Panel approves

excise tax hike

Lack of funding kills bill aimed

at spurring long-term care plans

A proposal granting tax credits to people who purchase long-term care insurance policies is dead this year after lawmakers said they were unable to come up with the estimated $3.4 million that would be needed for the program.

Lawmakers and state Tax Department officials said they were pleased with their proposal to reward those who plan for their future health-care needs, adding that they would work together to find funds for the credits next year.

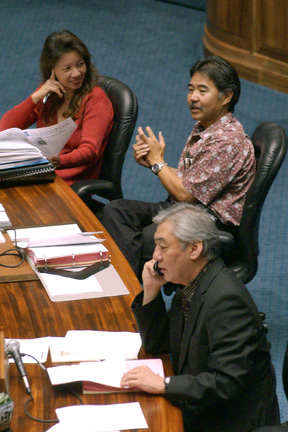

House Health Chairman Dennis Arakaki (D, Alewa Heights-Kalihi) said the issue of providing long-term care solutions for Hawaii's rapidly aging population remains a priority for the Legislature.

"It's just a matter of finding a funding source," Arakaki said. He suggested raising cigarette taxes as one possible option.

Under House Bill 97, individuals who purchase long-term care insurance policies would have been able to claim up to a $250 credit when filing taxes, starting next year. The credit would have doubled in 2007.

The Tax Department estimated the credits would have cost the state about $3.4 million in the first year and $6.9 million in subsequent years.

According to a recent report by the U.S. Census, Hawaii residents age 65 or older are expected to make up about 22.3 percent of the state's population by 2030.

The long-term care proposal was among dozens of bills lawmakers took up yesterday as they worked up against a midnight deadline to have all bills in their final form before taking final votes on all legislation next week.

The 2005 session ends Thursday.

Both the House and Senate have to agree on the final form of a bill to send it to Gov. Linda Lingle for consideration.

Bill to restore VEBA health plan for teachers faces final approvalLegislators gave tentative approval yesterday to a bill that would restore the Voluntary Employee Benefit Association Trust health plan for Hawaii's public school teachers for a three-year trial period.The state teachers union has complained that its members have faced higher insurance premiums and diminished benefits since the Legislature forced teachers to move out of the VEBA Trust in 2001 and into a separate health plan. The new state teachers contract, ratified by the union yesterday, contains a framework for employer contributions to the VEBA Trust. But that was contingent on the Legislature authorizing the plan's restoration. The VEBA Trust could be more permanently established following the trial period. The measure is expected to pass in a final vote on Tuesday.

|

House Bill 140 requires the agency to provide information to the Legislature on how it is spending money allocated to the state under the federal Temporary Assistance for Needy Families program. Lawmakers can then evaluate the expenditures, hold public hearings on programs that are receiving funds and make recommendations to the agency.

"We want to ensure that the TANF funds will be used for the intended purposes, and the Legislature has taken a position that we must do our part in administration of these funds," said House Human Services Chairman Alex Sonson (D, Pearl City-Waipahu).

Majority Democrats have criticized the Lingle administration over its use of some TANF funds for an anti-drug ad campaign. The Department of Human Services has said its use of the money is well within the program's broad federal guidelines.

A federal audit into the use of the TANF funds is pending.

Lawmakers also approved a proposal to collect DNA of anyone convicted of a felony, for the purpose of establishing a statewide database and databank identification program.

House Bill 1733 establishes procedures by which the biological evidence would be collected and tested and how it could be put to use. It also establishes procedures for the destruction of samples and the removal of someone's information from the database if the person's conviction is overturned by a court.

Meanwhile, another measure shelved due to lack of funds was a proposal to establish a vote-by-mail pilot program next year in the three representative districts with the lowest voter turnout in the past two election cycles.

Senate Bill 433 was aimed at determining whether all future elections should be held by mail as a way to increase the state's traditionally low voter turnout.

|

Legislators vow to support the increase

to 4.5 percent from 4 percent

The Legislature is moving to allow the counties to raise the general excise tax 12.5 percent, with the extra money designated for transportation problems across the state.

Tax and transit timetableHow the transit tax would work:1. By Dec. 31 each County Council must hold a public hearing and then vote on the tax increase proposal. 2. The tax can be no more than 4.5 percent. The state tax director will collect the tax and give the money to the county, after deducting 10 percent for expenses. If all counties collect the tax, it is expected to raise an extra $150 million a year. 3. Neighbor island counties may use the money for a "public transportation system, public roadways, buses, trains, ferries, pedestrian paths or sidewalks or bicycle paths." 4. Honolulu must use the extra money for "a locally preferred alternative for a mass-transit project." 5. Mayor Mufi Hannemann's timetable is to start an environmental analysis for the project in July and finish it by December 2006. The impact statement is expected to be written by March 2007. The request for proposals would be issued in September 2007 and awarded by March 2008. Groundbreaking would be April 2009.

|

Senate President Robert Bunda predicted approval for the plan because it is supported by lawmakers representing areas along the traffic-choked H-1 and H-2 corridors.

"The consensus for Leeward and Central Oahu residents from Kalihi to Waianae is they recognize there is a huge, monumental traffic problem," Bunda say. "They want the Legislature to find solutions to relieve that."

Rep. Joe Souki (D, Waihee-Wailuku), Transportation Committee chairman, echoed that optimism and promised approval in the House.

"We are on the way to getting the rail. The House will pass it, and the second step is for the Council to get it passed by the end of the year," Souki said.

According to House Bill 1309, the counties have until Dec. 31 to adopt a resolution raising the excise tax. The tax would then start Jan. 1, 2007.

Kauai, Maui and Hawaii could use the money for any transportation improvements, including highways, buses, ferries, sidewalks or bikeways.

But Oahu could use the money only for a "locally preferred alternative for a mass-transit project."

Mayor Mufi Hannemann said yesterday that the city is ready to start with the planning and could break ground as soon as April 2009.

Hannemann said the first phase of the transit line would be from Kapolei to Waipahu, although he would like to see it go all the way to Aloha Stadium or the airport.

"There is a real opportunity to find a transit option for this community," Hannemann said.

But Lowell Kalapa, executive director of the Hawaii Tax Foundation, called the conference committee decision "a historic mistake."

"The Legislature is deciding to raise the excise taxes after keeping it at 4 percent for 40 years," Kalapa said.

"It is going to raise the cost of living for all, and it will make its way through the entire fabric of our economy," he said.

On average the increase to 4.5 percent would cost residents an extra $450 a year, Kalapa said.

The excise tax, unlike a sales tax, is charged on every exchange of money, so the tax is applied whenever goods or services change hands, including at the wholesale level. A sales tax is paid once, only at retail level.

Hannemann, however, said the tax proposal and the transit line have the support of the Chamber of Commerce, the Building Trades Council and the General Contractors Association, plus the state's political leaders.

"We feel the stars are aligned," Hannemann said, noting that Hawaii's congressional delegations support the transit plan, Gov. Linda Lingle supports allowing the counties to raise their own taxes, and the Legislature and City Council support the county-option tax increase measure.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]