Bankoh’s earnings

beat estimate

No Michael O'Neill.

No problem.

Bank of Hawaii Corp., operating its first full quarter with Allan Landon at the helm, boosted fourth-quarter net income 19.6 percent to surpass analysts' forecasts.

![]()

"We think that the (strength of the) economy is an important factor ... but it's not sufficient," Landon said. "The other thing that's really important is our team performing well with customer service and good technology -- and pricing (the cost of services vs. convenience) always helps at the end of the day."

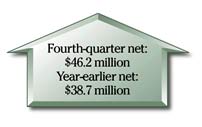

Net income was $46.2 million, or 82 cents a share, compared with $38.7 million, or 66 cents a share, a year ago. That was 7 cents better than the 75 cents consensus estimate of nine analysts surveyed by Thomson Financial.

Landon said, however, it was unlikely those analysts factored in two items that affected Bank of Hawaii's earnings.

One item was the return to income of $6.5 million from a loan and lease losses allowance that boosted earnings 7 cents a share. The other item was a penny-a-share for $757,000 in bond losses.

The result, Landon said, is that the bank finished at the high end of the range of analysts' estimates and likely beat the consensus estimate by about a penny a share.

For the year, Bank of Hawaii's earnings rose 28.2 percent to $173.3 million, or $3.08 a share, from $135.2 million, or $2.21 a share, in 2003. The bank is projecting net income for 2005 to be approximately $174 million to $177 million. The forecast includes a $10 million provision for loan and lease losses.

"I think if you remove from our forecast the effect of the provision, we're looking at a percent increase in pretax operating income of high single digits," Landon said.

Bank of Hawaii, which was struggling with its credit quality before O'Neill took over in November 2000, saw nonperforming assets plunge 56.3 percent to $13.9 million in the fourth quarter from $31.7 million at the end of 2003. The ratio of nonperforming assets to total loans and foreclosed real estate was 0.23 percent compared with 0.55 percent a year ago.

"It was a combination of a good economy and good processes on our part -- both in terms of underwriting new loans and in terms of working with borrowers on mature loans," Landon said.

Assets rose 3.3 percent to $9.8 billion from $9.5 billion a year ago. Total loans and leases gained 4 percent to $6 billion from $5.8 billion. Total deposits increased 3.1 percent to $7.6 billion from $7.3 billion a year ago.

The bank's board also kept its dividend at 33 cents after having raised it to that amount the previous quarter.

It will be payable March 14 to shareholders of record at the close of business on Feb. 28. The yield on the dividend is currently 2.5 percent. Bank of Hawaii's board also authorized an additional $100 million for its share buyback program and said that the company repurchased 400,000 shares between Jan. 1 and Jan. 21 at an average cost of $48.98 a share.

Bank of Hawaii's return on equity, a measure of how well it used reinvested earnings to generate additional earnings, rose to 23.63 percent in the quarter from 18.59 percent a year earlier.

Its return on assets ratio, which indicates how many dollars of profit it achieves for each dollar of assets it controls, was 1.89 percent from 1.66 percent a year earlier.

Bank of Hawaii's net interest margin, which reflects the difference of what the bank pays depositors and what it brings in from loans, rose to 4.40 percent from 4.35 percent a year ago. Net interest income increased 7.1 percent to $100 million from $93.4 million a year ago.

Noninterest income, which includes revenue from service charges and fees, slipped 2.2 percent to $48.4 million from $49.4 million a year ago largely due to a decline in gains on sales of mortgage loans.

Noninterest expense fell 1.6 percent to $82.1 million from $83.4 million a year ago that was partly due to a reduction in salaries and benefits related to incentive compensation and separation expenses.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]