|

|

Sale on,

sale on,

salesman

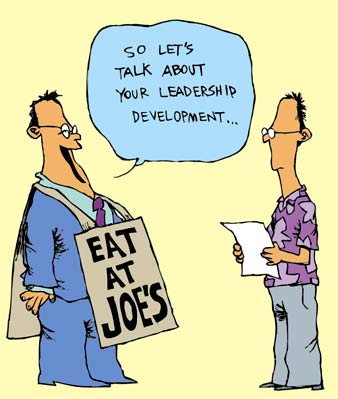

Every leader that enjoys

long-term success has learned

how to be a good salesperson

Recently, a long-standing client for whom I had done considerable leadership development work asked me to design a training module for the company's sales people.

The specific concern was that many staff seemed to be losing sight of the organization's fundamental premise. Namely, building win-win customer relationships was the key to successful long-term sales.

Don't let your natural "Ho hum, what else is new?" immediate response lead you to stop reading. Like you, I knew that premise was true before they asked me for a "new program." I noticed, however, that in putting together this new program about an old truth, I was continuing to reach for bits and pieces from the previous work I'd done on leadership development. And then it hit me.

Every manager and leader in an organization that enjoys any long-term degree of success at what they do does so because they have learned how to be a good salesperson.

Their "customers" are their colleagues. Their "products" are their ideas, proposals and plans to keep the organization on the path to excellence.

It is their ability as sellers to form and maintain win-win relationships with these "customers" that results in loyalty and commitment, the cement that holds the organization together.

A few examples on the direct parallels will suffice.

It is well documented that sellers who simply describe their product's or service's features and advantages over their competition's are generally unsuccessful. On the other hand, sellers who can make direct and clear benefit statements to their prospective buyers are very frequently rewarded with the sale.

"Given what you said about needing X, elements Y and Z of our product will be of specific relevance to you."

A benefit statement, in other words, links directly to a buyer's need.

And how do sellers get potential buyers to voice their own needs? The sellers exhibit what I call their "pull skills." By giving their full attention, they create an environment where the potential buyer feels invited to think aloud about what they need and why. By asking open-ended non-leading questions, and actively demonstrating that they understand what is being said, they demonstrate that they have listened and heard. Then, and only then, are they in a position, to use their "push skills" to make a benefit statement.

"Nice theoretical idea," you think, "but the parallel breaks down because real customers have a choice to buy or not." And you are right, in part. Employees who report to you cannot decide not to "buy your proposals." But having identified their specific needs can still be of value in helping you to explain why they can't be met this time. Commitment and loyalty can be preserved when you don't have to ram the product down the customer's throat with no logical explanation.

And then, of course, there are those cases when the customer for your idea is your own manager, who has a choice to buy it or not.

So my suggestion is simple: The next time you find someone resisting buying an idea you've been trying to sell, take a wander over to your own sales department. See if you can get your No. 1 salesperson to have a cup of coffee. Tell her that you would benefit from any advice on how better to package and sell your idea. Specifically ask how to deal with buyer resistance.

My bet is that if you listen really carefully, what you will hear is that the top salesperson exhibits a high degree of very skillful behavioral flexibility. The best ones have learned how to adjust behavior to the needs of a specific buyer, and across different buyers who also have different needs. Not necessarily product-related needs but most certainly relationship-related needs, i.e., how they need to be treated to feel that you are trying to create a win-win relationship.

This relationship is directly parallel to current research on effective leaders. They, too, just like successful salespeople, have the behavioral flexibility and sensitivity to vary their approaches to meet their colleagues' needs.

Finally, I am acutely aware that whether or not you have bought this argument, whether or not you see it of benefit is completely a matter of whether or not you feel a personal need to become a better leader.

Do your kids a favor:

Teach them how to budget

Raid that penny jar for the cash

you'll need to make your points

Teaching your kids to budget adds up. They learn responsibility, develop planning skills, understand long-term -- rather than immediate -- gratification, and learn to set priorities. These life lessons cannot be taught too early.

You can start teaching your kids about money by taking them grocery shopping. Explain that to buy things you need money.

Teach them how to count money by showing them how many pennies it takes to make one dollar.

Establish a standard allow-ance. A consistent allowance helps your child budget and plan. Wouldn't it be hard to plan for all your needs if your income fluctuated? It's even harder for kids.

Teach them to think of their allowances as income. And those little gifts from aunties, uncles and grandparents? Consider those bonuses. A regular allowance can help you in your efforts to teach your children about saving and prioritizing purchases. This can reduce or even eliminate their pestering you for additional money.

Sit down with your kids and show them how you budget your own expenses, but don't just use numbers -- be creative and visual. It will help your kids understand.

One way to demonstrate budgeting is to use 100 pennies to represent your total income; then show what percentage -- how many pennies -- you need for housing, utilities, etc. Everything after the necessities is what's left for "play money."

Show what happens when the cost of water or electricity goes up. In our household, the needed funds come out of the "play money" stack. This lesson could even help your kids understand why it's important to conserve water and turn out the lights when they leave a room.

Here are some tips to help your kids to create their own budget.

» Deposit allowances directly into their accounts: If you open the account at your bank, you can probably transfer the money electronically or by phone. Withdrawals then become a deliberate decision.

» Save those "bonuses": Birthdays and Christmas are your kids' "bonus" time. The temptation to spend on impulse purchases may be just too great. Put the money into the savings account and plan what purchases the "bonus" money should go for.

» Set goals: Sit down with your kids and write down their "goal" purchases. Help them outline their current savings and projected allowance, then budget to see if they can immediately buy the item or if they need to save. Post the written goal where your children can easily see it, maybe on the fridge.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]