— ADVERTISEMENT —

Territorial earnings

rise 16.7 percent

Territorial Savings Bank's third-quarter net income grew 16.7 percent as a drop in new mortgage loan volume was offset by an increase in deposits and gains from the sale of mortgage-backed securities.

The state's sixth-largest bank in terms of assets, which opened its 20th branch yesterday in Mililani, has been on a growth track that also boosted total deposits and total assets in the quarter.

The state's sixth-largest bank in terms of assets, which opened its 20th branch yesterday in Mililani, has been on a growth track that also boosted total deposits and total assets in the quarter.

"We're trying to grow as much as we can, as quick as we can," said Chairman and Chief Executive Allan Kitagawa.

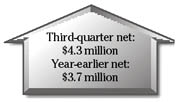

Territorial, which is privately held by Territorial Mutual Holding Co., logged a net income of $4.3 million in the three months that ended on Sept. 30.

Total deposits grew 18.6 percent to $998.2 million, which in turn helped raise total assets by 18.4 percent to $1.16 billion.

The bank's new loan volume dropped 50 percent compared with the third quarter of 2003, when a refinancing boom was still under way due to prevailing low interest rates at the time.

Still, the bank's mortgage loans and mortgage-backed securities eked out a 3.6 percent increase to $952.4 million.

Kitagawa said the bank was able to capitalize on interest-rate fluctuations by making gains on the sale of mortgage-backed securities, which are loans guaranteed by the federally sponsored companies Freddie Mac, Fannie Mae and Ginnie Mae.

Kitagawa said the bank doesn't expect long-term interest rates to rise significantly but the bank was nevertheless being more cautious in its mortgage lending in the event that property values decline after their run-up of the past few years.

"When and if the market drops, we want to make sure we're adequately secured with good-quality assets," he said.

Territorial's net interest margin, which is the difference of what it pays depositors and what it earns from loans, slipped to 3.64 percent from 3.83 percent.

The bank's return on equity, which measures how well it used reinvested earnings to generate additional earnings, also declined to 20.38 percent from 22.55 percent.

The bank's efficiency ratio, a measure of how much it costs the bank to make a dollar of revenue, worsened to 46.28 percent from 43.35 percent.

Territorial Senior Vice President Stanley Tanaka said the efficiency ratio could face further strain as the bank spends on its expansion. The bank plans to open two more branches in the first quarter of 2005 in Kapolei and Kahala.

"In the long run, expansion helps. But it takes a while for new branches to become profitable," Tanaka said.

— ADVERTISEMENTS —

— ADVERTISEMENTS —