|

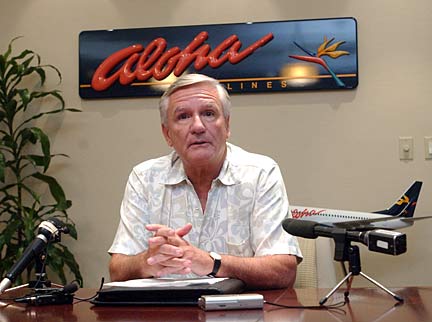

Aloha Air bankrupt

Rising fuel costs and smaller

profits since 9/11 spur the move,

the airline's CEO says

Three years after they nearly merged in a bid for survival, Aloha Airlines joined rival Hawaiian Airlines in Chapter 11 bankruptcy yesterday, saying it needs court protection from creditors as it works out a plan to reduce mounting costs.

Gimme Shelter

Aloha Airgroup says its bankruptcy will not affect flights, reservations or its frequent-flyer program but could result in:

» A leveled playing field with rival Hawaiian Air.

|

"Aloha took this step so it could continue to pursue cost-reduction initiatives needed to offset higher fuel and operating expenses in a fiercely competitive market," Banmiller said.

He said the company needs to make sharp cost cuts under a 2005 budget still being drawn up, and did not rule out layoffs.

Besides rising costs, Aloha is at a competitive disadvantage with Hawaiian Airlines' extended stay in bankruptcy protection, Banmiller said. Hawaiian declared bankruptcy in March 2003, a move that has shielded the airline from creditors and allowed it to restructure some aircraft lease agreements.

He added that United Airlines and ATA Airlines -- both of which compete with Hawaiian and Aloha on mainland routes -- are also in bankruptcy.

"Aloha expects to align its aircraft lease rates and match its expenses to those of competitors who have already benefited from bankruptcy protection," Banmiller said.

In its bankruptcy filing, Aloha Airlines and its parent listed more than $130 million in combined debt owed to the top 20 creditors, including $42 million to First Hawaiian Bank.

Chapter 11 allows companies to restructure under court protection while continuing daily operations, and Banmiller said the move would not affect tickets, reservations, frequent-flyer programs or the airline's routes and scheduling.

Banmiller, who took over the controls at Aloha six weeks ago, said he expects the airline to be out of bankruptcy "quickly," unlike "other companies that have made an art form" of it.

In December 2001, Greg Brenneman, a former Continental Airlines president, said at a press conference that a new company, Aloha Holdings, had been formed to ensure the continued viability of Hawaii's interisland air service. That merger attempt between Aloha Airgroup and Hawaiian Airlines failed in 2002.

"These are difficult times for all airlines. Bankruptcy is hard on a company and its employees, so we have lots of sympathy for our colleagues and competitors at Aloha," he said.

Banmiller, a former executive at Jamaica Air, has been on a cost-cutting mission since taking over at Aloha.

He said that on Dec. 1, Aloha embarked on a plan to reduce 2005 operating expenses by $60 million, or about 12 percent to 15 percent.

The company cut low-yield routes to the Central and South Pacific. It also laid off 12 top managers and froze 35 management positions in a move that will save $3 million a year. The company also has been negotiating with its aircraft lessors on obtaining more favorable leases.

But the company was unable to meet the savings target, and Banmiller said he decided to file for bankruptcy rather than start 2005 on shaky financial ground.

Among Aloha's largest expenses are the leases it pays on aircraft supplied by providers such as GE Capital Aviation Services and Boeing Capital.

Some of the lease rates are substantially higher than current market rates, Banmiller said.

He said management has been negotiating with the airline's unions on a new contract and has asked for concessions, though he would not spell those out.

"I wouldn't characterize it as layoffs at this point. We will be re-evaluating our staffing levels as part of the '05 budget process," he said.

Capt. John Riddel, an Aloha pilot and spokesman for the Air Line Pilots Association, said the company has asked workers to agree to significant reductions in pay, work rule changes and reduced benefits in talks over amending contracts that expire in 2006.

"But why put a Band-Aid on a hemorrhaging business?" said Riddel, who added that Aloha's problem was not staffing and wages, but the lack of a viable business plan for the carrier.

Banmiller will begin traveling around the state today to brief staff on yesterday's move. The impact on Aloha's 3,668 employees will become clearer in the next few weeks as contract talks and the budget progress, he said.

However, saying you cannot "expense an airline out of trouble," Banmiller promised to unveil a new advertising strategy and new scheduling for mainland routes. Aloha also is looking to add new slots in mainland cities.

Having the state's two largest carriers in bankruptcy is sure to revive debate over whether Hawaii needs and can sustain two major airlines. Banmiller said there is room for two, and would not comment on whether Aloha's bankruptcy makes a merger possible again.

"We expect to emerge from bankruptcy as soon as possible and as a much stronger company," he said.

The bankruptcy filing left some Aloha workers stunned.

"Everyone is in shock right now," said Randy Kauhane, assistant general chairman of the International Association of Machinists District Lodge 141.

But for many who follow the industry, the news was not unexpected, Riddel said.

"It's the norm for the industry. All the airlines are doing it throughout the country," he said, adding he suspects that Banmiller was brought in specifically for that purpose.

"The new guy specializes in getting quick concessions from employees and taking airlines into bankruptcy," Riddel said. "It's his template and forte, and he's done it at other airlines, including Sun Country Airlines and Pan American World Airways."

Riddel said fear over job security is rife among the airline's work force but that some employees believe the reorganization could make their jobs more secure.

"Now Aloha will be on a level playing field with the likes of Hawaiian, United and ATA," he said.

|

Airline has history

of reliability, affordability

When Trans-Pacific Airlines made its maiden flight in 1946, it was appropriately scheduled on an Aloha Friday.

![]()

![]()

Hung Wo Ching: Isle real estate investor helped found and grow Aloha Airlines

Aloha, which filed for Chapter 11 bankruptcy reorganization yesterday, has a long history of providing affordable and reliable flights to the neighbor islands for local residents.

It also boasts a long track record of local ownership.

The airline was founded by local publishing executive Ruddy Tongg as an upstart challenger to Hawaiian Airlines. Tongg's original investors included local real estate investor Hung Wo Ching, according to Bill Wood's book "50 Years of Aloha."

The airline business took off in 1959 with the advent of jet service to the islands.

In the early 1970s, the airline nearly merged with rival Hawaiian Airlines before the deal was scuttled at the last minute.

In 1986, Ching, then Aloha's chairman, and local developer Sheridan Ing fought off a takeover attempt from Dallas-based CNS Partners by taking the company private.

The company continues to be controlled by members of the Ing and Ching families.

In 2000, Aloha launched its first mainland routes with flights between Honolulu and Oakland, Calif. The airline now operates 42 weekly mainland flights.

A year later -- and months after the Sept. 11, 2001, tragedy -- Aloha and rival Hawaiian discussed another merger. The deal, which was initiated by Dallas-based TurnWorks Inc., later fell apart with both sides pointing fingers at each other.

55 years of serviceHere's a brief history of Aloha Airlines:

1949: Local publisher Ruddy Tongg organizes the hui Trans-Pacific Airlines as a charter carrier.

Source: "50 Years of Aloha: The Story of Aloha Airlines," Star-Bulletin

|

www.alohaairlines.com/

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]