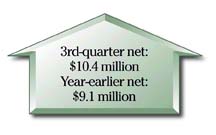

HMSA income

rises 15%

to $10.4M

Hawaii Medical Service Association said today that third-quarter net income increased 15 percent despite investments generating $2.7 million less than a year ago.

![]()

"I think it was sort of an unremarkable quarter," said HMSA Chief Financial Officer Steve Van Ribbink, noting that health-care inflation and the use of benefits continued to climb during the period. "For every $1 we collected, we had a 1 percent return. When I look at the prior quarter a year ago, yes, we are doing better. But even then it was half a cent for every dollar we collected."

Heath-care service expenses, which include hospital, physician and drug costs, rose 4.8 percent to $376 million from $358.9 million. Administrative expenses increased 14.8 percent to $30.5 million from $26.5 million.

However, the year-over-year comparisons of health-care service costs and administrative expenses are skewed because of an Insurance Division accounting change that altered the way certain costs are categorized. That resulted in $4.2 million in disease-management expenses during the quarter being shifted from health-care service costs to administrative expenses. Under previous reporting guidelines, health-care service costs would have risen 5.9 percent last quarter and administrative expenses would have decreased 0.9 percent.

"In the industry, paying out a percentage in health-care service costs above 88 percent is considered quite high, and historically we've paid about 93 percent," Van Ribbink said. "We do pride ourselves on keeping our administrative costs as low as we can and trying to provide value by making sure as much as possible what the members pay us actually goes to their care in terms of payments to hospitals and providers."

Administrative expenses represented 7.4 percent of revenue last quarter.

HMSA, which had 689,525 members at the end of last quarter, received state approval earlier this year for rate increases. Businesses with 100 or more employees will see premiums rise an average of 5 percent beginning in January.

Small businesses saw their insurance premiums rise 7.7 percent beginning last July for the fiscal year ending June 30, 2005.

HMSA's reserves grew 5.7 percent to $516.3 million, or $749 per member, at the end of the third quarter from $488.6 million, or $722 per member, at the end of last year. Given the company's monthly expenses, the reserve would allow HMSA to operate for 3.9 months if no dues were being received.

"This is well below the maximum reserve of six months allowed by statute," said Van Ribbink.

Van Ribbink said HMSA is content with its current reserve level.

"We don't think we really need to go higher," he said. "We don't think it would be prudent to go less. We think it's a comfortable reserve for the responsibility that we have to our members, our providers and the community."

HMSA's investment income, which is used to offset losses and unexpected emergencies, decreased to $4.9 million from $7.6 million a year earlier.

"Investment income is very important to a nonprofit health plan like HMSA," Van Ribbink said. "Not only does it strengthen reserves, but it also helps subsidize future dues."

Van Ribbink said health-care costs rose about 7 percent through the first eight months of this year and he projects those costs will end the year up about 8 percent.

Other income that contributed to HMSA's bottom line last quarter was $389,922 it received from TriWest, which has a health-care contract with the U.S. Department of Defense. Also, HMSA received a tax benefit of $910,939.

www.hmsa.com