IDENTITY THEFT INSURANCE

|

Better safe than sorry

Insurance companies now will

cover the thousands of dollars it may

cost you to recover your identity

The burgeoning problem of identity theft is spurring new lines of insurance to cover the rising costs of consumers reclaiming their good names.

"Most of the insurance companies, the bigger companies, are offering it," said John Schapperle, president of Island Insurance Cos. "I think the trend is following the scare in the nation ... there's a lot of publicity about it."

Coverage is not just for wealthy individuals, Schapperle said. "It can happen to anybody and everybody at any time."

In addition to Island Insurance, most local insurers are offering coverage, said state Insurance Commissioner J.P. Schmidt.

In addition to Island Insurance, most local insurers are offering coverage, said state Insurance Commissioner J.P. Schmidt.

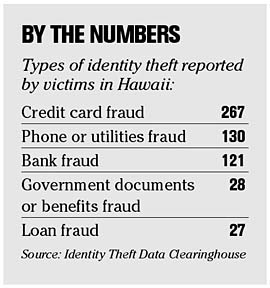

Hawaii cases of identity theft shot up 188 percent from 2001 to 2004, according to the Federal Trade Commission. The most dramatic year-to-year increase -- 167 percent -- occurred between 2001, with 222 reported cases, and 2002, when 593 people reported stolen identities to the FTC.

Hawaii ranks No. 33 among the 50 states in identity theft cases reported to the FTC in 2004, with 640 reported cases.

Other states have it worse than Hawaii, "but it is something that is escalating," said Schapperle.

There were 9 million different attempts of identity theft occurring over the Internet in May 2004, said FBI agent Arnold Laanui. "By the end of last year, there were 200 million forms of identity theft, so it's blown up exponentially," he said.

"It's become incumbent on folks to take steps to protect their identity, to protect identifying data about themselves, so those individuals out there don't misappropriate it," Laanui said.

Identity theft insurance policies cannot usually be purchased on their own. "It is normally an endorsement to a homeowners policy," Schmidt said.

Rates for the policy additions average $25 to $30 a year, and offer an average of $15,000 in coverage with a $250 deductible, he said. The rate also may include personal liability and other coverage in addition to identification theft insurance, which some companies may add for free, Schmidt said.

Identity theft insurance policies don't cover monetary losses, but reimburse "expenses incurred as a result of identity fraud. These can be reasonable attorneys' fees or time taken away from work, or phone calls to get this stuff straightened out," said Schmidt.

The policies don't apply to losses via credit cards and bank accounts, which are covered separately.

Identity theft insurance does cover all members of the household but doesn't kick in if the identity theft "came out of a business you were operating," said Schapperle. "The purpose of a homeowner's insurance policy is not to cover business exposure anyway."

The method of identity theft used to victimize a policyholder is immaterial, Schapperle said.

"People are finding more and more ways to steal people's identities," he said. "We don't exclude phishing, we don't exclude dumpster diving."

Not counting the fraudulent expenses racked up by an identity thief, individual victims lose 600 hours and an average of $16,000 in wages on recovery efforts, according to a 2003 study by the Identity Theft Resource Center, a California-based nonprofit organization.

Victims spend an average of $1,400 paying for services and items such as notarization, postage, photocopying and other out-of-pocket expenses once their identity has been stolen.

First Insurance has offered identity theft insurance as an endorsement for a year and a half, according to Stephen Tabussi, vice president of customer solutions. Island Insurance began offering the coverage in May 2004.

Neither local insurance company has received any claims from policyholders yet, which Schapperle said is probably because identity theft-specific insurance coverage is relatively new.

Neither would disclose how many identification theft policies their companies have written, though Schapperle said the vast majority of the Island Insurance's homeowners policy holders have opted in to the coverage.

State Farm is not issuing the policies.

"We actually have not had the demand to add identity theft coverage to our homeowners policy," said Carolyn Fujioka, director of public affairs. "We continue to look at it."

"I think most customers have access to coverage through credit cards and so it has not been an issue."

www.consumer.gov/idtheft

Identity Theft Resource Center

www.idtheftcenter.org

Insurance Information Institute

www.iii.org

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]