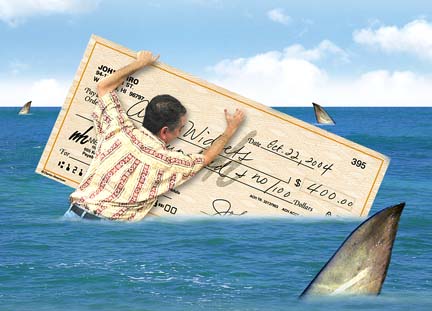

That sinking feeling

|

Under a new federal law,

floating your check could

leave you all wet

Hawaii consumers who have mastered the art of juggling monthly bill payments with their paychecks soon will have to contend with another ball in the air.

Checks and balances

The Check Clearing for the 21st Century Act, or Check 21, will go into effect Thursday. Here's what it means for banks and customers.

» Streamlines check processing and reduces or eliminates the float time for bill payments. Sources: American Bankers Association, Hawaii Bankers Association, Federal Reserve Retail Payments Research Project.

|

Even though bank customers are supposed to have sufficient funds in their accounts when writing checks, customers often take advantage of the lag time in mail delivery and processing by sending out checks before the money actually is in the account.

"I don't doubt for a second that there are a great number of people who write checks at Wal-Mart on Saturday and payday is Monday," said Wendy Burkholder, executive director of the Consumer Credit Counseling Service of Hawaii. "Probably, 98 percent of our client base has low to moderate income and living paycheck to paycheck is real life to them."

But the effects of Check 21, which allows financial institutions to use electronic check images to substitute for the real thing, won't be felt overnight.

"The adoption curve is going to be pretty slow because not everybody flips a switch and begins operating with substitute checks in lieu of canceled checks," said Greg McBride, a financial analyst at North Palm Beach, Fla.-based Bankrate.com.

Check 21 requires financial institutions to accept substitute checks -- essentially paper images -- as if they were the original canceled checks. The substitute checks are considered legal copies and can be used as proof of payment by the courts and the Internal Revenue Service.

The new law will cut down the time it takes for banks to receive their money and will reduce fraud by allowing faster detection. This new method also provides an option to the costly and time-consuming physical transportation of checks from one state to another across the country, as is being done now.

But while the law requires banks to accept substitute checks, it doesn't mandate that they accept them electronically because some banks, particularly smaller ones, don't have the necessary equipment or don't want to undergo the expense. Thus, some banks will do same-day processing through the electronic transfer of substitute checks while others still will continue to use the traditional method of physically transporting the checks. The changeover will take several years, but the dilemma for check floaters is that they won't know which bank is doing what.

Sheila Gomes, senior vice president and manager of transaction processing and services center for Bank of Hawaii, said she doesn't think Hawaii customers will see much of a difference when they're writing checks locally because most of the banks in the state have an agreement to exchange and process checks on the same day they are received.

"Customers are used to seeing money come out of their account on the same day they write their checks locally," Gomes said. "The dynamics will change when they write to the mainland."

Since most Hawaii institutions initially won't be accepting electronic transfers, Gomes said, sending a substitute check to a particular Hawaii bank would be done through air as it is being done now.

"Depending what financial institutions do on the mainland, it could shorten the time for checks to be charged to an account," Gomes said.

Hawaii's four largest banks -- First Hawaiian Bank, Bank of Hawaii, American Savings Bank and Central Pacific Bank -- all have said that they are not planning to accept electronic transfers at the outset.

However, HawaiiUSA Federal Credit Union, the largest credit union in the state with 92,000 members, is planning to accept electronic transfers through WesCorp Federal Credit Union, which is based in San Dimas, Calif., and has an office in Honolulu.

"The process should be transparent to the members," said Scott Kaulukukui, HawaiiUSA senior vice president of communication groups. "Members are going to find that the check will clear quicker and the law will allow the financial industry to be a lot more efficient so we don't have to be transporting around the paper checks."

Besides seeing their checks potentially clear faster, Hawaii consumers who are used to having their paper checks returned to them each month may find that all their checks are images or are a combination of images and the original canceled checks.

Currently, 36 percent of Americans receive their original checks, according to a survey by the American Bankers Association.

"The message from not only First Hawaiian but all banks throughout the country to convey to customers from a customer perspective is it's business as usual," said Duane Chun, vice president and project manager for First Hawaiian Bank's Check 21 Compliance Project Team. "They'll continue to write and use their checks like they do today."

In some cases, banks such as First Hawaiian already have the capability to accept electronic transfers but prefer to wait before implementing it.

"It's more than just getting our money faster," said Michael Coates, vice president and manager of First Hawaiian's Transaction Management Department. "There are operational issues that still need to be worked out before we move from a paper-based environment to an electronic environment.

"The bank has internal processes it has built over long period of time in terms of fraud detection and other systems that we use to manage accounts and manage the check process that need to be worked out before we get into that world."

The impetus for Check 21 came in the days following 9/11 when banks were either unable or delayed in processing checks because the airline industry was grounded.

"We really had a wake-up call with 9/11," Chun said. "Airlines were shut down and physically we couldn't clear our checks back to the mainland. Hopefully, these new regulations set the foundation for us to do this down the road."

For consumers, who write 50.9 percent of all checks in the country, it's another reminder that time is money.

"I think every financial institution has a segment of the population that relies on (floating checks), plans on it," said Abel Malczon, senior vice president of operations for American Savings Bank. "We've educated our employees to help our customers when questions arise.

"From our perspective, the customer needs to be aware of three things. Their checks could clear faster. They need to have sufficient funds because they have been banking on checks clearing slow and it could lead to an insufficient funds condition. The third thing is that they may not get their original canceled checks back."

For consumers like those that enlist the help of Consumer Credit Counseling Service of Hawaii, the new check processing will require them to be more efficient in how they spend their money. That could be a good thing in the long run because Consumer Credit Counseling's average client now has a record average of $18,000 in unsecured debt, according to Burkholder.

"We have a lot of clients who have overdraft protection as one of their debts," Burkholder said. "They've utilized all their credit cards to the maximum and they've used their personalized line of credit that prevents them from bouncing checks, but the interest that accrued on it goes into the overdraft. So, in the same way they utilized their credit card, they just keep dipping into their line of credit until they're at the maximum and then make the minimum payments and use it as another form of credit to get by month to month."

In Hawaii, bounced check fees range from $15 to $24, according to the last available survey conducted by the Star-Bulletin.

Burkholder said personalized lines of credit are a good safety net for the new Check 21 law as long as individuals don't turn it into another form of credit by making just the minimum payments.

"Credit lines are very generous and give people a lot of rope," Burkholder said. "But it's easy to hang yourself without a lot of education about debt."

Facts and figures

» About 59 percent of customers already have their checks withheld from their statements and use images to prove they paid for something.

» 36 percent of Americans still receive their original checks with their statements. » About 50 percent of consumers 55 and older gets their checks back; only 23 percent of consumers 18 to 34 do. » Banks process more than 40 billion checks each year. In 2001, the last available study, 42.9 billion checks were processed valued at $39 trillion. » The average value per check is $925. » Consumers write 50.9 percent of all checks. » Checks make up 15 percent of all consumer payments at the point-of-sale. » Image statements are offered by 50.1 percent of community banks, with another 19.2 percent planning to offer them. Sources: American Bankers Association, Hawaii Bankers Association, Federal Reserve Retail Payments Research Project

|