Home prices

set new records

Median costs are above

$600,000, a $115,000 increase

from the end of 2004

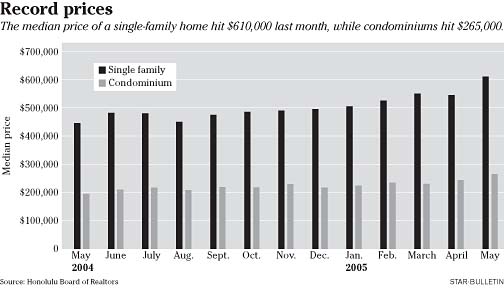

Oahu home prices erupted through previous records last month, topping out above $600,000, while condominium prices also continued their ascent through record territory.

Half the 366 single-family homes sold on Oahu went for more than $610,000 in May, 37 percent more than a year ago, according to a Honolulu Board of Realtors analysis of home resales. The median price jumped nearly 12 percent from April.

"Are you kidding me?" said Bank of Hawaii chief economist Paul Brewbaker, noting that median home prices have increased $115,000 since the end of last year.

But the number of homes sold fell 9.6 percent last month to 366 from 405 sold in May 2004, reflecting a lack of homes on the market.

"This marks the first time since the housing market started its expansion in mid-1997 that the overall number of sales was lower on a year-over-year basis," said Harvey Shapiro, the Realtors board's research economist. "But the decline was more likely due to the inventory shortage than a decline in buyers."

The stocks of both homes and condos available for resale are at record lows, with two months of single-family home inventory on the market and 1.2 months of condominiums.

In less than four years, median home prices islandwide have more than doubled, according to Realtors board data. At the end of 2001, the median price for a single-family home was $299,900.

The median resale price of a condo jumped 35.9 percent last month to $265,000 from $195,000 in May 2004. Prices increased more than 9 percent from April.

The number of condos sold last month slipped 2.8 percent to 692, according to the board's data. For the year to date, however, sales of both condos and single-family homes are running ahead of the same period last year.

Adam Lee, a Realtor associate with Abe Lee Realty, just saw a $750,000 Waianae home put in escrow.

"By seeing what's going on out west, then you can really get a good feel of what your Hawaii Kai or Waialae home is going to be worth," Lee said. "If somebody wants a mortgage under $2,000 and still wants a single-family (home), they gotta go to Waianae."

Single-family home buyers are using the hot market to improve their lifestyles, he said.

"They might have bought a house in Ewa four years ago, and they have $240,000 in equity," Lee said. "They might have gotten a raise or had another kid, and they're tired of the drive and now they're looking at upgrading and getting something closer to town."

So far this year, $2.18 billion in Oahu residential real estate has changed hands, 30 percent more than in the first five months of 2004.

Mortgage rates stuck at historic lows have kept the real estate market at record highs. The nationwide average rate for a 30-year fixed-rate mortgage fell to 5.62 percent last week, its lowest level in four months.

But a rebounding national economy might lead to rising worker pay and higher mortgage rates, an industry official said yesterday.

"Improvements in the job market and rising wages will likely put upward pressure on mortgage rates in the coming months," Frank Nothaft, chief economist at Freddie Mac, said in a Bloomberg News report. "However, the same growth in income will partially offset any rise in rates, enabling housing to continue to be a healthy industry."

A quarterly report from Carl Bonham and Byron Gangnes of the University of Hawaii Economic Research Organization, also released yesterday, noted that "sales volume and residential construction activity will begin to cool in the face of declining affordability and expected higher interest rates."

Brewbaker, the Bankoh economist, was in 2003 the first to predict Oahu home prices would pass $600,000. Last year, he forecast a median of $650,000 by 2006, but even that price could be surpassed by the skyrocketing market.

"It's looking like next month," Brewbaker said. "It's coming up fast."

The prices have been propped up by the slow pace of new home construction, he said, as developers are forced to wait for a sluggish permitting process.

"We've developed this institutional architecture that's well designed to prevent home builders from responding to the opportunity to deliver new homes," Brewbaker said.

Despite the rapidly rising prices, the market can sustain the appreciation, he said.

"The fundamental sources of strength in housing demand are real, not imaginary, so this is not a bubble," Brewbaker said.

Strong growth in jobs and income, coupled with low mortgage rates, provide residents enough support to afford the home prices.

"Is it a bubble?" Brewbaker said. "This ain't no stinkin' bubble."

E-mail to City Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]