on what your clients told you. Now you have to certify what a client has told you is true and certify that you've investigated your own client. I don't know how deep it's going to go, but it's really scary. No other area of the law requires that."

Credit card companies pushed for the new law because they said bankruptcy filings were costing them too much money. There were 1.6 million bankruptcy filings in 2004.

Tamm, though, scoffs at the notion that the companies are experiencing a hardship.

"The credit card companies are just plain greedy," he said. "The credit card and banking industries said they have to charge high interest rates because they're losing too much money through bankruptcy. But if they're losing so much money, then how come last year under the old law, the credit card industry posted a 50 percent increase in profits, according to the credit card companies' own trade journal?"

Banks earned $21.4 billion on their credit card accounts last year, according to an annual report from Credit Card Management magazine.

Bankruptcy attorney Greg Dunn, who works on consumer cases, said the number of bankruptcies he is handling has doubled from a year ago.

"This is the busiest I've ever been filing bankruptcy cases, and I've been doing bankruptcy since 1988," said Dunn, who expects the $571 he charges for a Chapter 7 filing to go up by $200 to $300 with the new law. "I'm working so much that I'm here at 6, 7 o'clock in the morning and seeing people at 9, 10 at night, and this is seven days a week."

Along with the higher attorney costs, filing fees also will go up on Oct. 17 to $274 from $209 for Chapter 7. Chapter 13 fees, though, will drop to $189 from $194.

"I'm telling people they should come in as soon as possible because they don't want to wait until the last minute because they may not be able to get an appointment," Dunn said. "The closer we get to October, I'm sure it will get even busier."

First Hawaiian Bank economics consultant Leroy Laney said it is unlikely the increase in bankruptcy filings signals any change in the direction of the state's economy.

"I would guess at this point it would be a blip because the economy is still relatively strong," said Laney, a professor of economics and finance at Hawaii Pacific University. "It's slowing some, and my forecast is that you'll see some downturn in the rate of growth next year, but no one is predicting a recession."

E-mail to City Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]