— ADVERTISEMENT —

Hawaii hotels

enjoying record year

Pent-up travel demand for Hawaii, as well as a resurgence in the state's convention, Japan and Canadian visitor markets, boosted hotel occupancy to a record for the first nine months of this year and pushed room revenue to $2.1 billion, the second-highest amount during that period.

|

"Our traditional valleys have become shallower dips," said Haas, attributing the fall's strong performance to the return of the Japan market and increased demand for Hawaii as a destination from other visitor segments.

Hawaii's unusually strong summer also could have contributed to September's boost, he said.

"Summer was so strong that it was difficult to find space and many people booked fall as an alternative," he said.

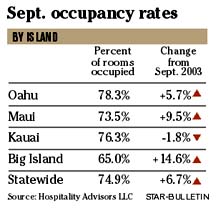

Indicators for the accommodations industry show that financial performance at Hawaii's hotels is on the upswing. A boost in visitor arrivals to the islands lifted statewide occupancy by 4.7 percentage points to 74.9 percent in September, according to the latest Hawaii Hotel Flash Report released yesterday by Hospitality Advisors LLC.

For the first nine months of the year, Hawaii hotels were 79.2 percent full, the highest since Hospitality Advisors began doing the survey.

But more important, strong visitor arrivals and high occupancy numbers have increased demand at Hawaii's hotels, said Keith Vieira, senior vice president and director of operations for Starwood Hotels & Resorts Worldwide Inc. He said hotels are able to charge top dollar for rooms even in the fall's softer season.

"The average rate growth was the benefit that we saw," Vieira said, adding that the hotel's revenue per available room was fairly close to levels seen in 2000, the all-time best year for hotel and visitor industry performance.

All across Hawaii, hotels have seen a fairly steady uptick in business, said Stan Brown, vice president of Pacific Islands and Japan for Marriott International.

"The 2004 rebound should get us back to 2000 levels and 2005 should be a record-setting year," Brown said.

Average daily room rates rose 3.2 percent year-over-year to reach $138.77 per night and hotels posted a 10.2 percent increase in room revenue, which rose to $103.94. For the first nine months of the year, Hawaii had the second-highest average daily rate and room revenue in the nation behind New York at $119.70 and $151.13, respectively.

"We're having a spectacular year," said Joseph Toy, president of Hospitality Advisors. "Room rates and occupancy are increasing because of tight supply and reinvestment in the market."

Business in Waikiki was especially good in September as hoteliers posted occupancy gains of 5.5 percentage points over last year. Overall, room revenue for Waikiki hotels surged 6.7 percent to $93.18 during the month, while average room rates rose nearly 2.3 percent to $119.01

Oahu hotels were the most full, with 78.3 percent occupancy in September, a 4.2 percentage point jump attributed to the rebounding Japanese visitor market and growth in Canadian arrivals.

Kauai hotels slipped 1.4 percentage points to 76.3 percent occupancy.

Big Island hotels, which had the lowest average occupancy rate at 65 percent, improved well above the year-ago results.

Maui hotel occupancy rose 6.4 percentage points to average 73.5 percent full.

— ADVERTISEMENTS —

— ADVERTISEMENTS —