— ADVERTISEMENT —

BancWest profits

increase 4.4%

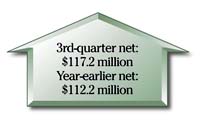

First Hawaiian Bank's parent said yesterday that net income rose 4.4 percent in the third quarter as the quality of its loan portfolio continued to improve.

|

Walter Dods, chairman and chief executive officer of BancWest, said First Hawaiian and sister institution Bank of the West in San Francisco continued to generate solid internal growth during the quarter.

"Now, we're moving ahead with two acquisitions that will expand Bank of the West's presence in the Central Valley of California and introduce the bank's brand to 10 additional states as far east as the Great Lakes," Dods said.

BancWest said its $1.2 billion acquisition of Community First Bankshares Inc., the parent of Community First National Bank and Community First Insurance Inc., is expected to close Nov. 1 with the branches to be merged into Bank of the West in December. Community First operates 156 branches in 12 states.

The other acquisition, a $245 million purchase of USDB Bancorp, also is expected to close Nov. 1 with the branches of Union Safe Deposit Bank to be merged into Bank of the West in January. USDB has 19 branches in San Joaquin and Stanislaus counties in the Central Valley of California.

Upon the closure of both mergers, BancWest will have an estimated $49 billion in assets and more than 530 branches in 17 Western and Midwestern states, Guam and Saipan.

"These are two complementary banks that fit in well with our company both strategically and financially," said Don McGrath, president of BancWest and CEO of Bank of the West.

BancWest ended the third quarter with $41.4 billion in assets, a 10.6 percent gain from a year earlier. Loans and leases rose 10.2 percent to $27.8 billion while deposits gained 9.6 percent to $28.4 billion.

The company's credit quality showed significant improvement as nonperforming assets were 0.4 percent of loans and foreclosed properties compared with 0.7 percent a year earlier. BancWest's allowance for credit losses dropped to 1.4 percent of total loans and leases from 1.5 percent in the third quarter of 2003.

BancWest's net interest margin, which reflects the difference of what the bank pays depositors and what it brings in from loans, fell to 3.8 percent from 4.2 percent a year ago. But net interest income edged up 0.1 percent from the third quarter of 2003 as average loans and leases gained 11.3 percent.

Noninterest income, which includes revenue from service charges and fees, rose 4 percent to $104.8 million while noninterest expense gained 5.2 percent to $234.5 million. Without merger-related expenses, noninterest expense was up 2.6 percent.

No earnings per share were reported since BancWest is a subsidiary of French banking giant BNP Paribas SA.

— ADVERTISEMENTS —

— ADVERTISEMENTS —