|

As the dollar weakens, the yen

gains value, giving Japanese

visitors more pocketbook power

HAWAII residents always talk about the high price of paradise, but for Japanese visitors, the Aloha State has been on sale. A strengthening yen against the dollar has helped lure eastbound tourists to Hawaii after a drop-off that began following 9/11.

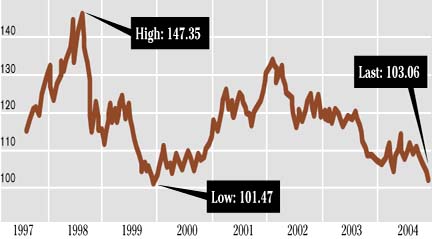

The yen, which just more than six months ago was around 114 to the dollar, is now hovering around 103 and threatening to go lower as the dollar continues its weakness against all major currencies. The last time the yen fell below 100 was on Oct. 23, 1995, when it hit 99.65.

Hawaii's economy has benefited from the weaker dollar, with the strong yen helping to attract 14 percent more Japanese tourists than a year ago, according to figures through October by the state Department of Business, Economic Development & Tourism.

"The last couple of months we've seen real strength in the Japan market both at the Outrigger and around the industry," said David Carey, president and chief executive of Outrigger Hotels & Resorts.

As the dollar weakens against the yen, Japanese tourists -- who already spend more on a daily basis than any other group -- have even more disposable dollars. In October, Japanese visitors spent $255 per person. The next closest group was U.S. East visitors at $178 per person.

"The yen-against-the-dollar ratio is working to bring more travelers here and we're seeing lots and lots of Japanese shoppers," said Anne Murata, marketing director of the Festival Cos., the management company for the center. "We've had strong sales figures and they're climbing double digits every month."

Japanese visitor arrivals grew another 3.2 percent in November, according to Japanese-Hawaii marketing firm Nashimoto & Associates LLC.

"We do see them buying different things," Murata said. "They're still shopping in our flagship luxury stores, but they're buying a lot of different types of items -- more trendy, but less expensive. But they're still buying just as much."

She said sales are up in the center's flagship luxury stores such as Hermes, Cartier, Salvatore Ferragamo, Bulgari, and Na Hoku. She also said the center's jewelry stores have done well.

However, Paul deVille, CEO of Hilo Hattie parent Pomare Ltd., said he doesn't think the stronger yen has made a difference in his retail outlet's business.

"For us, we've always had the view that if we have the right product, then eastbound customers will be buyers," he said. "We don't believe five or even 10 points on the yen will impact Hilo Hattie."

Bank of Hawaii chief economist Paul Brewbaker said the yen's recent rise in value suggests that the currency could strengthen further. As examples, he points to two periods since the mid-1990s that have been adverse to the Japanese and to Hawaii tourism. One was the yen's depreciation to 140 to the dollar from 100 in the mid-1990s; the other was its weakening to nearly 135 from about 100 shortly after 9/11.

"In each case, maybe the Japanese visitor arrivals ended up 20 percent lower than where we started," Brewbaker said. "So while it's a long ways back, there is some literature suggesting that the dollar could weaken past where it was in the mid-'90s relative to the yen. I'm starting to hear numbers of what would 80 yen to the dollar look like."

During the bubble economy in the mid- to late 1980s, the yen went from 240 to about 120 over a relatively short period of time.

"It's the classic of be careful what you wish for," Brewbaker said about the stronger yen's impact on Hawaii.

"In Hawaii, a stronger yen would have a positive short-term effect on tourism and investment. But the dark side is the timing. Just as Hawaii home property values reach their all-time highs, there's a possibility that additional foreign demand might show up if the dollar continues to weaken significantly. So just when you thought it's gotten expensive, some investor shows up from overseas, looks at our prices and says it's cheap because the dollar is cheap to them."

Harlan J. Cadinha, chairman, CEO and general partner of Honolulu investment advisory firm Cadinha & Co., said he doesn't fear a repeat of the 1980s real estate bubble.

"The Japanese probably won't be coming in here with a strong currency trying to buy all the land and assets," Cadinha said. "I think those days are gone because the banks in Japan that financed all that stuff aren't in the same shape they used to be in."

Hotel occupancy, buoyed by the increase in Japanese tourists, rose to 82.69 percent on Oahu last month from 75.12 percent a year ago. The average daily room rate on Oahu rose to $111.53 from $106.26.

"When demand rises, that gives hotels and others an opportunity to increase their prices and increase their yields," Carey said. "If Japan has a healthier economy and Hawaii has a less expensive product, those two things bode very well for market growth. My favorite words as a hotelier is, 'Sorry, I don't have any rooms.'"

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]