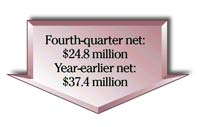

Hawaiian Electric’s

profit drops 33.7%

Hawaiian Electric Industries Inc. delayed the release of its earnings for two weeks to make an accounting adjustment. But the additional $1.5 million in net income it got for the final three months of 2004 wasn't enough to salvage a quarter that was hampered by higher operating, maintenance and depreciation expenses.

![]()

Revenue rose 14.1 percent to $518.4 million from $454.2 million.

For the year, HEI's net income fell 4 percent to $109.7 million, or $1.38 a share, from $114.2 million, or $1.52 a share. Income from continuing operations dropped 8.7 percent to $107.7 million, or $1.36 a share, from $118 million, or $1.57 a share.

Revenue for the year rose 8 percent to $1.9 billion.

Last quarter was marked by two one-time events. The first was the culmination of an overall $29 million settlement between American Savings Bank and the state Department of Taxation after the agency ruled that that the bank could not deduct from its taxes dividends paid to it by a subsidiary real estate investment trust. American Savings Bank took a $24 million charge to net income in the second quarter. Upon settlement, the bank reversed $3.5 million of that in the fourth quarter, resulting in reduced net income of $20.3 million for the year.

"Excluding the effect of the bank franchise tax settlement charge which covered multiple tax years, all business units -- the utilities, the bank and the holding and other companies -- showed improved results compared with 2003," said Robert F. Clarke, HEI chairman, president and chief executive officer.

The other unusual event resulted in HEI postponing the release of its earnings that originally were scheduled to come out on Jan. 24. On the day of the scheduled release, HEI said it was delaying its earnings because it had incorrectly applied amortization methods involving its mortgage-backed securities portfolio. Mortgage-backed securities are investments that are backed by mortgage loans.

The company said yesterday the change added $1.5 million to fourth-quarter earnings.

In the fourth quarter, electric utility net income plunged 40.7 percent to $13.2 million primarily due to a $10.4 million increase in maintenance expenses from a year ago. Contributing to the rise was a larger scope and timing of overhauls, repairs and maintenance, including an unscheduled major overhaul of an Oahu generating unit.

The utility in November filed a request with the state for a 7.3 percent rate increase, the company's first in a decade. The increase would raise an average residential bill about $7 a month, and raise about $74 million a year.

Bank net income rose 19.5 percent to $16.7 million from $14 million a year earlier. Excluding the $3.5 million reversal, the bank's net income in the fourth quarter would have been $13.2 million, down 5.7 percent from $14 million a year ago.

The bank's net interest income, or its revenue from lending and investments minus what it pays on deposits and other liabilities, rose 4.4 percent to $50.5 million. Its net interest margin, which reflects the difference of what it pays depositors and what it brings in from loans, fell to 3.02 percent from 3.16 percent.

www.hei.com

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]