Fuel hampers

Hawaiian Air earnings

Hawaiian Airlines' operating income fell in August for the third time in four months as high fuel costs continued to eat into one of the peak travel periods for the carrier.

The airline, which is in Chapter 11 reorganization, saw its operating profit decline 33.3 percent to $15 million from $22.4 million in August 2003. Still, it was the company's 17th straight month of operating profits.

Revenues rose 6.4 percent to $78.3 million from $73.6 million. The carrier's load factor -- a measure of how full its planes are -- remained strong at 87.3 percent and revenue per available seat mile -- how much money it brings in from its total capacity -- improved by 5.8 percent.

Revenues rose 6.4 percent to $78.3 million from $73.6 million. The carrier's load factor -- a measure of how full its planes are -- remained strong at 87.3 percent and revenue per available seat mile -- how much money it brings in from its total capacity -- improved by 5.8 percent.

Fuel costs climbed 47.9 percent in August to $12.7 million from $8.6 million in the same period a year ago. Labor and benefit expenses also rose 14.1 percent in the month to $20 million from $17.3 million a year ago. Overall, operating expenses increased 23.7 percent to $63.3 million from $51.2 million.

"August has always been a good month for Hawaiian, but the one-third drop is a reminder that the industry remains competitive and the environment we face is getting tougher," Hawaiian Airlines trustee Joshua Gotbaum said. "Fuel prices remain high, other costs continue to rise and fare competition continues to be intense."

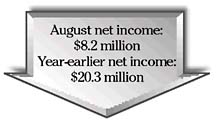

Net income fell 59.3 percent to $8.2 million from $20.3 million a year ago. The decline was partially attributable to $5.8 million in income tax expenses last month. Hawaiian recorded no income tax expenses in August 2003.

The airline's unrestricted cash increased to $143.5 million at the end of August compared with $141.9 million at the beginning of the month and $87.7 million at the start of the year.

Hawaiian, which said last week that it had agreed with Boeing Capital Corp. to restructure leases on 14 aircraft, will go to federal Bankruptcy Court on Monday to seek approval on that deal.

www.hawaiianair.com