— ADVERTISEMENT —

Local economy to keep

growing next year

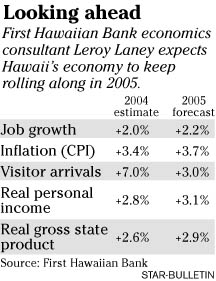

Hawaii's economy is poised to turn in another strong performance next year after outpacing the nation overall in 2004, one of the state's leading economists said yesterday.

First Hawaiian Bank economics consultant Leroy Laney told a gathering of about 450 business leaders at Dole Cannery that job growth will increase 2.2 percent in 2005 over this year, real personal income will rise 3.1 percent and visitor arrivals will gain 3 percent as the housing, construction, job and tourism markets continue to grow.

"Hawaii's economy has continued its spectacular performance in 2004," said Laney, who was joined by former Federal Reserve Board Gov. Laurence Meyer at the bank's 35th annual Business Outlook Forum. "Though we still live in a rather uncertain world, next year's outlook for Hawaii at this point continues to be very optimistic."

However, Laney warned that with the impressive growth will come a 3.7 percent gain in inflation on top of an estimated 3.4 percent increase this year over 2003.

"Anytime economic activity heats up like this, we can expect some upward pressures on inflation," said Laney, a professor of economics and finance at Hawaii Pacific University.

He said Hawaii's inflation usually closely tracks the mainland. When the state economy booms relative to the nation, he said, Hawaii's inflation is usually higher, and when it is depressed relative to the mainland, the inflation here is usually lower.

"With growth taking off again here, our inflation rate is again starting to top the mainland average," Laney said. "Honolulu CPI (consumer price index) inflation was 3.3 percent in the first half of this year, and that could even accelerate some by year-end. The biggest underlying causes are shelter costs and energy."

Laney expects job growth to accelerate to 2.2 percent next year from an estimated 2 percent growth this year. But he said the biggest constraint on growth is the availability of qualified workers as the unemployment rate falls and the labor market gets tighter. Hawaii's unemployment rate in August was the lowest in the nation at 2.9 percent.

The return of Japanese tourists should boost total visitor arrivals an estimated 7 percent this year from a weak 2003, and should stabilize next year with a 3 percent gain, he said. Laney called a 17.2 percent increase in Japanese visitors through August "dramatic," attributing some of the surge to low numbers in early 2003 that were the result of fears of severe acute respiratory syndrome and the Iraq War.

The return of Japanese tourists should boost total visitor arrivals an estimated 7 percent this year from a weak 2003, and should stabilize next year with a 3 percent gain, he said. Laney called a 17.2 percent increase in Japanese visitors through August "dramatic," attributing some of the surge to low numbers in early 2003 that were the result of fears of severe acute respiratory syndrome and the Iraq War.

"But more than that, a long-waited revival in the Japan economy undoubtedly had something to do with it," he said.

Real personal income, which is adjusted for inflation, is expected to be up 3.1 percent next year after a 2.8 percent estimated gain this year, Laney said. Real personal income is the broadest measure of the economy.

Walter Dods, who will be retiring at the end of this year as chief executive officer of First Hawaiian Bank and parent company BancWest Corp., returned from Japan this week and said he received positive feedback from the more than 50 CEOs he met with during his trip.

"It was the first time in years where I saw such optimism from chief executive officers," he said. "I think this time around (Japan's recovery) is real. Everywhere we went, CEOs were talking about increasing budgets, hiring for the first time, developing new projects."

Meyer, acknowledging that Japan's economy has turned the corner with 4 percent to 5 percent growth after a decade of stagnation, points out that the Japan government's projection of growth below 2 percent in the next fiscal year is an indication that the recovery will be uneven.

"My greatest concern of Japan is not the near term, but the longer term because they have some really fundamental problems," Meyer said. "They have an unsustainable fiscal debt burden that's a very serious problem that has to get corrected. Secondly, they face the most dramatic global aging impact of anyplace in the world."

— ADVERTISEMENTS —

— ADVERTISEMENTS —