|

The great scholarship

hunt is on for

Hawaii students

Filling out a few forms can be

the difference between getting

some free money and going into debt

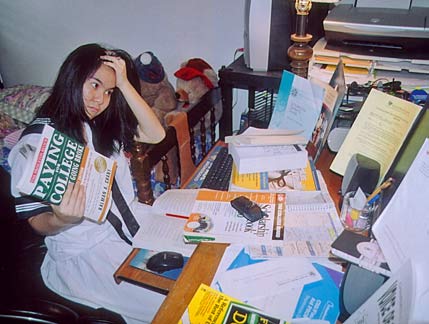

Tiffany Au is freaking out. She sits at a computer desk piled high with college applications and books with titles like "Paying for College" and "College Financial Aid for Dummies." The Sacred Hearts senior has applied to nine mainland schools, and figures the most expensive will cost at least $30,000 a year. But she hasn't panicked ... yet. She hopes to pay for a large portion of that sum through scholarships. For the past two months, this has been her 24/7 job.

About this series

This is the fourth in a series of occasional articles on college for Hawaii students and their parents by C. Richard Fassler, in preparation for his book "Hawaii's College Guide: From Preschool to High School." Previous articles published in the Star-Bulletin were:

Nov. 30, 2003: Choosing a college.

|

No wonder they're worried. Blue-collar jobs are disappearing or being sent overseas, placing pressure on high school graduates to get a college degree. Yet the cost of attending college has never been higher. According to the College Board, the annual price of tuition and fees at a public four-year school was $10,636 last fall, while private colleges charged $26,854. By contrast, the University of Hawaii-Manoa was an incredible bargain at $3,580, and community colleges were about half that.

TIFFANY'S CELL PHONE rings. It's the Hawaii Rotary Youth Foundation congratulating her on passing the initial screening. There's $3,500 at stake, so this is good news. Then, Tien -- her father -- interrupts:

"You've got to hear this! This is really great!"

Tiffany is embarrassed and shouts "No!" But her proud dad pushes the button on the tape recorder anyway.

"Our veterans have fabricated the ultimate masterpiece: liberty!"

It's Tiffany's entry for the Voice of Democracy contest. She has won $1,700 and an expenses-paid trip to Washington, D.C., to compete for an additional $25,000.

Tien and wife Lily escaped from Vietnam in 1979. Their boat, 13 feet high and 72 feet long with a capacity of 408 people, was attacked by Thai pirates. But they managed to make it to a refugee camp in Malaysia, where they stayed for a year before arriving in Hawaii in 1980. Tien is a bellman at the Hilton Hawaii Village. Lily is a nurse. Two years ago, fulfilling their American dream, they purchased a half-million-dollar home in Hawaii Kai. Tiffany and older sister Cynthia kicked in money from their summer jobs to help pay for the mortgage.

Cynthia, a Roosevelt grad, was the first in the family to go to a four-year college. She managed to chase down $8,000 in scholarship money before enrolling at Occidental in Los Angeles, from which she graduated last summer.

Tiffany has been a standout at Sacred Hearts for the past four years. Besides posting a 3.99 grade-point average, she has played in the band, acted in plays, participated in the National Honor Society, won awards for speech and debate, and even competed in the recent Junior Miss Pageant. She hopes to turn those achievements into gold. "There's so much money out there -- there's got to be some for me and everyone else!"

JUST HOW WILL Tiffany pay for college?

Every college that accepts a student will figure out a way for that student to pay the bills (primarily tuition, room and board, and books). It's like buying a Mercedes. Before you leave the showroom floor, the salesman will come up with a way for you to pay for the car -- no matter how pricey it is. This is usually in the form of a loan.

College is much the same way. It can be expensive, but you're going to be able to afford it. The college helps you pay the tab by offering: 1) a grant or scholarship (free money); 2) a campus job; or 3) a loan. It's that simple.

Obviously, Tiffany wants as much of No. 1 as possible, because if the free money is not substantial, the amount of the loan could be high, and she'd have to spend years working to pay off the loan. According to the American Council on Education, two-thirds of undergraduates have student loans, and those loans average $17,000. Roughly 80 percent of undergraduates work in school, with the average student working 25 hours a week. So, here's Tiffany's strategy:

» Do well in school. It's no secret that good grades, meaningful activities and community service are the ticket to entrance into a top college.

But few people realize that a student's record of achievement is also the ticket to the money that will pay for that college. The people with the bucks are not looking for D students who go home after school to watch TV. Most scholarships require a 3.0 GPA, SAT scores at least in the 1100-1300 range, leadership roles in school activities and some community service. Get started on these in the ninth grade -- if not earlier.

» Fill out the FAFSA (Free Application for Federal Student Aid). The FAFSA is a federal government document that requires you to "spill your financial guts"; that is, you tell Uncle Sam how much money you and your family have. This determines how much financial aid you'll receive.

It costs nothing to fill out, and you can even fill it out online (www.fafsa.ed.gov/). But each year roughly 50 percent of high-schoolers heading for college don't bother, depriving themselves of thousands of dollars in grants and low-cost loans. Worse, each year, thousands of low-income students who are eligible for a free-money federal Pell grant (which provides up to $4,050 for college assistance) will not send in a FAFSA.

You'll need your tax information to fill out your FAFSA. You have until June 30 to file the document, but the sooner you fill it out, the better your chances will be of receiving assistance.

» Try for national scholarships. The best way to locate national money is to go to the scholarship Web sites that are available online. Tiffany recommends FastWEB (www.fastweb.com), which claims to have more than 600,000 awards in its database.

If you can slog through the ads, it's pretty amazing. After you register (free), you fill out a detailed form that includes, among other things, your GPA, college major, career interest, hobbies, sports and whether you are an orphan, gay, the first one in your family to go to college, a military dependent, a Chinese speaker, Hawaiian, a 9/11 victim or an employee of Hilton.

I filled out the form for my daughter, Kim -- a junior at Williams College -- and up popped 60 possibilities, including some at the school that I was totally unaware of, complete with internship possibilities! Any parent or student who ignores FastWEB does so at their financial peril.

» Try for local scholarships. The mother of all local scholarship organizations is the Hawaii Community Foundation (HCF), where students can choose from 112 funds that gave $3 million to 1,600 students in 2004.

If you are a Hawaii resident with at least a 2.7 GPA and good moral character who is planning on attending a two- or four-year college or graduate school, then go to www.hawaiicommunityfoundation.org and download their Scholarship Seekers Guide for 2005-06. The deadline is March 1. Better hurry!

How unwise would it be to pass up HCF? Listen to scholarship officer Kalei Stern.

"If a student fills out our online application correctly and sends in supporting documents before the deadline, I'd say he or she would have a 50 percent chance of winning a scholarship," Stern said.

Consider this: In 2004 there were 258 students -- half of the number who applied -- who received funding after meeting the requirements of the Marion Maccarrell Scott Scholarship Fund (2.8 GPA, public high school graduate, taking classes in one of 11 fields, and the submission of an essay on "world peace"). The students received an average of $1,749 each. This fund gives away a half-million dollars a year!

THE PEOPLE who control the funds make the decision as to who receives their money, and most often that money will go to students who demonstrate financial need. But not always.

"The funds consider each student's situation," Stern said. "If an upper-income student is accepted by an expensive school -- say, Georgetown -- he or she could receive a scholarship because of the high cost of tuition and travel."

Even more impressive -- moneywise -- is the financial assistance that Kamehameha Schools doles out each year. In 2004, Kamehameha gave away $14.8 million. Of the 4,500 students who applied, 57 percent (2,600) received an average of $5,692. Who got the funding? Surprisingly, not just Hawaiians.

"Anyone can apply for our scholarship money, though by policy we give preference in our awards to applicants of Hawaiian ancestry," Kamehameha Schools spokesman Kekoa Paulsen said.

The deadline for applications is May 5. Go to www.ksbe.edu and click on "Financial Aid and Scholarships."

Another popular source of scholarship money is www.collegeconnections.org. After registering and filling in some particulars, I found 268 possibilities for Kim, including the Bill Bickson Scholarship Fund for marketing and travel industry management majors (90 grants of $1,120); the Jean Fitzgerald Scholarship Fund for girls who play tennis (four grants of $2,000); students headed for UC-Berkeley ($1,500); persons of Portuguese descent ($500); graduates of Castle High ($1,000) or Hilo High ($750); and children of sugar workers ($1,000). For students who really want to hit the jackpot and serve their nation at the same time, the Army has ROTC scholarships that pay $17,850 a year.

CHECK SCHOLARSHIPS at the colleges to which you have applied. Hardly anybody thinks of this -- with the exception of Tiffany, of course. By exploring the Web sites of her nine colleges of choice, she discovered a treasure trove of money, including the Presidential Arts Program at George Washington University.

"If I am chosen," she says, "I'll have access to the theaters of D.C. and a $15,000 deduction from my tuition!"

Other tips: Ask your college counselor about scholarship opportunities. Borrow books from the library. Search online. Speak to past scholarship winners.

Tiffany has a month or so before hearing from her nine colleges. She knows that her top picks will probably offer her the least amount of money, so she continues to fill out applications. There's no question the effort is worth it.

"I want to get somewhere in life and live up to my full potential," she says. "College will open up opportunities -- opportunities my parents never had."

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]