|

|

Boom-to-bust

not inevitable

Prices may have peaked,

but demand is likely to

prevent a steep drop

Bank of Hawaii Chief Economist Paul Brewbaker raised eyebrows in 2003 when he predicted that the current real estate cycle would take Oahu's median home price to $600,000 or more.

|

|

"This one is pau," Brewbaker said of the boom in sales volume that has lit a fire under prices since then. "We're sitting here watching the oven waiting for the pie to bake, but it's already done."

Could Hawaii's record-shattering property market -- a boon to homeowners and the real estate industry, a bane to renters and frustrated home buyers -- finally be ready to slow down?

Brewbaker was right last time, and the numbers lend him some support today.

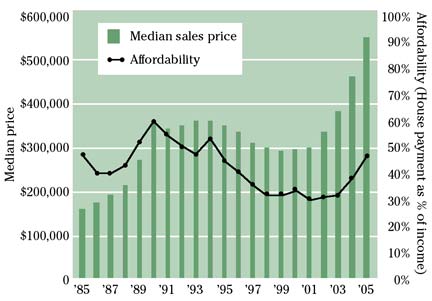

It takes about 47 percent of the median household income to buy a single-family home at the March median price of $550,000, according to a Honolulu Board of Realtors affordability calculation.

The last time it was that high was in 1995, when in hit 53 percent, around the time the market went into a tailspin that did not bottom out for several years.

But history might not repeat itself this time.

Wages in Hawaii are rising, the economy's long-term prospects are good, and state and county leaders still have no meaningful plan to bring significant amounts of new housing onto the market.

So where does that leave home buyers?

They can wait and pray for prices to recede, or they can take the long view.

"The first thing you have to do is forget the past because it will never be that way again," said Kem Lineham, an agent with RE/MAX 808 Realty.

Lineham practiced what she preaches by recently selling her own Moiliili condo and moving up to a $700,000 Hawaii Kai house.

Journeyman laborer Toa Eva lays down iron work for one of 86 affordably priced homes being built in Nanakuli by D.R. Horton- Schuler Homes. Hawaii’s restrictive land-use laws are expected to hold back developers from delivering significant amounts of affordable housing.

For many of today's buyers, that might mean settling for something several ZIP codes from their dream home and working their way up.

"Unless you get into home ownership and build equity, it's very hard to jump into a market like this later and get the sort of home you really want," said Kendall Hirai, executive director of the nonprofit Hawaii HomeOwnership Center.

"Look at a lot of the people who got into home ownership recently," he said. "They took the condo or townhome and rolled it into a single-family home. Or guys in Pearl City took their equity and moved into town. But if they didn't have that start, I would venture to guess that many of them wouldn't be able to afford the house they're in."

That's the approach Rachelle and Dan Haiola are taking.

Two years ago, the Brigham Young University-Hawaii graduates decided they wanted to buy a home and began pinching every penny in anticipation. They quickly realized that prices ruled out Windward Oahu, their preferred location.

So they are taking a detour through Mililani, where they bought a condominium in November.

"You've got to get some sort of nest egg started," Rachelle Haiola said. "We wanted to buy in Ahuimanu, but were we ready to pay $600,000? Not today!"

A snack jar serves as a piggybank for small treats in the Dan and Rachelle Haiola household. It has been an effective tool in teaching their 3-year-old son, Kahiau Haiola, the concept of budgeting.

Rachelle keeps the family budget, and a wish, wants and needs list as well as home- buying tips and personal notes in a composition notebook. “Sometimes it’s like the whole ‘home’ thing is all we think about. But nowadays if you really want something like this you have to look inside yourself and find a way to make it work,” Rachelle said.

Dan's salary as a public school teacher is modest, and the Mormon couple donates 10 percent of all their earnings to the church. Rachelle has decided not to work so she can take care of her 3-year-old son.

But as they work toward their dream, hardly a penny is unaccounted for. They keep a detailed log of all expenses, buy cheaper vegetables in Chinatown or farmer's markets and supplement their larder with Dan's spearfishing. Saving money permeates their daily lives.

Before buying their condo, the couple cut out photos of desired homes and taped them to their credit cards to serve as reminders of the ultimate goal whenever they were about to spend on something.

But as a result they are able to pay an extra $100 each month on their $1,379 mortgage, which they expect will knock several years off their 30-year mortgage.

Ultimately, the plan is to rent out or sell the condo and move up to a Windward home.

"Sometimes it's like the whole home thing is all we think about. But nowadays if you really want something like this, you have to look inside yourself and find a way to make it work," Rachelle said.

Failure to adapt to the new paradigm can be a recipe for frustration.

Beverly Lum and her husband, Brian, resolved to buy only in the Kaimuki-Hawaii Kai area, and have adopted the seemingly reasonable practice of deducting estimated repair costs from whatever offers they make on houses. But they have been outbid on aging homes time and again during the past year, and despair has set in.

"We're getting depressed more and more," Beverly said, "and if we finally find something, I'll be working until I'm at least 75 to pay off the mortgage."

The high prices have once again made affordable housing a high political priority after more than decade of being largely ignored. Lawmakers this session passed an omnibus bill aimed at lowering housing costs.

But nothing proposed would create significantly more housing, said Craig Watase, of Mark Development, which builds affordable housing.

The big hurdles faced by developers are still there, he said -- high insurance premiums, rising materials costs and, especially, the cumbersome several-year process of getting land entitled for development, obtaining the proper zoning and getting building permits approved.

"It takes so long to do a project, and there are so many different variables -- lumber prices, strikes, etc.," Watase said. "Any one of those things can just kill you. It's a strange and risky way to make a living."

Yet loosening the reins on developers is equally risky because then "they become the winners, not the community," said Laura E. Thielen, executive director of the Affordable Housing and Homeless Alliance.

But even she admits developers' hands are tied.

"One reason they're not developing more affordable housing is that it doesn't pencil out. They face a lot of barriers," she said.

Brewbaker said it's "ridiculous" that recurring affordable-housing crunches have not yet led to meaningful reform of the system from government as "gatekeeper" to government as facilitator.

"Surely if you were a political leader, you knew that this (housing shortage) was going to happen. What were you thinking when you weren't doing anything five years ago?" he asked.

Either way, the supply-and-demand imbalance will underpin prices for the foreseeable future, said University of Hawaii economics professor Carl Bonham.

"All of the properly entitled land is built out, and that means prices will keep going up over the longer term. There's not a lot of risk of there being too much product," he said.

Those should come as comforting words to Donn and Nina Arizumi, newlyweds from Manoa who went way out of their price range and preferred neighborhood when they bought a Mililani home for $535,000 in March.

"Everybody said we were crazy," said Nina.

Donn noted that people thought his parents were crazy when they bought the land for their Manoa home in the 1970s for $90,000, now worth nearly $1 million.

"They wouldn't call them crazy now. Times change," he said.

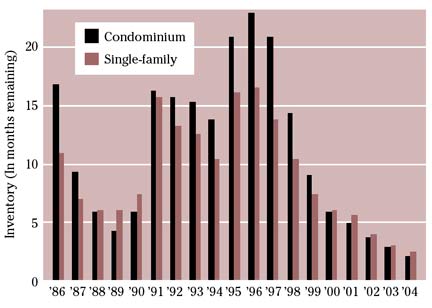

Fewer homes, higher prices

The lower interest rates of recent years have put homes within the financial reach of more Hawaii residents, fueling a buying boom. But as dwindling inventory pushes prices up, affordability is eroding fast:

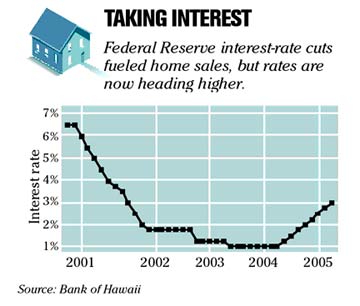

Taking interest

Federal Reserve interest-rate cuts fueled home sales, but rates are now heading higher.Tonight on KITV 4 News at 10 ...

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]