Apple and American

Eagle proved key to

first-quarter stock picks

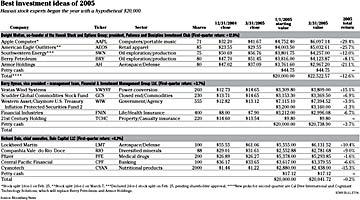

Dwight Melton not only clobbered

the indexes, he topped other local experts

![]()

![]()

Dwight Melton: Selection of Apple and American Eagle proved profitable

"It's really a stock picker's market right now," said Melton, co-founder of the Hawaii Stock and Options Group investment club. "I try to find the best of the best in the stock-selection process."

He certainly was on target in the first quarter as two of his five picks -- Apple Computer Inc. and American Eagle Outfitters Inc. -- rose more than 25 percent apiece, and all but one of his selections finished in the black.

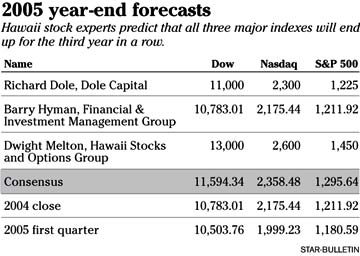

Contrast that with the major indexes, which all posted losses. Including dividend returns, the Dow Jones industrial average and Standard & Poor's 500 index each were down 2.1 percent while the Nasdaq composite index tumbled 8 percent.

Like Melton, the other two local stock experts also easily beat the indexes. Financial adviser Barry Hyman, a vice president in charge of the Maui branch for Michigan-based FIM Group Ltd., saw his picks rise 3.7 percent to $20,738.90. And Richard Dole, chief executive officer of investment banker Dole Capital LLC, eked out a 0.2 percent increase to $20,041.72.

"I'm trying to get ahead of the curve on the downtrend," he said. "The three primary indicators I follow are interest rates, inflation and company profits. With interest rates, the Fed just did its seventh consecutive rate hike that eventually will have an effect on the market. Inflation is going to creep up because of high oil prices. And with company earnings, you've just got to search for the strong performances."

Melton received the biggest pop in his hypothetical portfolio from a 29.4 percent return from Apple Computer, whose iPod music player sales continue to remain strong. American Eagle Outfitters, which sells jeans and T-shirts to 15- to 25-year-olds, was close behind with a 25.7 percent gain. Both companies also split their stocks 2-for-1 during the quarter.

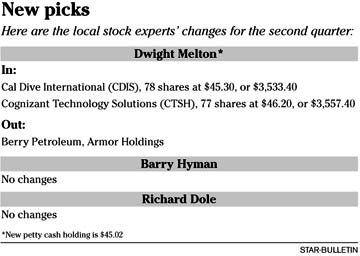

But Melton isn't holding pat. Under the contest's new rules for 2005 that allow for changes each quarter, he's picking up two new stocks and dropping Berry Petroleum and Armor Holdings Inc., a maker of vehicle armor, body armor and aircraft safety products that had its stock fall 21.1 percent in the quarter. His new selections are Cal Dive International Inc., an energy services company that is involved in projects in the Gulf of Mexico; and Cognizant Technology Solutions Corp., a New Jersey-based computer-services company with about two-thirds of its workers in India.

The Denmark-based company is the world's largest windmill maker. He had two other gainers in Scudder Global Commodities Stock Fund Inc., up 6.9 percent, and Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2, up 3.9 percent.

Financial Industries Corp., a life and health insurer; and 21st Century Holding Co., a property and casualty insurer, were down 1.3 percent and 6.7 percent, respectively.

"With 40 percent of our picks in what is basically inflation-protected fixed income, 15 percent in commodities, and 15 percent in alternative energy, this is a pretty defensive small group of stocks," said Hyman.

"But there are still a few select opportunities if one searches the globe," he said. "For example, some areas where we have been able to find compelling value as well as good long-term prospects are in selective alternative energy companies, and certain Asian markets where we can find solid dividend yields, low valuations and attractive earnings prospects. We also feel commodities have likely begun a long-term bull trend, although in the short term they have become a bit overheated and we would not be surprised to see some short term volatility."

Dole, who had a 1.6 percent gain in last year's contest, eked out a gain in the first quarter because of two stocks -- aerospace and defense giant Lockheed Martin Corp., which gained 10.4 percent; and Brazilian iron-ore producer Companhia Vale do Rio Doce, which rose 9 percent.

Of his other picks, pharmaceutical giant Pfizer Inc. slipped 1.6 percent and two Hawaii-based companies, Central Pacific Financial Corp. and nutritional products maker Cyanotech Corp., lost 6.6 percent and 15.3 percent, respectively.

"No changes planned at the moment, as I don't want to be accused of being a day trader," Dole said.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]